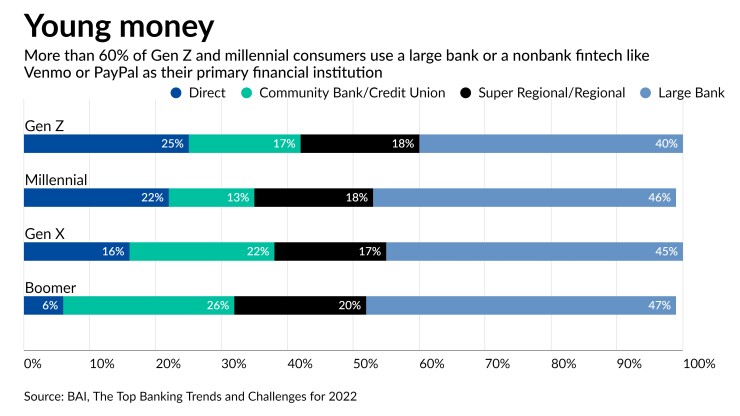

Research suggests credit unions are losing the battle to connect with young consumers, causing some institutions to prioritize programs aimed at millennials and Generation Z.

Michigan State University Federal Credit Union, for example, plans to let its

The moves come as

“When we looked at all of the players in the market, it was just more of the same [and] they were just different versions of the same stuff," said Ben Morales, chief technology and operations officer for the $4.7 billion-asset Washington State Employees Credit Union in Olympia. Morales helped lead the campaign for its core platform shift in 2017 when WSECU partnered with the Amsterdam-based financial technology firm Backbase.

The credit union is now working with the technology firm to develop digital products that are specifically aimed at young consumers. "We needed someone that's going to bring the best ideas to the table [because] we as credit unions can't be the guys that are driving all the innovation when our job is to serve members," Morales said.

This includes new financial guidance resources and updated marketing programs that appeal to youthful demographics. The credit union is also exploring rewards programs for younger consumers that tie into their spending habits, such as cash back on gas purchases.

“We know that today talking about money is probably more scary than talking about the birds and the bees, and so that conversation is just not happening,” Morales said. “What we're trying to figure out is how we can build more guidance to help the younger generations and their parents [who are members] to understand what we can do for them and what we can do for their family as they're going through their life stages.”

One of the challenges credit unions face is that young consumers lump financial services in with other consumer products, which have a largely digital user experience, according to Karl Dahlgren, managing director at BAI. “They think about, what's the experience I had when I bought something else, not a financial product, and how does that compare to when I go out and buy a financial product?” Dahlgren said. “If you really understand the data as to what's important to certain generations and you're trying to attract them, you can move the needle and not on a giant budget."

There are fintechs and trade groups that offer services to credit unions, hoping to lower the economic and technical burden of upgrades. The Credit Union National Association, for example, has launched programs aimed at building awareness of credit unions.

“I don't think there's a gap on purpose. I think that there hadn't been a resource that consumers could go to that could help them better understand how to access and use a credit union or have a credit union as a financial partner,” said Christopher Lorence, the executive director of CU Awareness, a subsidiary of CUNA.

The divide between credit unions and potential members is partly due to a lack of credible resources for those interested in joining but unsure about their eligibility, Lorence said. “The first sort of major obstacle was their understanding of whether they were eligible to join, and the second was their understanding of how easy it was or accessibility of their funds or their money," Lorence said.

Both banks and credit unions are addressing

Credit unions are also

The traditional credit union mission of “people helping people” will help attract consumers who value support for local businesses, Lorence contends. “I think credit unions are in a perfect opportunity at this point, given that they are mission-driven organizations that are focused on their members, and that I think is what differentiates them in the marketplace and resonates well with millennials and Gen Z,” Lorence said.

As financial institutions continue seeking out untapped avenues for reaching Gen Z and millennial clientele, leaders are preparing for the continually changing bull’s-eye.

“If I want to be successful in marketing to that generation, then I want to make sure that I'm going to where they are [and] not expecting them to tear their eyes away from the tablets, get up off the couch to go borrow mom and dad's keys and then go walk into my branch in order to save a quarter percent of the loan — I don't see it happening,” said Chris Hall, vice president of sales for the U.S. and Canada for Backbase. “I think instead you need to be where they are and speak their language, if you expect them to want to do business with you.”