Want unlimited access to top ideas and insights?

Nearly the entire staff at American 1 Credit Union in Jackson, Mich., is getting a pay raise.

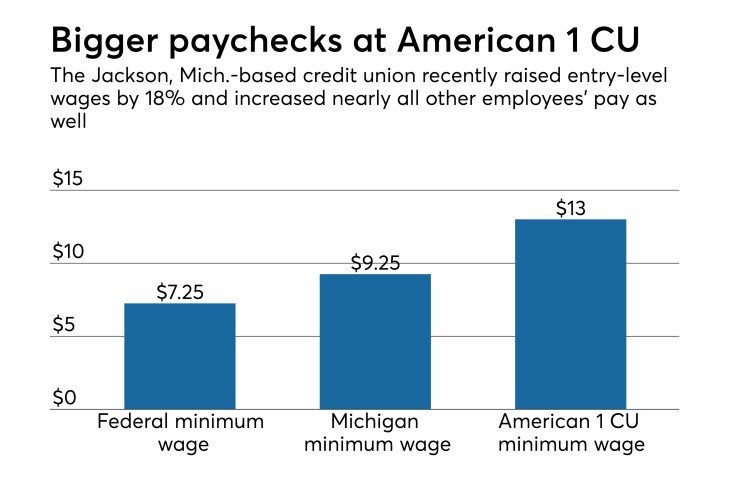

The $340 million-asset institution recently enacted a new compensation plan, which increased the pay for all employees except the CEO. Under the new plan, starting wages have been raised to $13 per hour (compared to Michigan’s $9.25 per hour minimum wage), an 18 percent increase from the prior level.

The new policy will result in an increased annual compensation of more than $950,000 spread among the credit union’s nearly 190 employees. About 74 percent of that figure covers the credit union’s hourly staff, while the remaining 26 percent covers increases in pay for management and executives.

“Credit unions are cooperatives,” said Martha Fuerstenau, America 1’s president and CEO. “We provide financial services to members and, when we are as successful as American 1 is, we make it a priority to give back as much as possible to our members. It simply makes good business sense to give back to our employees.”

Fuerstenau also said she expects the higher salaries to help with recruitment and retention at American 1 CU.

A number of other credit unions, including the $2.3 billion

Laura Pryor, American 1’s VP of marketing and communications, told Credit Union Journal the CU is enacting a “trickle-up effect” in which the starting pay for all employees was adjusted upwards, not just for the people making the minimum. The percentage increases for other positions varied.

Pryor said the across-the-board pay hikes have been in the works for many months.

“All of the details were in place – the timing was simply a matter of being ready to implement the changes,” she said.

American 1 CU has also had several successful years in a row recently, earning nearly $6.9 million in net income in 2017 and nearly $5 million in 2016. Its most recent call report shows the credit union earned just over $2 million during the first quarter of this year.

While legislators in Michigan and at the national level have taken measures in recent months and years to roll back a variety of regulations and reduce the compliance burden (and associated costs) for credit unions, Pryor said the changes at American 1 are unrelated to any larger external factors.

Rather, she said, the credit union was motivated by a “desire to retain great employees and attract new talent,” adding that Michigan is a particularly competitive state with relatively low unemployment.

“Remaining competitive – and even leading the way – is not new to American 1 CU,” she said. “Our benefits package has been robust for a long time. Additionally, effective in the fourth quarter of 2017 we introduced student loan repayment benefits and a shift premium for employees who work after 5 p.m. on weekdays and on Saturdays. These new benefits are in addition to health insurance, dental and vision at no cost to the employee, among other benefits.”

American 1 CU’s decision comes as the economy in Michigan gradually improves.

According to the

While wage increases are sometimes instituted in order to keep pace with other local employers making similar adjustments, that is not the case at American 1, said Pryor. “These changes were a result of internal evaluation and discussions and were not motivated by outside factors,” she noted, adding that as of now the credit union is not planning any further large-scale salary hikes.

Does a rising tide really lift all boats?

American 1 is just the latest in a continuing trend of credit unions increasing wages to keep pace with costs of living and the nationwide “fight for $15.”

Cindy L. Swigert, vice-chair of the CUNA HR & OD Council and VP of human resources at University of Virignia Community Credit Union, said some banks in her market recently adjusted starting pay for tellers to $15 per hour.

“Currently, the majority of our employees are earning at least that, so we have not felt the need to make any changes,” she noted, adding that management continues to monitor the market for changes in compensation trends.

But one analyst cautioned not to get too excited about improved pay.

John W. Andrews, executive vice president at D. Hilton Associates in Houston, Texas, said that mandatory minimum wage increases may sound reasonable on the surface but may actually reduce overall job opportunities.

Andrews pointed out that while the food service industry has been one very visible example of employees and the public pushing for higher wages, many restaurants have begun to rethink their “customer experience model,” moving away from traditional wait staff to more self-service models in order to address the impact of higher wages for staff.

“Because unemployment in the retail and technology sectors is at historic lows, many credit unions are reviewing their pay structures annually,” he said. “Market forces are impacting current wages much more than mandated legislation. Credit unions, like many retail businesses, rely on nontraditional workers (part-timers, college students, contractors, etc.) to supplement their full-time workforce to fully staff branches and contact centers.”

Thus, Andrews cautioned, any attempt to address a certain portion of a credit union's workforce, whether it be tellers, mortgage loan officers or programmers, naturally has a “ripple effect” across the whole organization.

“Addressing internal equity on a routine basis is crucial to ensuring a highly engaged workforce,” he added.