Where are the future credit union CEOs coming from?

That’s a big question currently plaguing the industry, which is facing a wave of retirements of older executives As financial services become ever more complex and multifaceted, it is imperative for credit unions to prepare solid succession plans for their top leadership. Some institutions have done that.

But others have failed to outline detailed plans to ensure they have qualified individuals to take over when a longtime CEO decides to step down.

“There is a serious crisis looming for boards and the demand/supply they will find in being able to identify, attract and appoint qualified CEOs,” said Robert Voth, co-lead of the consumer and commercial financial services practice at Russell Reynolds Associates, a search and leadership advisory firm in New York. “This is why we cannot recommend strongly enough the need for quality succession plans.”

Almost two-thirds of U.S. credit unions with more than $2 billion in assets have CEOs who are now near or at retirement age, Voth said.

“Probably two or three of every five credit union CEOs we talk with are planning on retiring in the next five years or less,” said Maria Kell, senior executive compensation consultant at Business Compensation Consulting in Dallas.

Credit unions facing a transition need to begin the search process 12 to 18 months before the current CEO’s targeted retirement date, Voth said.

That starts with having a plan in place. Most credit unions have done some succession planning but it is generally lacking, said John Andrews, executive vice president at D. Hilton Associates in The Woodlands, Texas. These plans may need to be tweaked to account for the added job responsibilities CEOs have to take on today, Andrews said.

For instance, CEOs must now deal with increased compliance and regulations, ever changing technology and new competitors in the form of online lenders.

Succession plans at some credit unions may also be limited in detail or scope, Kell said. For instance, the plan may identify evaluating internal candidates to replace a retiring executive but may not outline the criteria that will be used, who will be included in the process or how the process will be communicated to the existing staff, she added.

Other credit unions may have long-serving executives so their staff, boards and human resources department “have been lulled into an artificial sense of security,” Voth said. Sometimes the management team and board are overloaded with their day-to-day requirements of their jobs so succession planning is put off, Kell said.

What succession planning should look like

There are a few best practices that credit unions should follow in their succession planning. For one, true succession plans consider at least the next three years and look at both internal and external candidates, Voth said.

Identifying external candidates can give an institution a sense of the talent currently available. That can then be compared with the qualifications of internal candidates and help human resources educate, train and develop employees, Voth said.

Outside candidates maybe particularly important to institutions where many on the management team are around the same age.

“Many organizations have a fairly homogenous demographic on the executive team with leaders who are near the same age and life cycle,” Kell said. “This results in the credit union losing multiple executives within a short period of time. Additionally, if multiple internal candidates apply for a CEO spot, often the one who is not selected will leave and go elsewhere.”

Turning to an outside firm to help with the search can have its benefits. For example, if the departing executive had a long tenure with the organization, it is frequently necessary to engage an executive recruiter, compensation consultant or an attorney to help the board with details regarding current marketplace expectations, trends as well as current regulatory and legal requirements, Kell said.

Voth said that making sure the credit union moves beyond its normal circles to find talent can help ensure its management team has a diverse and relevant skillset.

“Considering the importance of a CEO and their leadership to the financial and reputational well-being of the credit union, looking to outside sources is a wise move,” he said.

Is the future female?

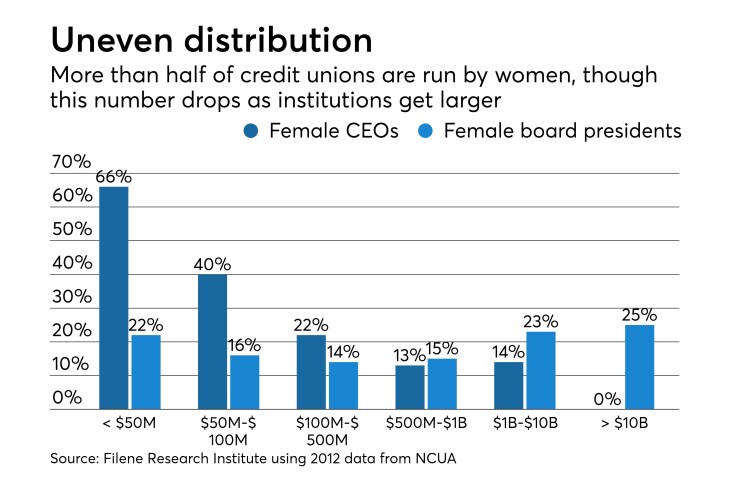

As of 2017, 52 percent of credit union CEOs were female, compared with only four to five percent of CEOs at banks and Fortune 500 companies, according to internal data from the Credit Union National Association.

While a large number of credit union CEOs are female, most leaders at the largest credit unions remain male. An exception to that is the recent announcement that Navy Federal Credit Union had named

About two-thirds of credit unions with assets below $50 million had women as CEOs, according to a report from the Filene Research Institute that looked at 2012 data. That number drops to 14 percent for credit unions with $1 billion or more in assets, according to the report.

Voth recommends that credit union boards put a premium on racial and gender diversity in their c-suites as women surpass men in college education and Hispanic and Asian populations increase.

Kell believes it is likely that more of the larger credit unions will hire female CEOs.

“There is a continuously growing pool of very capable female leaders among the executive ranks,” she said. “Many of them are being promoted into CEO positions or are being recruited into them. As there continue to be more and more CEO positions becoming available, it makes sense more women will be moving into the top spots."