Heritage Trust Federal Credit Union in Newburgh, Ind., has agreed to purchase the assets and assume the liabilities of Elberfeld State Bank in Indiana.

The deal would expand the $699 million-asset Heritage’s member base and grow its footprint, giving it 13 branches across the Evansville, Ind., region.

"The partnership with Heritage will bring a wealth of expanded products and services to our customers, as well as continue the strong local community ties to the markets we serve,” Burtis Ritterling, CEO of Elberfeld State Bank, said in a press release. “We are excited for the opportunities it will provide to our employees and we look forward to growing the combined organization with them.”

The transaction is still subject to approvals from regulators and the bank’s shareholders, but integration is expected to be completed during the first quarter of next year.

Hoyde Group advised the bank in the transaction. Financial terms of the deal were not disclosed.

The $82 million-asset Elberfeld State Bank earned $110,000 for the first quarter, down about 38% from a year earlier, according to data from the Federal Deposit Insurance Corp. Heritage FCU posted net income of just under $1.1 million during the first quarter, down about 7% from the same time last year.

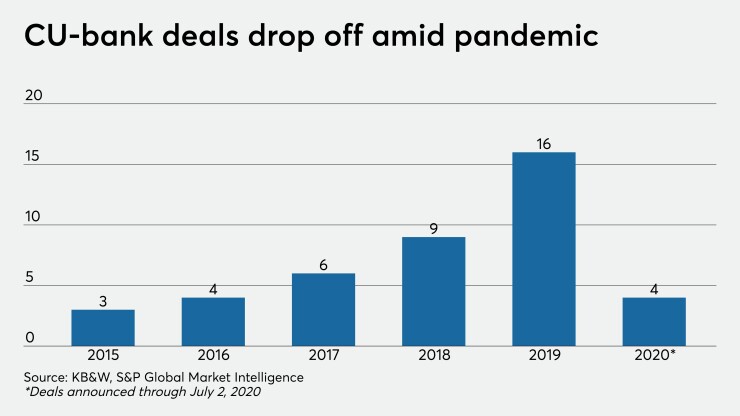

This is the fourth credit union-bank acquisition announced this year, half the number of deals announced through the beginning of July 2019. The coronavirus has slowed the pace of these transactions, and a number of bank mergers have been called off in the wake of the pandemic.