The start of a new academic year means new opportunities for credit unions to introduce (or reintroduce) themselves to potential members.

August, when most students return to school, is traditionally the year’s third-highest month for new credit union membership, according to data provided by CUNA Mutual Group, though September is generally flat followed by a steep drop-off in October. Steve Rick, chief economist at CUNA Mutual, explained earlier this year that the early-fall slump is largely because October is a slow month for lending and many CUs close inactive member accounts during the fourth quarter.

With August historically being the last big month of the year for membership growth, the chance to bring new members aboard with the start of the academic year is even more important. And for university-affiliated credit unions with an on-campus presence – be it ATMs, branches or both – a flood of potential new members couldn’t be closer.

One example of that is Phoenix-based Canyon State CU, which last month expanded a partnership with Grand Canyon University that began in 2015. The $186 million-asset institution has an on-campus branch and has also created a new “Lopes Checking” account, named after the university’s mascot Thunder the Antelope. The account also includes an affinity debit card, and CSCU will make a donation to the university’s scholarship fund for every qualified purchase made with the card.

“They help us get the words down and we provide scholarships to the school based on transactions on the debt cards and student number that join our credit union,” CEO David Skilton said. The credit union also works with the university to help recruit students to staff the on-campus branch, and employees are on campus at the start of the school year to highlight the services the credit union provides and the convenience it can offer students, he added.

Since many young consumers aren’t aware of the difference between CUs and banks, university credit unions must also work to bridge the awareness gap.

East Lansing-based Michigan State University FCU, the world’s largest university credit union, utilizes a variety of on-campus promotions to get the word out, including a prize-wheel contest where students can spin a wheel and answer trivia questions about financial products and services.

“We use it as an engagement tool to gauge students’ understanding on a particular financial topic, learn about their knowledge gap and help educate them about these financial products in the next four years,” said Deidre Davis, chief marketing officer of MSUFCU.

According to Nick Somers, business development manager at Signature FCU, which also offers a student checking account, those sorts of offers can benefit young consumers who want to build a credit history and invest smarter. Since credit unions fly under the radar for many consumers, he added, CUs that don’t target products at younger adults could be losing out on growth opportunities.

Steve Reider, president of Birmingham-based consultancy Bancography, reminded that the competition for market share is won one account at a time, and said credit unions can benefit from smaller, more focused and incremental marketing campaigns.

Davis seconded that. She said that through its targeted marketing efforts, the $4 billion-asset credit union has seen an increase in not only the percentage of people opening new student accounts, but also being active with them, she said.

Approximately 40% of incoming college freshmen opened student accounts with the credit union last year, according to MSUFCU statistics.

School spending on the rise

Back-to-school season can also be a boon for CUs that don’t have college ties, and with the high cost of new clothes, school supplies and more, the event serves as an opportunity for some credit unions to offer lending products.

Security First Credit Union offers a special “Back 2 School” loan with a 12-month repayment plan. While eligible applicants must have 12 months of membership, this closed-end loan requires no credit check, enticing new student members to start a relationship with the Edinburg, Texas-based credit union, CEO Erasmo Ramos said.

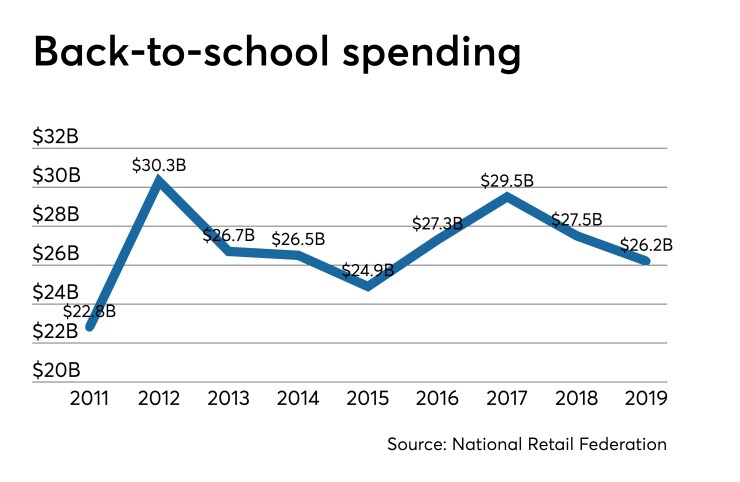

The return to school remains one of the year’s biggest shopping events, and the National Retail Federation predicts total sales this year of about $26.2 billion. That figure is down slightly from the last two years, though per-household spending continues to inch up each year, with averages this year expected to come in at just under $700 per family. The disparity between rising per-household spending and declining overall spending, NRF noted, is due to a decline in families with children in grades K-12.

Whether in kindergarten or off to college, credit unions understand they must market these offers on the channels where they will be most effective, including social media.

Signature FCU’s Somers said the credit union places ads on Facebook and Instagram, along with notices in checking account statements and quarterly newsletters.

In addition, the credit union delivers oversized postcards to all its members during back-to-school season, introducing products such as student loans and checking accounts. This marketing strategy allows Signature FCU to push out information to existing members, expecting students to become informed about ongoing promotions by word of mouth from friends and relatives who are members of the credit union, Somers said.