Want unlimited access to top ideas and insights?

With the official start of this year's hurricane season just weeks away, some parts of the country are still picking up the pieces from the 2017 storm season, and among the hardest hit were small businesses.

As a result, it’s harder for those small businesses to get the recovery cash they need.

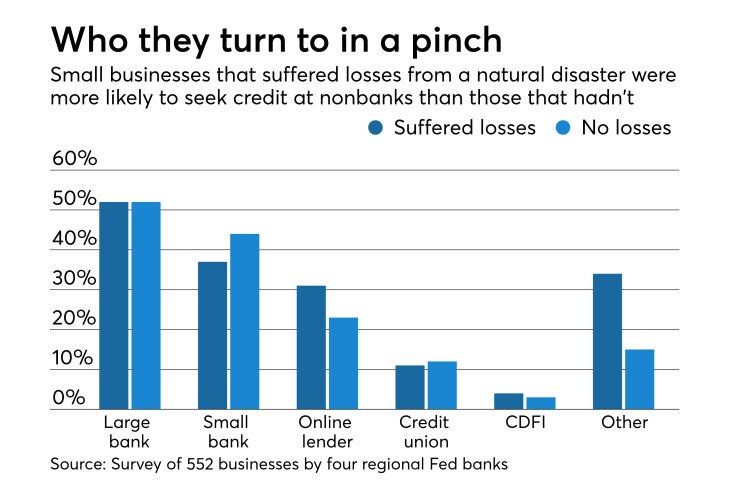

About half of the small businesses that sought financing after a calamity, regardless of whether they were damaged, filed applications with big banks. Unaffected businesses were more likely to apply to small financial institutions for credit than their counterparts who had suffered financial losses (44 percent versus 37 percent).

Even more telling: businesses that suffered disaster-related losses were more likely to apply to online lenders for credit than those that had not (31 percent versus 23 percent). And damaged businesses were far more likely to tap other non-bank sources of credit (34 percent versus 15 percent) such as specialty lenders, friends or family, or nonprofits.

The amounts sought were relatively modest. Sixty-two percent of small businesses that experienced losses from natural disaster sought financing of $100,000 or less, the report said.

But the bar for success was high. The number of the companies that suffered losses that actually obtained all the financing they applied for was 34 percent, compared with 45 percent of those that had not suffered losses.

Opportunity for CUs?

The findings suggest that those affected businesses were already financially vulnerable, independent of the calamity affecting their area, and that disasters tended to exacerbate those vulnerabilities.

Natural disasters caused more than $300 billion of damage in the United States last year, and climate scientists do not anticipate that extreme climate events will abate anytime soon.

Hence, vulnerable small businesses in disaster-prone areas are likely to need more financing and loan services for the foreseeable future.

Credit unions might be the answer for many of these small firms.

Pablo DeFilippi, senior vice president of membership and network engagement at the National Federation of Community Development Credit Unions, is a strong advocate for credit unions in helping micro- and small businesses get back on their feet after a natural disaster. DeFilippi noted that, according to the Institute for Business and Home Safety, an estimated 25 percent of businesses don’t even open again after a major disaster.

“The smaller and newer the business, the less likely that it’ll recover,” he warned.

Moreover, he pointed out, data from the U.S. Census Bureau shows that these businesses

“This is significant because small businesses are not only the lifeblood of many communities, but central to broader national economies,” DeFilippi explained. “In the U.S., they account for

Historically, credit unions have played a major role in helping small businesses following natural calamities. For example, in the wake of Hurricane Katrina in 2005, many credit unions – including the now $348 million-asset ASI Federal Credit Union of Harahan, La. (a suburb of New Orleans), and the now $889 million-asset Jefferson Financial Federal Credit Union of Metairie, La. – provided financing for small businesses in the New Orleans area.

But natural disasters, DeFilippi observed, can create unusual and difficult dynamics in afflicted local regions. For example, despite the need for credit to finance recovery, such disasters also constrain the capacity of lenders to supply it because so many households and businesses are impacted at once.

"Furthermore, most credit unions are local, which means that they also are affected by the situation,” added DeFilippi. “The good news is that, as regulated financial institutions, credit unions are required to have contingency and disaster recovery plans that enable them to more quickly resume operations.”

There are also some clear advantages to being a financial cooperative, De Filippi noted. Many credit unions are part of the shared branch network, which is an invaluable tool to continue serving their members even if a credit union’s physical location is out of commission.

What CUs can do

Credit unions can also help people in disaster zones in other ways.

Gwen Rivers, chief lending officer at the $88 million Caro Federal Credit Union of Columbia, S.C., said credit unions with the necessary resources could focus on helping with relief efforts and food drives. “They can also go out and meet the business owners to assess their needs and offer the products and services the credit union has to help them get back on their feet,” she said. “Whether that is a personal loan/lines of credit, HELOCS and/or vehicles, [credit unions] are here to help and save them money at a very critical and challenging time.”

Jeffrey K. Conrad, CEO of the $333 million Pelican State Credit Union in Baton Rouge, La., said that when a disaster strikes, every minute of a business owner’s day spent on recovery is time not spent focusing on operating a profitable business. Thus, swiftness and urgency are critical.

”Small businesses choose online lenders, fintechs and other non-traditional banking options because they believe that they can get approval and funding faster through those channels,” he said.

Credit unions also need to augment their presence in social medial and the internet, he recommended.

“Credit unions need to consistently publish comprehensive and easy-to-read content that’s beneficial to current and potential members along with ensuring that key terms and offerings are clearly listed on their website in order to improve their SEO performance for small business loans,” he added.

Conrad explained business is often driven by search engines such as Google, and how a credit union shows up in online search results can impact whether or not they lose out on new business.

“Consumers assume if you are near the top of the list of search results that you must move a higher volume of business, and therefore your loan process must be smoother and faster,” he said.

Conrad suggested that in order to get the word out about small business recovery loans, credit unions should advertise or send email to members in the disaster-affected areas. “Another way to advertise…is to host a community ‘lunch and learn’ where you share recovery resources available to the local business owners, including your loans,” he offered. “Bring in local experts to talk about other resources like tax credits and government assistance. If you want the business, you must ask for it as a credit union. We are not traditional lenders in the business arena – consumers will not think of us first for business loans and we need to change that mindset. The more you talk about it, the more opportunities will come to your doorstep.”

Doing what the big banks can’t (or won’t)

DeFilippi also pointed to the fallout from Hurricane Maria, which smashed into Puerto Rico last year, and how credit unions can step in to help needy people and small businesses when big banks simply cannot or will not do so.

“It took an average of 48 hours for the Cooperativas de Ahorro y Credito of Puerto Rico to re-start operations after the hurricane hit,” he said. “In comparison, many bank branches remained closed, many for months afterwards and some were never reopened. In fact, out of the 78 municipalities in Puerto Rico, 17 are currently being served exclusively by CACs – and, not surprisingly, they happen to be the most rural ones.”

In the case of Puerto Rico, CUAID, the New York Credit Union Association and the Federation came together to deploy more than $250,000 to almost 500 credit union employees throughout the island.

“Our industry’s capacity to more effectively play a role supporting businesses and communities affected by natural disasters can be expanded if we work more closely with government agencies that have specialized teams for these type of situations, including FEMA, SBA and others,” DeFilippi said. “In areas prone to hurricanes, tornadoes, earthquakes [and other disasters]. contingency plans must include how those institutions will work with federal, state and local agencies in the aftermath of a disaster. The frequency and severity of disasters will