What began as a short-term loan solution for members of Washington State Employees Credit Union has now expanded to provide similar lending opportunities for other financial institutions.

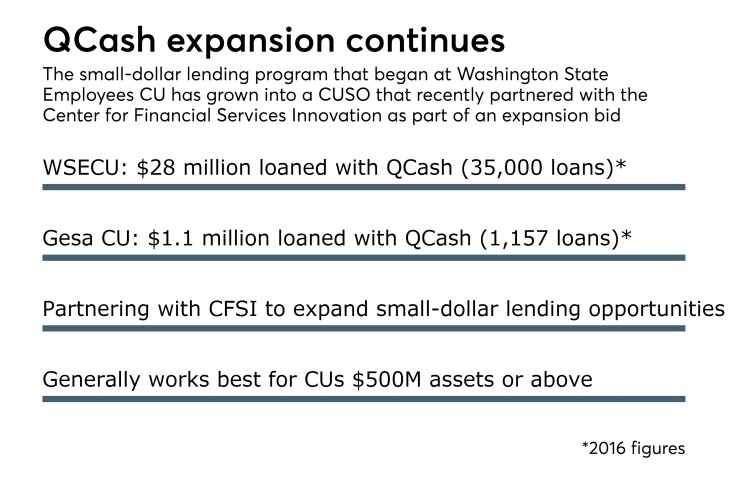

WSECU launched QCash Financial in 2004 in order to provide short-term loans for members in need, and the program subsequently grew into a CUSO, which now provides automated, cloud-based omni-chanel small-dollar lending technology solutions for FIs. QCash recently joined the Center for Financial Services Innovation’s (CFSI) Financial Health Network as part of a concerted effort to improve small-dollar lending practices.

“We have been a member of their network for just over a month and we have already had referrals from their network for credit unions to take a look at our solution,” said Ben Morales CEO of the Olympia, Wash.-based QCash Financial and chief technology and operations officer at WSECU. “We are all working together to develop financially healthy solutions that will help the market place.”

The Prairie du Sac, Wisc.-based CFSI continually supports the innovation of higher quality financial products and practices. QCash joins roughly 120 other companies in its network.

“We thought QCash was doing some pretty interesting things, so we wanted them to be at the table participating,” said CFSI SVP John Thompson. “QCash didn’t come from a fintech development, but rather sourced from inside a credit union from the needs that they see, which is a powerful thing.”

The CFSI partnership is the latest in a string of recent collaborations for QCash, which earlier this year announced

Morales said the program is tied to the very foundation of the credit union movement.

“We have to get back to why credit unions first started — the root was small dollar lending,” said Morales. “That’s in our wheelhouse, so let’s get back to doing that in a way that is effective and serves member needs.”

Thompson is encouraged by QCash’s offering, as many members are looking outside their CU for lending options only to find high interest rates on payday loans and the like.

“There is demand for small dollar credit in different forms,” said Thompson. “Our research has shown that there has been a shift in the last few years from single payment — payday style — to installment solutions, larger amounts spread over time.”

Small-dollar success

In order for small-dollar lending to be successful at a credit union, Morales said, it all comes down to respectable margins. This, he noted, will ensure that small-dollar lending is on a CU’s “menu of items” for the “long run.”

Currently, WSECU offers two small dollar lending options: Q-Cash and Q-Cash Plus. For the former, members can obtain a low-fee loan on amounts ranging from $50 to $700, which doesn’t require an application. For the latter, members can obtain loans from $701 to $4,000. While a credit report is not needed for this loan, a $25 application fee applies.

Aside from WSECU, three CUs are currently using QCash, including USAlliance Financial and Gesa Credit Union. According to Morales, WSECU originated nearly 35,000 loans with the QCash platform in 2016, amounting to a total of more than $28 million. Gesa Credit Union used the QCash platform to originate 1,157 loans ($1.1 million) in the first six months of its small-dollar lending program.

To date, QCash is offered to approximately 800,000 members nationwide. Morales said that QCash’s CU clients are all institution so more than $1 billion in assets – in other words, size matters.

“In general, we see credit unions with $500 million or more in assets to have an adequate open core system and enough technical expertise to operate the solution in an efficient way,” he said. “There are a lot of smaller sophisticated credit unions, but we generally we run in to accessibility and scalability issues. We are continually looking for solutions to serve the smaller market.”

In Thompson’s view, the demand for small-dollar lending will continue to increase, which presents opportunities for credit unions of all asset classes.

“To see credit unions trying to figure out how they can meet the credit needs of underserved consumers, and bringing their financial health along in a positive way, feels like an interesting step forward in to the future,” said Thompson. “Using technology from inside the credit union instead of human blocking and tackling also feels like the right type of innovation.”