Want unlimited access to top ideas and insights?

A recent study from the Credit Union Executives Society raises big questions about credit union governance models and casts doubt on how well the movement’s paid and volunteer leadership work together.

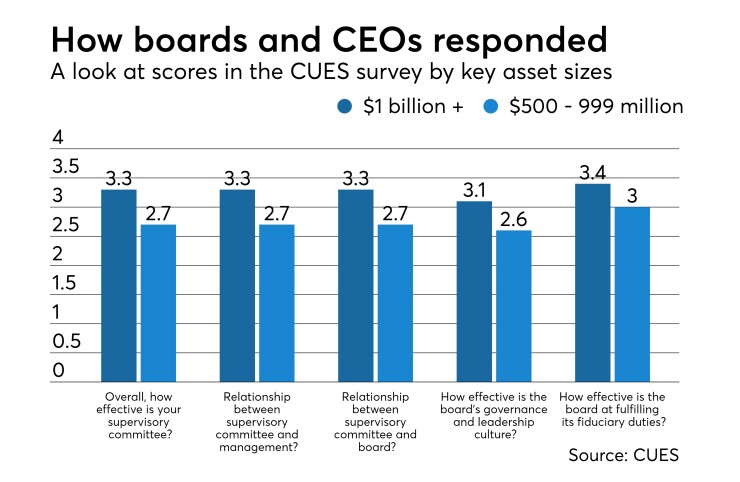

CUES and Quantum Governance L3C recently released “The State of Credit Union Governance 2018,” which reveals how credit union boards, CEOs, supervisory committees and senior staff members are performing across the industry.

In a survey questionnaire examining vision, mission and strategy; board structure and composition; fiduciary oversight; governance and leadership; and supervisory committees, CU executives and boards were in alignment just 16 percent of the time

“The biggest surprise that came out of [the study] was that when you consider the importance of a balanced, constructive partnership among the board, CEO and supervisory committee — the three-leged stool of good governance — there were a number of areas where boards and CEOs had different perceptions on the quality of governance,” noted Christopher Stevenson, SVP and chief learning officer at CUES.

Among the other findings were that boards’ and CEOs’ perceptions of governance vary largely based on tenure, with board members who have served longer having a more positive assessment of governance than those who have served less time. The opposite was true for CEOs, with opinions on governance declining the longer an executive serves.

So what can be done to bring the two sides closer together? According to Stevenson, strong governance and nominating committees are key, along with ensuring that committee has a well-designed charter.

“That’s step one,” he said. “To help prioritize governance excellence, ensure a plan for board rejuvenation and ensure knowledge and learning aren’t a second thought. It’s part and parcel with ensuring your board is able to meet its needs.”

Additionally, he said, governance committees can also help in ensuring that boards, supervisory committees and CEOs have a constructive partnership, and that board chairs and CEOs are working together to shape board meetings to encourage strategic discussions and questions.

Volunteer vs. paid boards

One factor that may be contributing to the divide between boards and leadership, said Stevenson, is the increasing complexity of financial services offered by credit unions.

“I think credit union boards are having to ensure that their makeup is moving along with the sophistication of the competitive environment,” he said. “It goes back again to the importance of the governance and nominating committee to ensure the right makeup is on that board. Volunteer or paid, either way, that board needs to be made up in a way that ensures they have the right skill sets, and the governance committee is essential to that. Many states are moving toward allowing credit unions to have paid boards; I don’t think that’s necessarily a bad thing, because it does make it easier to attract the type of board members you’ll need…I also believe that for states where credit union boards are exclusively volunteer, those boards can still attract the right mix. It might create more challenges, but if you’re diligent and your governance committee is working hard to ensure you have an evergreen list of candidates, you can meet that need.”

The CUES/Quantum Governance study did not address issues of paid-vs.-volunteer boards at credit unions.

Credit union leaders hoping to ensure both sides of the equation are well aligned, advised Stevenson, should be doing self-assessments and examining the culture of their organization.

“Credit unions that participate in only the [CUES] survey rate themselves pretty high relative to those that go through a more comprehensive evaluation of their governance,” he said. “Those credit unions that do a further analysis of their policies, bylaws, committee charters and get some outside feedback from a facilitator… rate themselves with a more balanced perspective than those doing the survey alone. But that type of deep dive helps a credit union’s board and executive team identify the areas that need focus and create a development plan to back it up.”

Of course, small and mid-size credit unions are significantly less likely to have the time or resources to commit toward that level of analysis and evaluation, conceded Stevenson, but there is still plenty they can do.

“The addition of a governance or nominating committee, if they don’t have one, can help prioritize governance excellence [and] ensure there’s a plan for board rejuvenation,” he explained. Along with that, it’s important for CUs of all sizes to continually be identifying people either within the membership base or the community at large who might be able to meet various needs on the board, while also working to ensure that current board members are contributing in a constructive manner and continually enhancing their knowledge so they’re prepared when strategic issues arise.

This is the first time CUES has looked specifically at an assessment of governance, and the last time it did anything at all similar was more than a decade ago, when there were nearly twice as many credit unions in the marketplace (though significantly fewer members).

This story was updated Feb. 21, 2018 at 11:15 a.m.