The economies in California and Nevada continue to be on the upswing, and the credit unions in the Golden and Silver States are prospering as a result.

That is the message from Second Quarter Credit Union Trends Reports issued by the California and Nevada Credit Union Leagues. The Leagues said in aggregate, locally headquartered credit unions operating in the two states continue hitting new records in membership, loans and deposits.

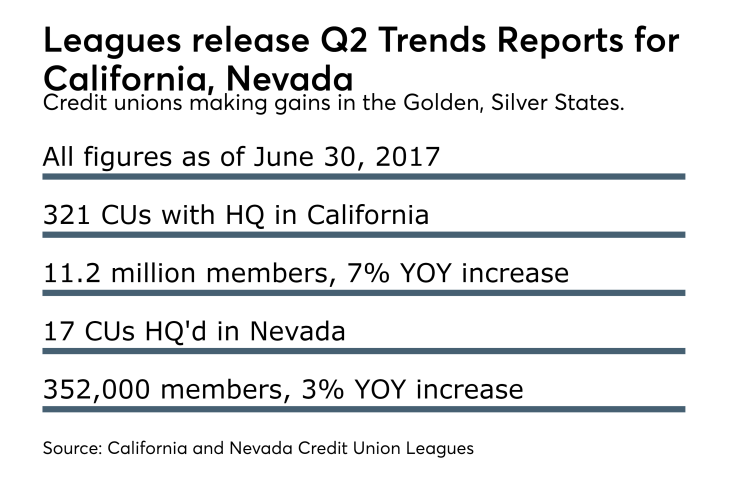

There are 321 locally headquartered credit unions serving 11.2 million members in California, and 17 CUs serving 352,000 members in Nevada, the CCUL/NCUL said.

Some key numbers regarding loans:

Credit unions in California had $119 billion loaned out, a 14 percent year-over-year increase. Total loans have jumped 73 percent from a post-recession low of $68.7 billion in 2011. The $119 billion figure represents a record outstanding dollar amount (first mortgages, second mortgages, HELOCs, business loans, new and used auto loans, credit cards, and sometimes other consumer loans). The last historical peak was $80 billion in 2008.

Credit unions in Nevada had $2.7 billion loaned out, a 12 percent YOY increase. Total loans have increased 39 percent from a post-recession low of $1.95 billion in 2013, and are at an outstanding dollar amount not seen since 2010. Nevada’s historical peak was $3.05 billion in 2008.

According to the leagues, CUs in the two states can use Localized Trend Reports to spotlight how consumers are spending their money on homes, remodeling projects, new and used automobiles, higher education, surviving life events and other big-ticket items, and as a barometer into what is happening across both states’ local economies. The localized reports detail regional breakdowns for 12 geographies across California and two for Nevada.

Dwight Johnston, chief economist for the California and Nevada Credit Union Leagues, said loan and deposit trends detailed in the reports reveal how consumers are “feeling” about spending money given each region’s current economic climate and the still-somewhat-low interest rate environment. Johnston noted the continued fuel behind this fire is jobs and wages.

“The pace of job growth in California has slowed significantly this year compared to the prior five years, but this is actually a good sign,” Johnston said in a statement. “There are a record number of job openings, but businesses are having difficulty finding workers in a tight market. This, in turn, is leading to wage gains in California that are far outpacing the national growth rate.”

California consumers are feeling “quite confident” about the future, Johnston added.

Regarding Nevada, “The job market has been very steady, and wages are growing slightly above the national average,” Johnston said. “Nevada consumers are also confident in the future. This is reflected in the stable housing market and the growth in auto lending taking place there.”

CUs 'need to be nimble going forward'

Matt Wyre, manager of media relations for the California and Nevada Credit Union Leagues, told Credit Union Journal the reports are broken down into numerous local areas because every credit union is different in how it fits into its local community and local economy.

“We aggregate quarterly data by regions, and combine it with local economic forecasts. The goal is for credit unions to use these reports as part of their strategic planning,” he explained.

In the second half of every year, especially August, September, October, many credit unions are doing their planning for the following year and want to know where their local economy is going, Wyre continued. He said the CCUL/NCUL also looks to keep boards of directors at all credit unions in the two states apprised as to where the economy is going in their area, as well as how other credit unions in their area are doing.

“We ask for feedback from credit unions about these Trends Reports, and they tell us the reports are powerful in those two areas: strategic planning and monitoring their local economy. For example, everyone wants to know if auto lending trends are going to continue.”

What has been interesting to Wyre is each region has a little bit different “flair.” He noted the many reports showing CUs in general are breaking records on memberships, deposits and loans, but he said when preparing the reports it is clear there is “great variance” region by region.

Some of the trends Wyre has spotted include: in the San Francisco Bay Area – San Francisco County plus the nine surrounding counties – there is significant growth in first mortgages and HELOCs; Northern Nevada is seeing growth in business loans; CUs in San Diego County are doing well in new car loans; and, both new and used car loans are on the rise in Los Angeles and Orange Counties.

“What is interesting to me is California and Nevada are completely different animals,” Wyre said. “Nevada has taken a long time to recover from the recession.”

Since the two leagues began releasing the Trends Reports a few years ago, they have drawn increasing interest from business reporters in local media. Wyre noted the quarterly data contained in the reports has the potential to have a positive impact when credit unions visit state and federal legislators.

“For lawmakers to see the local economic impact credit unions are making in their communities via lending and savings opportunities, that is huge and it speaks volumes about their mission to help consumers thrive and prosper.

“This is all experimental,” Wyre added. “We know we need to be nimble going forward, so we need to try different things to serve our members’ needs so they can serve their members.”