Want unlimited access to top ideas and insights?

WASHINGTON — Senate Republicans have announced another round of funding for the Small Business Administration’s Paycheck Protection Program as part of a new stimulus bill to deal with the coronavirus pandemic.

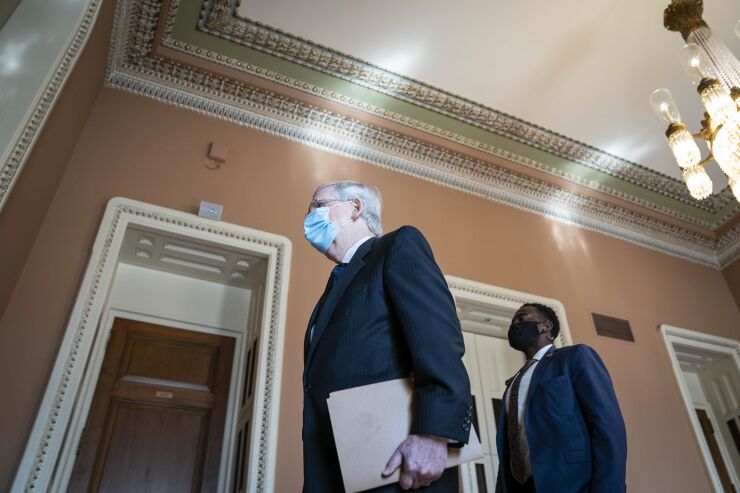

Senate Majority Leader Mitch McConnell, R-Ky., outlined the GOP plan in a floor speech but did not specify how much money would be allocated for the small-business loan program.

“So we have one foot in the pandemic and one foot in the recovery,” McConnell said. “The American people need more help. They need it to be comprehensive. And they need it to be carefully tailored to this crossroads. That is what this Senate majority has assembled.”

McConnell said the stimulus proposal, known as the Health, Economic Assistance, Liability Protection, and Schools Act, or HEALS Act, will include another round of $1,200 relief payments to individuals. Republicans are also proposing to extend the expanded weekly unemployment benefits that were provided in the Coronavirus, Aid, Relief, and Economic Security Act, but decrease the dollar amount from $600 per week to $200 per week.

McConnell's announcement comes as unemployment benefits in the CARES Act are set to expire at the end of this week. But PPP funds are still available. The program also allows loan borrowers

Banks have generally supported the PPP, but

Republicans still need to negotiate with Democrats before any additional stimulus legislation can become law. The Democratic-controlled House in May passed the Health and Economic Recovery Omnibus Emergency Solutions Act, or HEROES, Act. Yet that $3 trillion package has been panned by the GOP.