With financial education requirements still not universal across all schools, one credit union in Pennsylvania is taking matters into its own hands, tweaking its own offerings to ensure they align with and bolster what’s required by the state.

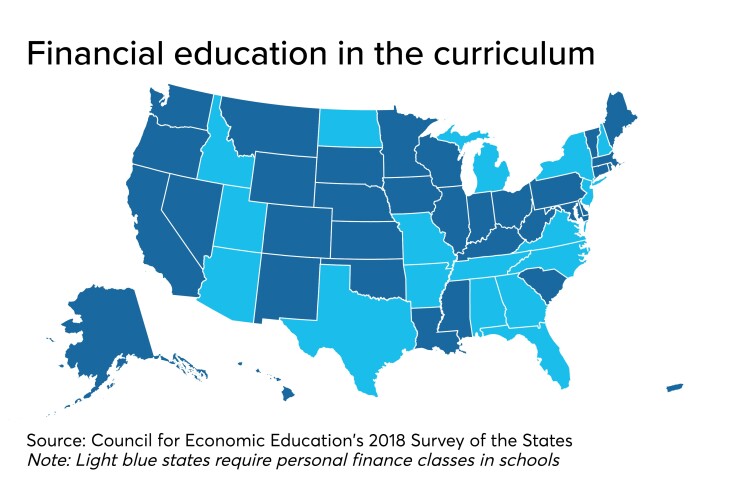

A 2010 law requires the Pennsylvania Department of Education to issue a biennial report on financial education in schools, but the Keystone State is in the minority when it comes to financial literacy for students. According to the Council for Economic Education’s

The Pennsylvania State Board of Education sets academic standards in 12 subject areas, addressing what students should know at specified grade levels. Family and consumer sciences, which was incorporated into state standards in January 2003, requires students to understand consumer rights in third grade and personal finances in 12th grade.

Still, those standards are just overarching themes, and each of the state’s 500 local school districts are required to develop their own specific curricula, said Eric Lewis, press secretary for the Pennsylvania Department of Education. Schools there face an uphill battle. According to data from the Consumer Financial Protection Bureau, 10% of Pennsylvanians age 18 and older encounter frequent financial struggles and material hardship, compared to 9% nationally.

With that in mind, Mechanicsburg, Pa.-based Members 1st Federal Credit Union this year began the process of revamping its own financial literacy training in order to better align with state standards. The credit union has established a dozen content areas, including credit, consumer awareness, budgeting and more.

In order to better align with state standards for financial and resource management, the credit union offers high school programs on auto loans, including insurance and operations, and fitting those costs into a monthly budget. Seminars on financial aid and state and federal grants for education are also available.

While Members 1st has six in-school branches, it serves consumers across the state. Chief Marketing Officer Michael Wilson suggested schools are more likely to partner with institutions that help teachers meet benchmarks required by the state. Along with the 12 areas it has developed training on, Wilson said the CU also works with educators on an individual basis to customize financial education offerings.

“We talk about how to establish credit but if a teacher prefers that we focus on how to balance accounts in the digital era, we will certainly take a look at that,” Wilson said. “We’re constantly adding exercises based on what teachers are seeing as needed in the classroom and monitoring the curriculum to keep it aligned.”

While it’s unknown exactly how many credit unions in the state or nationwide are aligning their financial literacy standards with local schools, there are a variety of other ways the industry is stepping in to fill consumers’ financial education needs. Earlier this year the World Council of Credit Unions

Little momentum

The Keystone State is home to 365 credit unions serving about 4.3 million members, and according to Michael Wishnow, SVP of marketing and communications at the Pennsylvania Credit Union Association, a growing number of institutions are utilizing in-school branches as a laboratory to reinforce the financial topics they’re learning about in the class room. And, he added, it has the added bonus of increasing awareness about the possibility of a career within the credit union movement.

“We have about 50 credit unions across the state that have in-school branches and almost all of them do something from a curriculum standpoint,” Wishnow said. “They teach kids personal financial habits and give them exposure to what it’s like to work in the financial services industry.”

Despite what’s happening in Pennsylvania, momentum for financial education in schools remains slow, according to Paul Golden, spokesman for the National Endowment for Financial Education. That’s why it’s necessary for credit unions to pick up the slack with their own financial literacy programming in order to fill a need that is generally not being met in the classroom and at home.

Whether by integrating course offerings with state standards, lobbying state representatives to jump-start the coalition for financial literacy as a national organization, or making financial programs affordable by reducing the barrier to access, credit unions across the nation can get more involved to help better shape the course of students' early financial lives, Golden said.

“Financial education on a high school level actually leads to better borrowing for college financing, especially when college indebtedness is a pretty big issue right now,” he said.