-

In an effort to compete with the vast resources of big banks, credit unions are partnering with fintechs to deliver banking products designed for children.

August 6 -

The Consumer Financial Protection Bureau is restricting its civil penalty fund from paying for consumer education and financial literacy programs.

June 19 -

-

Banks can and should play a key role in giving members of minority groups and other underserved communities the tools they need to navigate an increasingly complicated financial landscape.

December 24

-

Hundreds of thousands of Americans leave prison each year with little or no financial literacy. It's in the interest of banks and the communities they serve to educate them.

September 19

-

Financial services professionals should be in the business of normalizing discussions about personal finance. The result will be a more financially literate population, and that's good for everyone.

June 20

-

The state's lottery program has begun referring the 30,000 people a year who buy winning tickets to credit unions for financial advice.

August 25 -

With financial literacy apps, scholarships and college-team sponsorships, credit unions are fighting for market share among students.

August 19 -

The Charlotte, N.C., company and the nonprofit Operation HOPE already partner to provide coaching at nearly two dozen counseling centers within Truist’s branches. They plan to add 26 more counseling hubs, serving 1,000 Truist branches, by 2025.

April 29 -

Too many Americans lack a sound grounding in personal financial management, which limits their opportunity to build long-term financial independence.

April 9

-

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

Many credit unions offer youth accounts to help establish early banking relationships, but a new account for kids from the nation’s largest bank has raised the level of competition.

October 21 -

In an exclusive interview announcing the regulator's new financial inclusion program, NCUA Chairman Rodney Hood explains why the time was right to double down on the agency's efforts to expand access for marginalized communities.

October 19 -

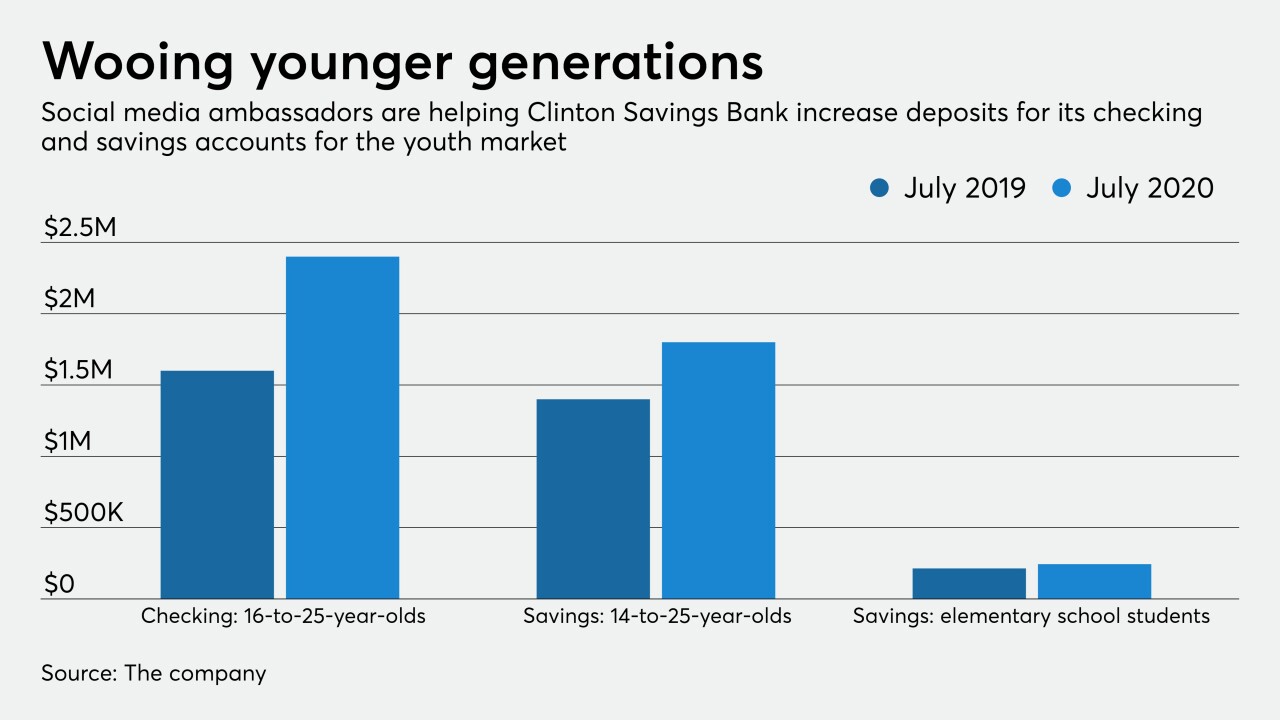

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

From student-run branches to courses on credit, budgeting and more, one of the industry's longest-running partnerships is being upended as districts across the country move to virtual learning.

August 12 -

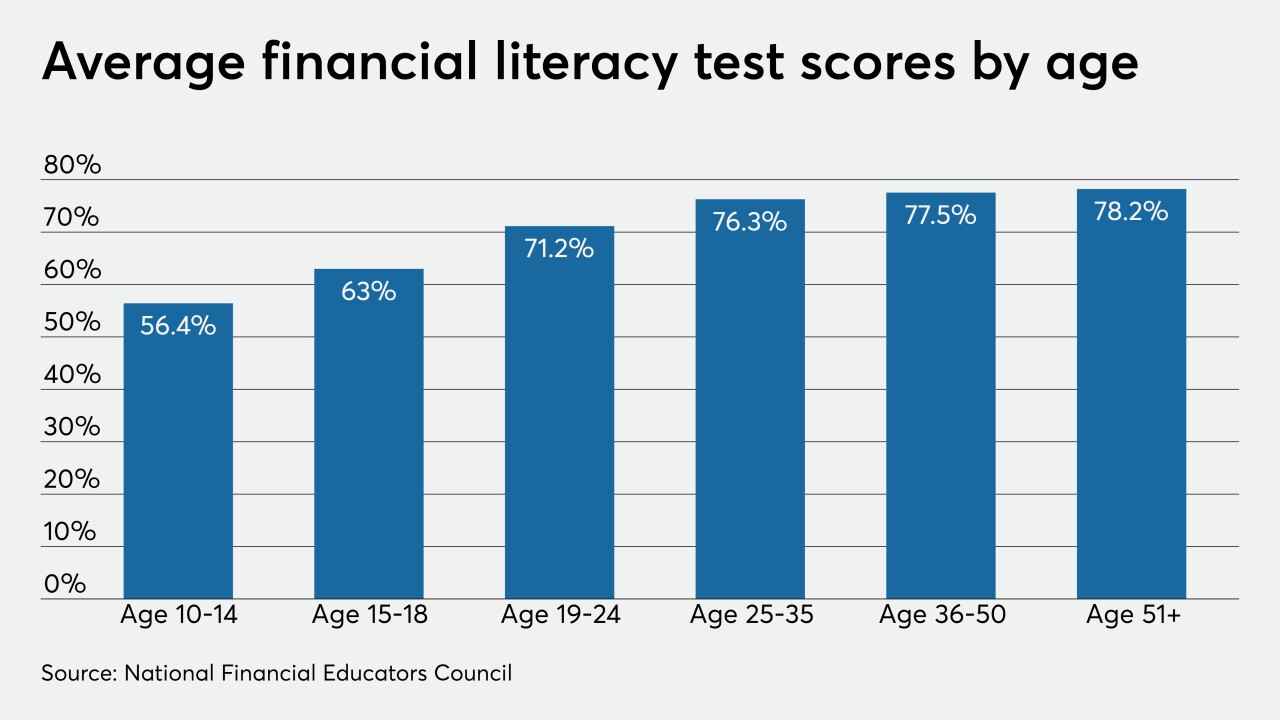

Older Americans also did fairly poorly by getting an average score equal to a C plus.

April 8 -

The Trump administration proposes cutting personnel and other budgetary items at the bureau, while the agency’s director — who controls the purse strings and was hand-picked by the administration — aims to boost spending and hire more employees.

February 20 -

The promotion of Melinda Chausse was one of several leadership changes the Dallas company announced this month.

January 23 -

One credit union's experience helping Puerto Ricans after Hurricane Maria illustrates how powerful financial wellness tools can be.

January 3 PenFed

PenFed -

A new study from the National Endowment for Financial Education indicates there could be wider interest for financial education in the coming year.

January 3