U.S. Rep. Joyce Beatty (D-Ohio) asked for a show of hands during a recent credit union event in Washington.

“Every year, the NCUA sends out a diversity self-assessment for all of you to complete,” she said during the National Association of Federally-Insured Credit Unions’ Congressional Caucus last month. “How many of you knew about this?”

Only a few hands in the hotel ballroom went up.

“Not enough,” she quipped.

The National Credit Union Administration sends an annual

Despite that low response rate, diversity is

According to Shirley Cate, president of Portland-based Providence Federal Credit Union, the self-assessment “was an eye-opener for me based on what they wanted me to answer and based on what they were asking.” The survey includes questions about whether institutions have written policies in place on diversity – not just for hiring, but for director-level positions, vendors and more – along with whether CUs publish information on their diversity efforts, perform their own internal assessments on the topic, conduct diversity outreach initiatives and more.

“I think that what it did for me was that it told me that we need to put this in part of what we do every single day and have a direction or a vision of what we want to do,” said Cate.

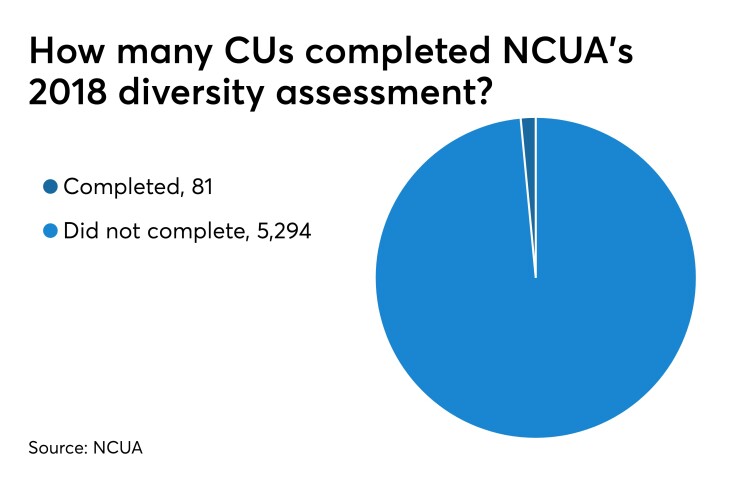

Of the 81 credit unions who completed the survey, 49% conduct their own internal diversity self-assessment. More so, 40% have made attempts to modify their diversity policies and practices based on a self-assessment and only 7% have published information pertaining to their diversity policies and practices. Ten percent said they make their diversity strategic plan public knowledge.

In order to help boost awareness of these issues and the assessment itself, NCUA subsequently announced a

‘Culture shift’ for CUs

If diversity is such a big issue in the industry right now, why the low response rate? Some say NCUA itself may be partly to blame.

“This is a long-term project and we recognize that, for some credit unions, it represents a culture shift, a new way of running their operations,” said John Fairbanks, a spokesperson for the regulator. “We expect participation to increase as more credit unions see the advantages of a focus on these issues.”

NCUA also plans to boost participation by promoting the event at industry conferences and better communication with trade associations at both the state and national level.

Still, NCUA may have its work cut out for it since many CUs and industry groups aren’t even aware the survey exists. Diana Dykstra, president and CEO of the California and Nevada Credit Union Leagues, said she wasn’t even aware NCUA sent the assessment out until she read a report from the agency on the most recent year’s findings.

“NCUA didn’t tell the league that they were sending it out, otherwise we would’ve helped support them and encouraged our credit unions to complete them,” she said, adding that sometimes when the agency sends items out that it’s not always apparent that any action needs to be taken.

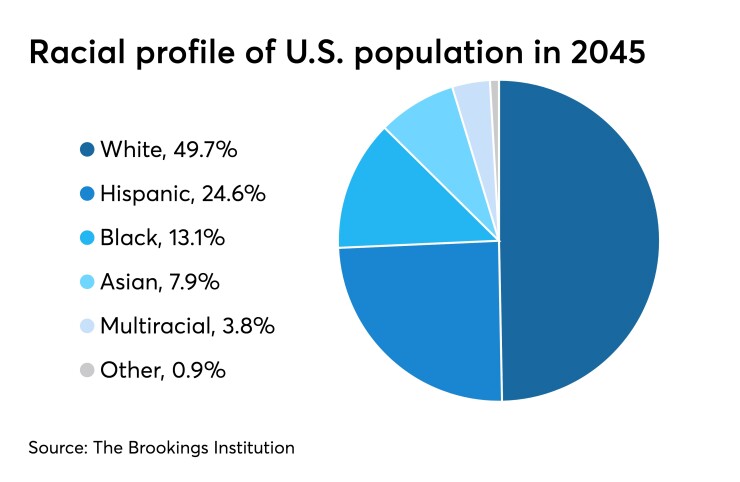

Dykstra noted that she was unsure if that was true in this case, but affirmed that credit unions need to remain vigilant and pay attention to community representation.

Credit unions lead the financial services sector in

The Credit Union National Association’s board of directors passed a resolution last month pledging its support for

And the jury is still out on whether NCUA’s self-assessment tool is even the most effective method for measuring these efforts.

When asked if the self-assessment form should become mandatory, CUNA President and CEO Jim Nussle said that though the form was a good tool, it doesn’t tell the full story.

“I don’t think a government form necessarily answers the full question here,” he said. “It may provide numbers, but in and of itself that doesn't necessarily answer the complete picture of the journey a credit union is on for diversity, equity and inclusion.”

While diversity initiatives are slowly making inroads in the industry, more attempts to understand their progress are also underway. The Filene Research Institute introduced six new research pillars earlier this year, including one focused on DEI practices at CUs.

“One thing we want to do is create clear, understandable confident benchmarks of what the state is of diversity, equity and inclusion at credit unions,” said George Hofheimer, EVP and chief research and development officer at Filene.

Along with identifying new ways to help consumers in an increasingly diverse marketplace, Hofheimer said the think tank also hopes to identify gaps within the industry itself, including demographic issues on credit union boards of directors.

Shirley Cate of Providence FCU said that’s an area her institution has already identified as an issue – for better or for worse. She noted that NCUA's questionnaire requested information about the board's diversity and if there was a process or discussion around diversity of the credit union's board.

"There really isn't," she said. “The only diversity we really talk about is if we can get someone younger or someone with finance experience.”

This story was updated at 9:58 A.M. on Oct. 3, 2019.