The National Credit Union Administration faces mounting opposition to a shared facilities proposal

The current rule requires credit unions to hold an ownership stake in a branch or ATM in order for it to count as a service facility. The proposal would change that, allowing credit unions with shared branch or ATM agreements to count those facilities as their own for the purposes of expansion — a move that would allow institutions to grow and expand their fields of membership without the huge capital outlay that is traditionally necessary to do so.

But many are pushing back against the proposal, with opposition coming not just from bankers, as expected, but also from those close to the agency.

Mark McWatters, a

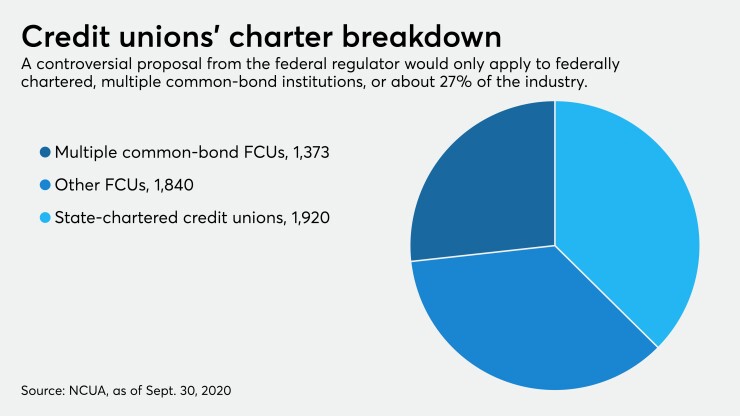

The NCUA board in December voted to move ahead with the rule, which would allow federally chartered, multiple-common-bond credit unions to include any ATM, shared branch or other shared electronic offering among its service facilities.

The rule would only apply to multiple common-bond credit unions with a federal charter. As of Sept. 30, there were 1,373 credit unions that met that criteria, or about 27% of the industry. Of those, only 286 participate in a shared branching network, an NCUA spokesman said. About 71% of federal credit unions with multiple common-bond charters have assets of $100 million or less.

Todd Harper, a Democrat who last month was

"I do not find that a leased ATM, among other proposed structures, creates a sufficient field of membership nexus under the Federal Credit Union Act," he said in December. It is unclear when the proposal might come before the board again, but it does not appear on the agenda for the Feb. 18 board meeting.

NCUA representatives did not provide comment on allegations that the proposal might violate the law.

Harper’s opposition may not matter despite his being chairman, since he is outvoted on the panel. Board member Rodney Hood, who was chairman when the proposed rule was introduced in December, called it “

“These are changes that really should have happened a long time ago,” Hood said during the December meeting.

That feeling isn’t universally shared, and bankers have pushed back strongly against the proposal.

The NCUA received more than 700 comment letters on the matter, many of which came from banks and trade groups representing them. Timothy Keehan, vice president and senior counsel for the American Bankers Association, suggested the rule would allow, for example, a federal credit union in South Carolina to add employer groups in South Dakota. That, he argued, would pave the way for national, online credit unions that would "devalue, dilute and ultimately dissipate” the common-bond concept.

"The proposal flatly contradicts Congress’s pointed directive to confine a credit union’s field of membership to a local presence," Keehan wrote. "Consequently, NCUA has exceeded its statutory authority under the [Federal Credit Union Act]."

ABA representatives declined to comment on whether they were prepared to sue the NCUA over the proposal, as they did with a 2016 revision to field-of-membership rules. Bankers ultimately lost that case last summer after the Supreme Court elected

For now, banks are speaking out against the credit union regulator. Susan Horton, president and CEO of Wheatland Bank in Spokane, Wash., wrote that Congress intended for credit unions to maintain a local presence in the communities they serve. "NCUA does not have the authority to re-write the Federal Credit Union Act in this way, and every step they take away from that statutory mission undermines the tax-exempt status of the credit union charter," she added.

Those in the industry, however, argue that the change helps bring credit unions into the digital banking era.

With members increasingly relying on digital services and visiting branches less frequently, transactions at many credit unions are down. Mary Isaacs, chief financial officer at Altra Federal Credit Union in Onalaska, Wis., said the average number of teller transactions per member declined by 11% last year, while ATM deposits were up by 63% and mobile deposits rose 12%.

"Hopefully soon, NCUA will move to the logical and timely next step of recognizing digital means as qualifying as service facilities," Isaacs said. "It is certainly justifiable and a full reflection of today’s constantly changing technological marketplace for financial services."

Credit union trade groups have also spoken up in defense of the rule, with the National Association of Federally-Insured Credit Unions calling bankers’ claims “falsehoods and mischaracterizations” of the rule’s intent.

"The proposed rule would define service facility in a manner that provides clarity, consistency and the appropriate recognition of technological advances and the current operation of shared branching," said Elizabeth LaBerge, NAFCU’s senior regulatory counsel.

While the Federal Credit Union Act contains field of membership requirements, Michael Bell, an attorney with Michigan-based Honigman, said it’s time for those rules to be reviewed and updated. What constituted reasonable proximity to a credit union service facility 20 years ago “is very different from reasonable proximity now, and we all know and recognize this in our everyday lives," he said. "Moreover, the meaning of a 'service facility' 20 years ago is very different from service facility now."

The NCUA’s proposed update, he said, “makes logical sense, legal sense and conforms with" the Federal Credit Union Act.