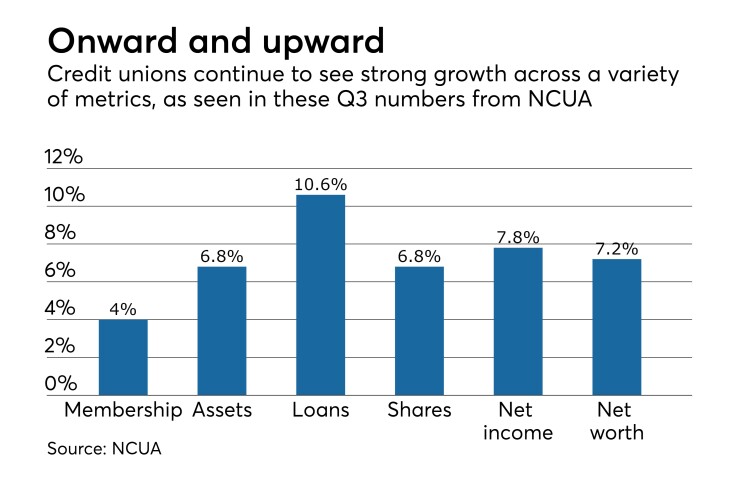

Credit unions overall continue to see strong gains in membership, loans and assets, according to newly released third-quarter data from the National Credit Union Administration.

As of Sept. 30, 2017, membership at federally insured credit unions was up by 4.3 million (4 percent) over the past 12 months, with total membership reaching 110.5 million at the end of Q3. Similarly, total assets rose by 6.8 percent in that same time period to $1.36 trillion. Loans grew by double digits, seeing a $90 billion increase (10.6 percent) to a total of $937 billion. Additionally, the average outstanding loan balance at CUs rose to $14,708 during the third quarter, a 4 percent ($561) increase.

Other highlights from NCUA’s data:

• Shares grew by 6.8 percent to $1.15 trillion

• Loan-to-share ratios increased by 2.8 percentage points to 81.4 percent

• Net income was up 7.8 percent to an annualized total of $10.5 billion

• Net worth increased 7.2 percent to $149 billion

• The delinquency rate stood at 79 basis points, essentially unchanged from the prior year

• Net charge-off ratios were at 56 basis points, a three basis-point increase from Q3 2016

• The net interest margin was at $39.5 billion (3 percent of average assets). One year prior it was $35.8 billion (2.9 percent of average assets).

• Return on assets was at 79 basis points, an increase of one basis point from Q3 2016

• Median ROA across all federally insured CUs was 39 basis points, an increase of two basis points from Q3 2016.

Great divide goes on

As has become the case with these announcements, however, the news of those gains was tempered by a continued decline in the overall number of credit unions nationwide and statistics revealing continued growth of the “great divide” between large and small CUs, as those on the upper end of the membership and asset spectrum continue to see the biggest gains, while smaller CUs continue to struggle.

There were 202 fewer federally insured credit unions at the end of Q3 2017 as there were at the end of Q3 2016, a 3.4 percent decline for a total of 5,642 institutions. Specifically, that breaks down to 3,536 federally chartered CUs and 2,106 state charters.

As of Sept. 30, 284 credit unions have assets of at least $1 billion (compared to 268 one year earlier), though those institutions – just 5 percent of all CUs – hold 63 percent total system assets. CUs with assets of $1 billion or more saw loans grow by 14.7 percent, along with membership gains of 9.2 percent and net worth increases of 11.4 percent.

At the opposite end of the spectrum, the number of CUs with assets ranging from $10 million to $50 million dropped by 80 from Q3 2016 to 1,800 in Q3 2017, with these institutions seeing a 1.9 percent decline in loans and a 6.3 percent decrease in membership. Net worth for these credit unions was down by 3.6 percent.

Between Q3 2016 and Q3 2017, the number of CUs with assets under $10 million declined by 129 to 1,562. These CUs hold just $6.5 billion in assets (less than 1 percent of total system assets), and saw a 6.1 percent decline in lending and a 9.3 percent drop in membership. Net worth was down 5.9 percent.

One positive change: the number of credit unions with a low-income designation rose to 2,538, an increase of 79 new LICUs.

Credit union trade associations received NCUA’s new numbers favorably.

"The third-quarter data reveals the great benefits credit unions provide to their members, communities and the nation's economy as a whole," said Dan Berger, president and CEO of the National Association of Federally-Insured Credit Unions. "Credit unions continue to see growth because those in their communities see what a tremendous focus they place on delivering superior support and products to their members."