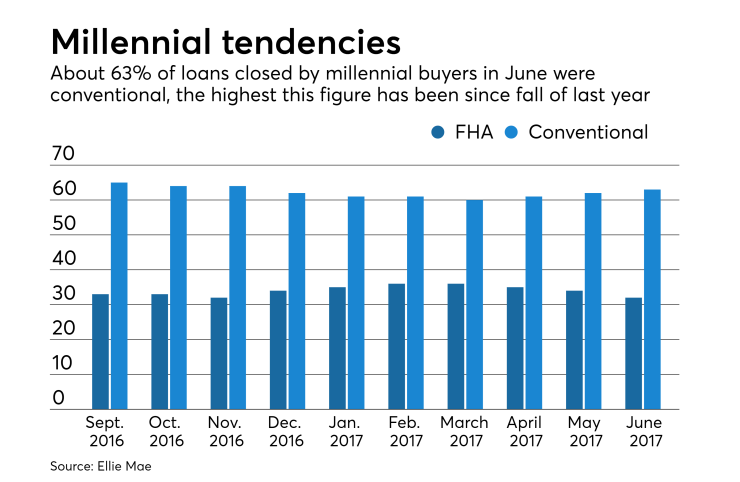

Millennials have taken a slight step back from FHA loans, signifying they may be able to afford more at the moment, according to Ellie Mae.

About 63% of closed loans made to millennial homebuyers in June were conventional, with an average amount of $205,066; about 32% of these closed loans were FHA loans for an average amount of $173,381. These loan types make up the vast majority of loan types among millennials.

In June, conventional loans made by

The dip in FHA loans doesn't necessarily indicate that millennials are shunning FHA loans, but that overall appetites for conventional loans have grown, according to Joe Tyrrell, Ellie Mae's executive vice president of corporate strategy. The numbers tend to swing in correlation.

"Many home buyers, especially the millennial generation, may gravitate toward conventional loans simply because they don't know about or understand fully all the other options that exist. A lack of awareness of FHA loans presents lenders an opportunity to educate their customers about the loan products available to them," said Tyrell in an email.

The main reasons millennials choose to buy are because they simply no longer want to rent and feel they have enough money saved, according to an Ellie Mae borrower insights study.

"The strength of the conventional mortgage market could indicate that millennials who are ready and willing to buy have been able to save or obtain enough funds to meet the down payment thresholds most of these types of loans require," Tyrell said.

One other reason millennials are buying? They want