Bellwether Community Credit Union in Manchester, New Hampshire, is doubling down on its partnership with the New York-based advertising technology firm

Consumer purchases of gift cards across the U.S. have continued to grow over the last 15 years. Data published last year by

Consumers pushing towards digital tools have helped drive the popularity of gift cards over the last few years, causing interested bank and credit union executives to adapt their strategies for marketing the products to buyers, said David Shipper, strategic advisor in Datos Insight's retail banking and payments practice.

When the $600 million-assets Bellwether began its partnership with Prizeout in January of last year, the credit union's leaders were in search of a product that would help distinguish their organization from other local players and provide members with more ways to safely purchase gift cards.

Banks and credit unions generally offer "checking accounts, auto loans, mortgages and other products as standard products, so we sought [Prizeout's CashBack+] feature as a value add to our members and also a differentiator for us to offer digital gift cards with a price benefit for our members," said Lori Holmes, vice president of marketing at Bellwether.

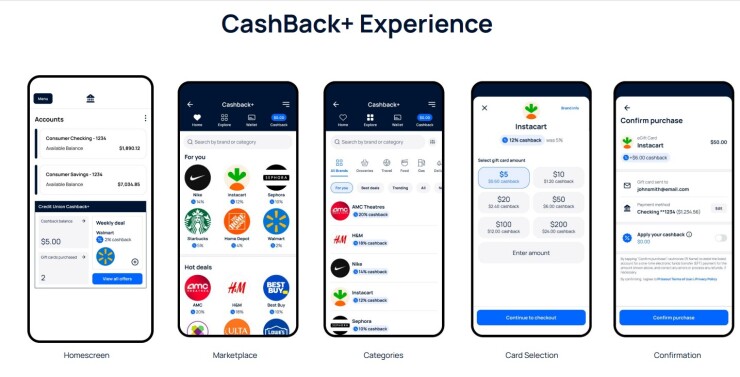

Members interested in purchasing a closed-loop card can navigate to the Prizeout widget within Bellwether's mobile and online banking portals and select from a network of local and national vendors offering cash back incentives. While categories of local participating business differ between geographic regions, consistently offered vendors include Walmart, Home Depot, Starbucks and more.

After purchasing the cards, cash back accrued by the member is stored in a tertiary "Cashback +" account, where the balance can either be transferred to a savings or checking account, or used to fund future gift card purchases. Prizeout additionally creates an added inflow of non-interest income by returning up to 3% of every consumer gift card transaction back to the partner credit union, which is supported by the fees paid by the merchant.

Holmes said member interest and engagement with the tool has continued to increase since Bellwether launched the product in November of last year, as "it was such a big value add to our members and I think they've realized it too," she said.

Some applications for gift cards and similar products extend beyond rewards. In 2022, the Canadian

Firms like Tillo, an embedded rewards firm which is dual headquartered in the United Kingdom and Austin, Texas, but also has an office in Australia, and the Pleasanton, California-based gift card giant

Jennifer Philo, group vice president of global commerce for Blackhawk Network, said that consumer expectations for banking experiences have shifted towards personalized insights that cater to their unique needs and preferences, pushing executives to meet cardholders where they are.

"This means offering a robust gift card portfolio in different denominations for low- and high-dollar reward options and flexibility, more opportunities to earn through category and even specific merchant spending," Philo said. "With the rise of omnichannel (particularly digital) banking, your cardholders provide you with a plethora of data you can leverage to tailor their experiences and keep your cards top of wallet."

Incentives like gift cards, when built into rewards programs, can help increase brand loyalty among consumers and employees alike, said Alex Preece, chief executive of Tillo.

"By putting your rewards toward a brand you love, it feels more like you are 'treating yourself' than just getting cash, which will likely go towards gas, bills and groceries, for instance," Preece said.

Prepaid cards have also become a popular option among banks and credit unions. After purchasing a $50 million portfolio of reloadable cards from an unnamed seller in July 2020,

Since February, New York City officials have been working with the locally-based fintech Mobility Capital Finance, or MoCaFi, to

Other financial institutions, like the $651 billion-assets U.S. Bank in Minneapolis, have faced regulatory action for missteps with prepaid programs. The bank

Experts with Datos Insights and Crone Consulting say that while initial consumer perception of gift and prepaid card usage is towards standard transactions, underserved communities with fragile access to credit products use them in some unexpected ways.

"Many consumers use these accounts as budgeting tools, where they will have the card issued by a grocery store or some other merchant and load funds on that as a way of controlling and categorizing their spending," said Heidi Liebenguth, managing partner at Crone Consulting. "This is especially appealing to those younger consumers who maybe don't feel comfortable with credit cards necessarily or don't want to take on debt."

CashBack+ is the first in a planned suite of tools offered by Prizeout to help partner institutions grow their market share in the gift card market and spur consumer spending.

"The gift card ecosystem is fascinating, because it's really the only thing that lives entirely outside Visa and MasterCard rails, but it's accepted by virtually every point of sale system. … So we've really leveraged that, in order to leverage acquisition for merchants and revenue for the credit unions," said David Metz, CEO of Prizeout.