A new report from West Monroe Partners indicates credit union M&A activity isn’t likely to slow down anytime soon.

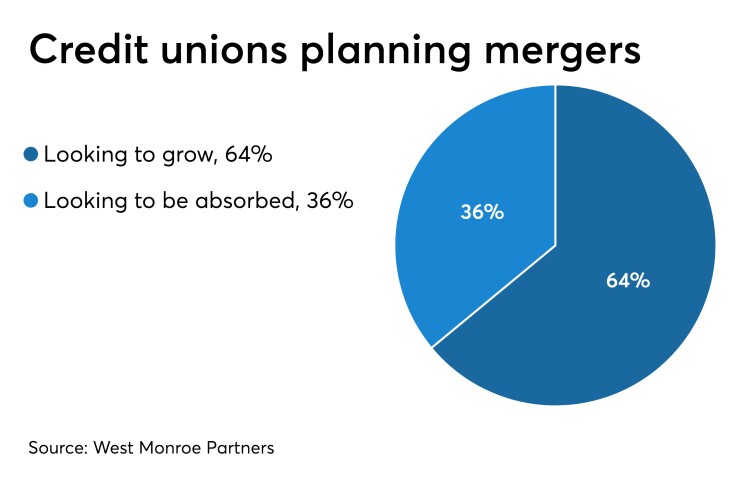

About two-thirds of credit unions polled say they are looking to acquire some type of institution within the next two years versus the remaining one-third who would like to be acquired.

For those looking to absorb, that includes the possibility of bank acquisitions. CU-bank purchases this year have already reached record highs, and the study reveals that as many as one-third of those CUs surveyed are looking to partner with a bank.

When it comes to how those partnerships are structured, however, respondents were split. Half of those who said they were interested in a bank deal were keen on purchasing one, whereas the other half said they would be willing to be acquired by a bank – a rare move within the industry.

West Monroe polled 100 credit union leaders actively pursuing transactions about the current M&A landscape. Fifty-one percent of CUs have participated in mergers over the past five years

Concerns remain however with those seeking a bank merger, with differences in mission or vision between the two institution types identified as a major concern. More than half of polled credit unions (59%) were unsure of compatibility.

Still, an uncertain economic environment over the next 12 to 24 months is leaving more than one-third of credit unions to wait out the storm as they continue mulling over the strongest M&A partners. Thirty-seven percent cited regulatory concerns to sit a deal out, which makes sense when accounting that 62% of those pursuing mergers faced delays due to regulatory concerns.

“To move forward successfully and respond to disruptive change, these organizations should first focus on what their growth plan should look like — then consider strategic M&A activity to support this plan,” the report concluded.