Despite credit unions and banks rolling out a host of offers for small-dollar lending and other unsecured loan products,

That’s particularly true among subprime borrowers who are requesting personal loans at less than half the rate they were at the start of 2020, the report found. Unsecured personal loans are a

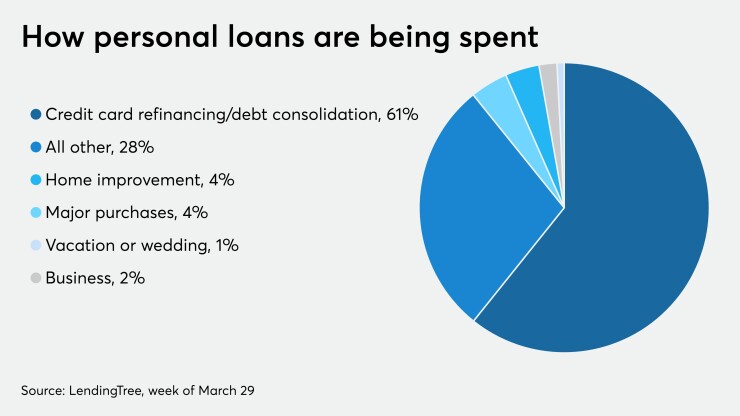

LendingTree’s reporting represents the week of March 29, the most recent data available.

Despite the drop in demand, requested loan amounts are higher than usual, in part because of prime borrowers. Mid-prime and subprime consumers, however, are asking lenders for smaller amounts than usual, but the company said borrowers with better credit scores are skewing the overall results toward higher loan amounts.

LendingTree said the decline in personal loan requests is largely due to a drop in luxury spending, which is borne out by a decline in loan inquiries for weddings and vacations, which are typically popular at this time of year. Loan inquiries for business needs, which had previously spiked, also dropped to new lows for 2020.

One loan category that is up, LendingTree found, is credit card refinancing and debt consolidation. The company said that indicates consumers are focused on getting their financial lives in order before the economy gets any worse.

“While demand for personal loans has normalized since the week of March 15 we are continuing to see increased interest in the product from prime consumers,” said Michael Funderburk, LendingTree’s director of personal loans. “Given the unpredictability surrounding employment in so many industries, lenders are struggling to determine which borrowers to lend to and at what rates. As they work on retooling their underwriting and pricing models, many lenders have significantly reduced their appetite to originate new loans and the net result is consumers being left with fewer options.”

Louisiana, Montana and Missouri were the only states where fewer than 50% of borrowers requested funds for debt consolidation, compared with Washington D.C., and Vermont, where more than 75% of borrowers planned to use the money for that purpose.