Credit union mortgage lenders could soon see some regulatory relief from changes the Consumer Financial Protection Bureau has proposed making to the Home Mortgage Disclosure Act.

The

Industry observers praised the moves, saying that the changes would provide needed regulatory relief to credit unions, especially given the costs of hiring new staff to meet the requirements.

“In 2018, we said HMDA reform was a top priority for credit unions,” said Andrew Morris, senior counsel for research and policy for the National Association of Federally-Insured Credit Unions. “Credit unions just submitted HMDA data in March, but that does not mean relief is not needed.”

Under the suggested changes to the threshold requirements, fewer institutions would be required to provide data. That should provide relief to smaller credit unions, which may do a limited number of mortgages, said Tim Mislansky, president of My CU Mortgage, a credit union service organization owned by the $4.4 billion-asset Wright-Pratt Credit Union. Bigger institutions could also indirectly benefit by the CFPB taking a more tailored approach to its regulation.

“In addition, this change also benefits larger credit unions as it could be a good step to the CFPB not applying a one-size-fits-all regulatory approach,” Mislansky said. “For too long, the CFPB applied too many of its regulations across all institutions regardless of size and structure.”

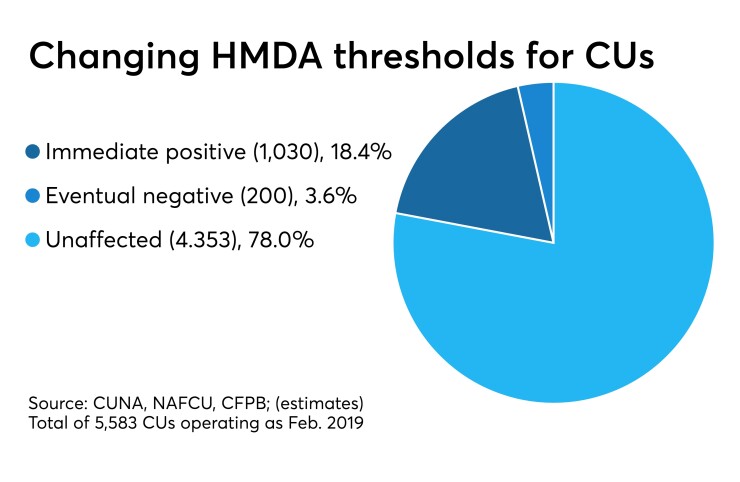

If the CFPB increases the closed-end mortgage loan threshold from its current level of 25 loans to 50 loans, it would provide HMDA relief to nearly 380 additional credit unions, according to Alexander Monterrubio, senior director of advocacy and counsel for the Credit Union National Association. If the threshold were to be increased to 100 loans, then more than 650 additional credit unions could see relief from HMDA reporting requirements.

“While we think the bureau could go further to provide regulatory relief to credit unions, this is a step in the right direction,” Monterrubio said.

However, CUNA was less happy with the agency’s plan to reduce the threshold of open-end lines of credit from 500 to 200 after 2022. That would mean more than 200 credit unions could lose their exemption, Monterrubio said.

“CUNA has serious concerns with decreasing this threshold and has repeatedly called on the bureau to make HMDA reporting voluntary for open-end lines of credit – as it was prior to the 2015 HMDA rule,” he added.

Reviewing HMDA categories

The potential decrease to the number of discretionary categories for data collection is the “best opportunity for broad-based relief,” Morris said. So far the agency hasn’t identified any data points that could be eliminated and instead is seeking input about considerations such as the cost of the data collection and usefulness of data in curbing lending discrimination, he added.

For years credit unions have complained about having to hire and train employees to deal with the data requirements. And some “data points are more problematic for credit unions than others,” Morris said.

“Collecting this data is costly and can be confusing, especially when the bureau has not provided the best guidance for collection,” Morris added. “The bureau has added categories beyond what was required by Dodd-Frank requirements.”

Both proposals will be entering comment periods soon, after each is published in the Federal Register, Morris explained. The proposed changes to reporting thresholds will have a 30-day comment period, while the plan regarding data categories will have a 60-day comment period.

Even if both proposals go through, credit unions would prefer additional changes. My CU Mortgage’s Mislansky said there still is too much data collected for HMDA reporting, making it a “time-consuming and costly regulation to comply with.”

“Even with the proposed changes, the modified rule still supports the original intent of HMDA, which is to prevent redlining in communities,” Mislansky said. “Because credit unions only lend to members, and membership is often community based, their lending efforts align with efforts to avoid redlining.”