CHICAGO-Offering both credit and debit cards goes a long way toward members seeing greater value in the credit union.

The finding is one of several from a recent data study conducted by Discover Financial Services on credit union member attitudes and payment preferences.

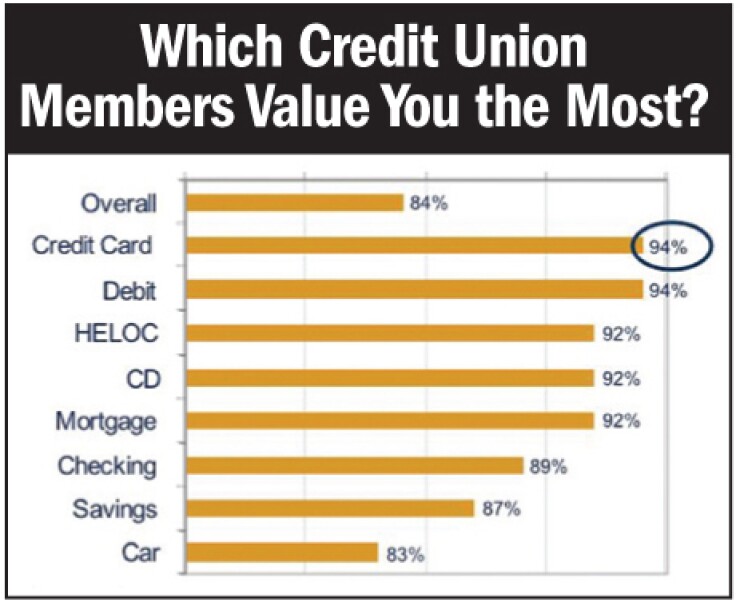

Of all products CUs offer, credit and debit cards drive the greatest loyalty, according to the study. The report indicates that 94% of respondents who said they value the credit union above community banks hold either a CU credit or a debit card, two percentage points above members who hold a home equity line of credit, CD, or mortgage.

The important takeaway, Discover VP Kevin O'Donnell told attendees during a breakout session at NAFCU's 43rd Annual Conference, is that only 29% of credit union members have a CU credit card. "This is a big opportunity for credit unions to generate even more loyalty," he said, noting that members today are reducing the number of credit and debit cards they carry in their wallet.

What is driving loyalty, no matter what products individuals hold, is a feeling members have of being able to relate to the credit union, the study found. "Members feel that the credit union is 'here for me,'" stated O'Donnell. "This ranks above trust, confidence, and satisfaction in the study."

O'Donnell said the report, which surveyed 140,000 consumers, shows that usage trends for credit cards indicate members are more careful with credit and are paying down card balances at a greater rate today than in recent years. "We are seeing more of 50-50 mix between people who carry a balance and people who pay off their bill in full."

Turning to legislation, it is difficult to predict how new regulations will impact card usage, according to O'Donnell, who added that the study shows a strong growing consumer interest in prepaid and general purpose reloadable card programs. Mercator Advisory Group, O'Donnell pointed out, predicts consumer demand for prepaid will continue to grow, and the total prepaid market size will become $427.5 billion by 2011.

On the mobile banking front, credit unions appear to be taking full advantage of the medium. Today, 52% of CUs offer mobile banking, up from 24% in 2009. "Mobile banking is here. But mobile coupon shopping is not. But it is coming," O'Donnell said. "I encourage you to start looking at that. As you get a better understanding of who your members are and what products they are interested in through your surveys, maybe drop in some questions around mobile couponing."

Other study findings:

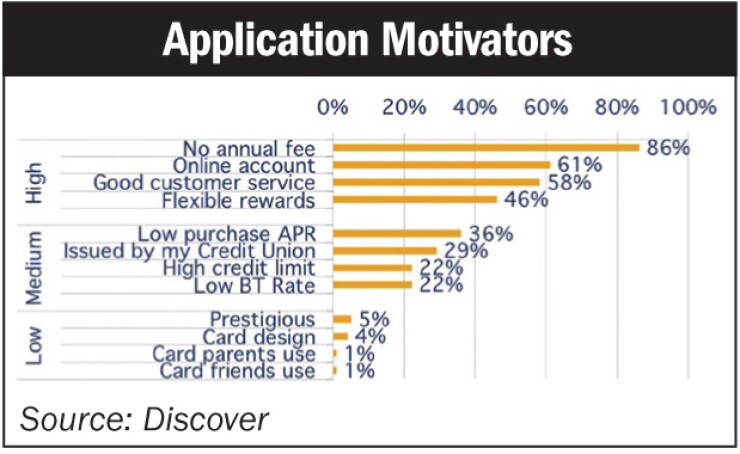

• No annual fee is the biggest reason members apply for a CU credit card.

• Credit union members are significantly more likely than non-CU customers to actively reduce their number of financial cards.

• A large shift is taking place among CU credit card holders, moving from a revolver to a "transactor" behavior.

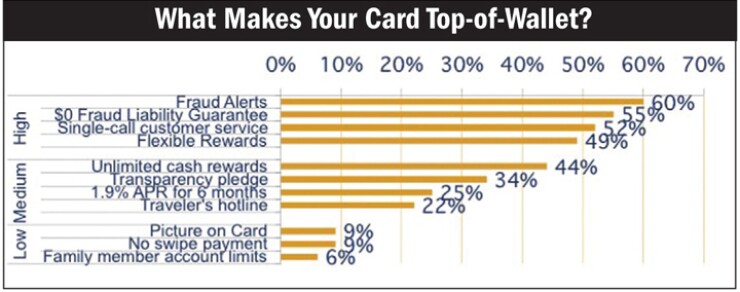

• CUs should have no trouble driving their cards to top-of-wallet with messaging focused on fraud protection and customer service.

• Credit unions have a high percentage of ATM/PIN-only cards. There is opportunity for CUs to increase transaction volume by offering dual-function debit, and not just PIN debit.