WARNER ROBINS, Ga.-Numerous business practices are responsible for Robins FCU's 1.49% ROA in 2010-including new technology, employee training, and net interest margin management. Yet the credit union says one simple business philosophy has made the biggest contribution.

"We don't spend money unless we can make a business case that the effort will provide value back to the member," explained CEO John Rhea. "We have been able to grow our business because we provide great value to members."

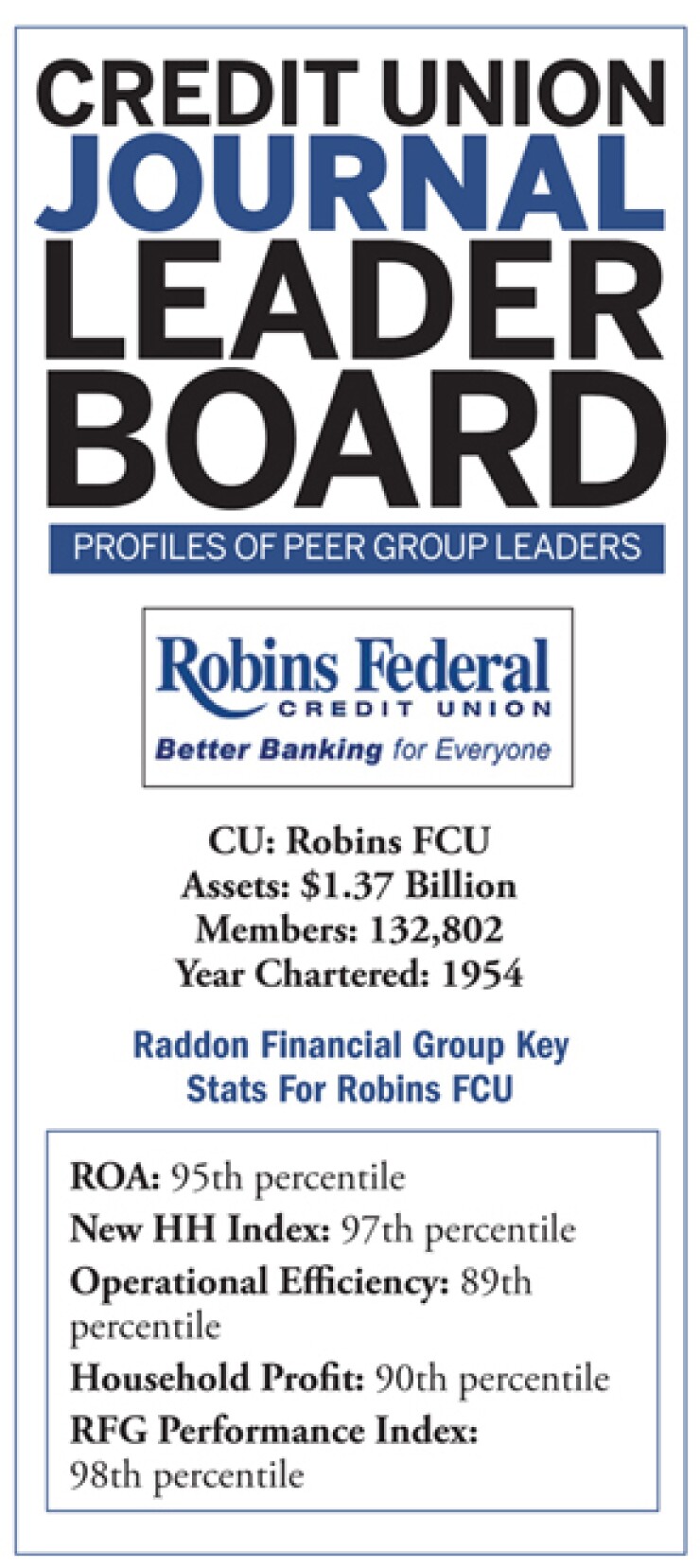

The $1.4-billion CU was ranked by Raddon Financial Group in the 95th percentile (2009) in its peer group for ROA (1.30%) and only saw the number climb due to its attention to member value. On top of excellent service, Robins FCU is consistently at the top of the market in loan and deposit rates, said Rhea. At press time the credit union offered auto and home equity loan rates as low as 2.85% APR and 4% APR respectively, and paid 1.10% APY for a one-year CD.

Great rates and service, in turn, lead to even more satisfied members and deeper relationships, reminded Rhea. The effect can be seen, he noted, in the CU's overall performance-and Raddon ranked RFCU in the 98th percentile (2009) among its peers for Performance Index.

Channeling money where it is most needed not only benefits RFCU members, but its employees, as well. Rhea said a great deal of the success comes from the skill and attitude of Robins Federal's employees, which proves the ROI of training. The 335-employee CU has added three branches in the last four years and boosted assets by $400 million, without adding to headcount.

"To me the expense part of the equation is critical, and that is one of the weaknesses of the industry-the lack of efficiency, especially compared to banks," Rhea offered. "We spend a lot of time on our employees improving their skill and efficiency. We have a wonderful training facility and a team of trainers, and curriculum for basically every level of staff. We spend a lot of time in the classroom and tie many of our teachings to our business plan and strategies. We try to get everyone on the same page and that has really paid off."

RFCU measures results, too, making productivity and service scores part of employee performance evaluations.

Rhea admits RFCUwas fortunate to have conservative lending policies in place well before the recession, which has led to low delinquencies and charge-offs, both at .5%. "We don't try to chase anything, just do what's right for our members and be consistent about how we underwrite."

RFCU's operating expense to average assets was 2.68% in November, but the goal is to shave that number down to 2%. "The use of technology has improved efficiency a lot," Rhea said. "But so many times you see organizations add technology but not change associated processes to take full advantage of the change. Anytime we spend money on technology that improves efficiency, the business manager's job is to review and change the associated processes we have in place."

For example, the addition of a software solution to improve back-office efficiency, has eliminated a great deal of retained, but unused, information. Rhea said the combination of the technology and process improvements led to a 50% efficiency improvement over four years.

Growth In Net Interest Margin

Moreover, "Our net interest margin has been improving for the last 18 to 24 months," Rhea said. "We have worked hard to make sure we are very conscious of our overall cost of funds. We want to pay a good rate, but not overpay. We do the same thing on the loan side. We got smarter about how we do things and now monitor and measure market rates every month and meet weekly. We make sure nothing is out of whack in the least. If we see anything out of line, we tweak our rates.

"All of these things are moving our ROA in the right direction when many in the industry are headed the other way," Rhea observed.