State-chartered credit unions in the Badger State continue to see strong performance, according to a news release from the Wisconsin Department of Financial Institutions.

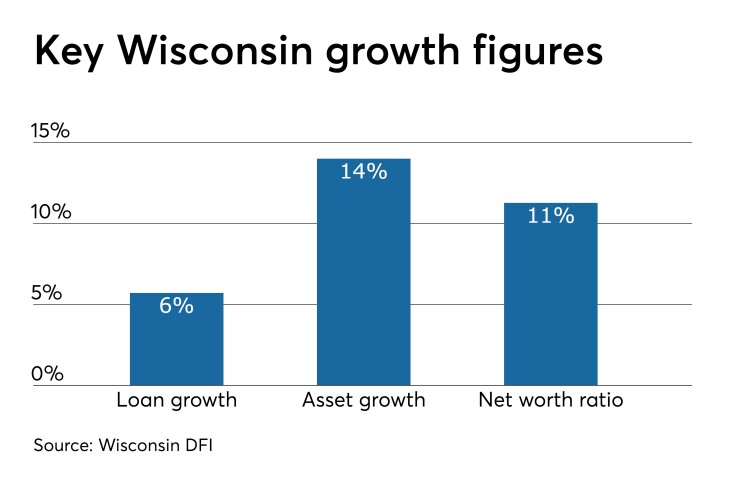

Lending at Wisconsin’s state-chartered credit unions was up 5.71% during the first six months of the year with balances just above $31 billion, according to the release. Net income, meanwhile, stood at $208 million, or 1.09% of average assets, with loan-to-share ratios hitting 93.6%.

Delinquencies were also at historic lows, standing at 0.62%, identical to where they stood in June 2018 and in line with other recent quarters, the DFI said. Net worth remained stable at 11.27% while total assets rose 14% to hit $39.6 billion – a four percentage-point increase over the same period last year.

“State-chartered credit unions continued to perform well during the first two quarters of 2019,” DFI Secretary Kathy Blumenfeld said in the release. “Their continued solid performance is a result of a good economy during the first half of the year and strong fiscal management.”

Three credit unions in the state were merged with others during the first half of the year.