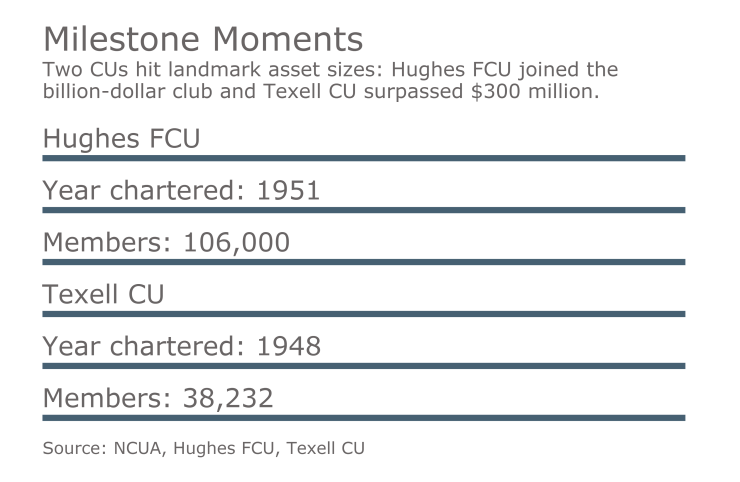

Credit unions in Arizona and Texas recently topped major asset milestones – Hughes Federal Credit Union, Tucson, Ariz., said it surpassed $1 billion in total assets, while Texell Credit Union, Temple, Texas, now has more than $300 million in assets.

Hughes FCU now serves 106,000 members. John Sansbury, chairman of the board, said the credit union doubled both its assets and its membership in the past seven years – since the Great Recession ended.

“This is a major milestone for Hughes,” Sansbury said in a statement. “To put our growth in perspective, the credit union’s assets grew 20% in 2016, or one-fifth our size in one year.”

Sansbury noted there is a national trend of consumers choosing a local alternative to national banks, which he said was one of several factors that contributed to the growth of the CU.

“People have been making a switch to Hughes Federal Credit Union to enjoy the benefits and peace-of-mind of banking with a locally-owned, not-for-profit financial institution,” he said. “Our financial cooperative model is what allows our member-owners to enjoy products and services such as our ‘certified’ high rates on savings and our ‘One Low Rate’ offered on most loans. It is all part of our mission to make a positive difference in the financial lives of our members.”

Hughes was established in Tucson in 1952. It is rated 5-Star “Superior” by BauerFinancial Institution, and rated A+ by the Better Business Bureau and accredited since 1974. Datatrac, an interest rates research firm, certified that Hughes FCU offers up to 22 banking products that outperformed the Tucson metro market up to 324%, earning the 2017 Great Rate Award.

Texell Credit Union

Tony Hale, president and CEO of Texell Credit Union, attributed the CU’s “continued and steady” growth over the past several years to “loyal members, dedicated staff, and excellent loan and deposit rates.”

When the CU announced it had surpassed $300 million in assets, Hale said, “We are pleased to have reached this milestone as it shows the strength of not only Texell, but also of Central Texas. We strive to make Central Texas a better place to live and do business. I believe this growth reflects our emphasis on these core values.”

Founded in 1948 to serve employees of the Temple Post Office, the Temple Veterans Administration and the Temple Soil Conservation, Texell said it has steadily increased its asset size and expanded operations.

Texell has grown in recent years, and now has eight locations.

“The foundation of Texell’s success and growth is our staff. Our members are loyal to us and trust Texell because of the excellent service they receive every day,” Hale continued. “Being member owned means that we only need to focus on our members’ best interests when we set goals, roll out new products, and open new locations.”

With roots dating back to the 1940s, Texell serves nearly 38,000 members.