Some credit unions have recently adopted a lending practice long associated with banks – syndicating loans.

Although loan participations aren’t new, the amount that credit unions are participating out each year is increasing. Participations are where the originator of the loan has other lenders buy part of the credit to mitigate risk. This is usually done with larger commercial loans but there has been a rise in consumer credit syndications as well.

Credit unions have been increasingly drawn to this practice because of the promise of higher returns and a chance at greater diversification.

"Credit Union A has more loan demand than it can handle, Credit Union B has no loan demand," said Ben Rempe, chief operating officer of LenderClose, a digital lending platform. "Should Credit Union A stop lending because it is 'loaned-out?' No, Credit Union A should sell to Credit Union B. It's a win-win."

Why loan participations are attractive

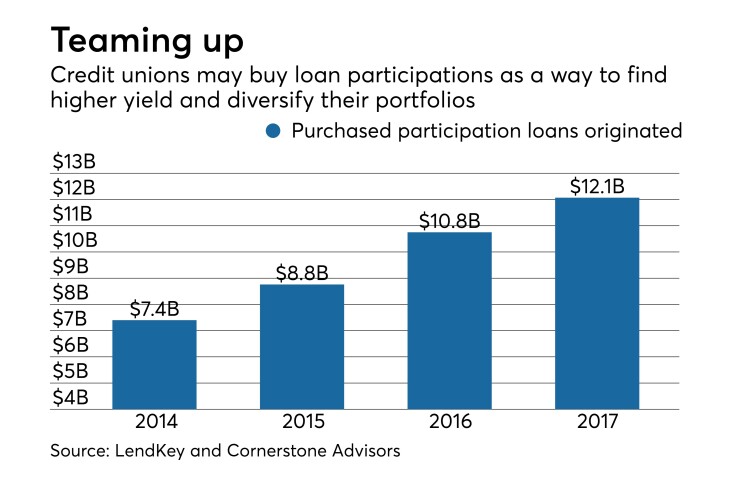

Twenty-nine percent of all credit unions hold loan participations on their books, up 6 percentage points from 2014, according to a report from LendKey and Cornerstone Advisors. The amount of purchased participation loans originated by credit unions rose roughly 61 percent, to $12.1 billion, from 2014 to 2017, according to the report. As a percentage of total loans outstanding, purchased loan participations rose from 2.27 percent to about 3 percent.

Vince Passione, CEO of LendKey, believes that credit unions have deepened their involvement in loan participations because historic low interest rates over the past decade have forced many credit unions seek out new ways to find yield. These loans also help to offset risk for lenders.

“Syndications significantly help to mitigate risk, especially when more lenders are involved in the loan, since the equity held by each institution is decreased and the risk spread out,” Passione said.

The report cited that credit unions purchasing loan participations saw their loan-to-share ratios jump by almost 7 percentage points over the past four years, compared with an increase of less than 2 percentage points at credit unions which haven’t purchased participations.

“Loan participations afford many credit unions, especially those with limited fields of membership, the ability to access loans that they otherwise would not be able to get through their member base,” Passione observed. “Oftentimes these loans are producing superior [return-on-assets] than what the credit union would receive in traditional investments. This has driven more credit unions into participations.”

The composition of such loans has also been shifting from commercial to consumer. In mid-2017, commercial loans represented 31 percent of loan participation portfolios at credit unions, down from 56 percent in 2012. Meanwhile, consumer loans increased from 15 percent to 28 percent.

Mortgage loans, especially non-conforming ones from areas of the country with higher real estate value, have also been a major source of loan participation growth, Passione said.

Auto loans in particular have been a major source of these consumer loans, as credit union market-share has grown to nearly 30 percent of the auto financing industry. That has caused some credit unions to pay close attention to concentration levels in their balance sheets.

Why participations can be challenging

So far mostly larger credit unions have dipped their toes in loan participations. In 2017, the average asset size of credit unions purchasing participation loans was almost $600 million, nearly six times the size of the average credit union that did not purchase participation loans.

Citing interviews with credit union executives, the report from LendKey and Cornerstone Advisors said that some credit unions did not want to get involved in loan participations because of time-consuming due diligence, member business lending cap management and risk management, among others.

Purchasing participations requires credit unions to develop additional capabilities, such as counter-party due diligence and monitoring, writing additional policies and procedures, accounting and financial reporting for off-balance sheet assets, and participation pool review processes, said Mike London, chief lending officer at the $1.3 billion-asset Georgia United Credit Union in Duluth, Ga. Not every institution wants to do that.

There are also issues around ensuring that the participation will provide a reasonable return, especially as short-term interest rates rise, said Jon Paukovich, chief lending officer at the $5.3 billion-asset Ent Credit Union of Colorado Springs, Colo. Rising rates mean there could be better investment opportunities for potential buyers.

“The sellers won’t accept a price attractive enough to attract buyers because they might book a loss. Plus, the alternative investments are likely more liquid and allow flexibility,” Paukovich said.

London said the decision to get involved in buying loan participations comes down to balance sheet needs and that calculation has changed as loan demand has picked up.

“If you look at loan growth in credit unions globally, you’ll see that loan growth has significantly exceeded deposit growth over the last several years,” London said. “Credit unions with strong direct loan growth or strong indirect auto loan origination channels do not have a need to purchase participations to fulfill their loan growth needs.”

Passione advises credit unions that are exploring loan participations to make sure they have a good understanding of the National Credit Union Administration’s requirements and guidance in this area, and to partner with companies that can help them manage risk, including ensuring price transparency and access to thorough diligence on credit unions they may consider working with.

Deke Alexander, CEO of CU Evolution, a CUSO that assists small-asset credit unions, believes that loan participations are "always something for a credit union to review and consider.” They key for the credit unions, Alexander indicated, is to know and understand how to mitigate the risk.

"Any purchase has to be reviewed," Alexander stated. "What I have seen is credit unions desperate for yield purchase loans without a thorough understanding of how it affects their asset mix, concentration or overall risk to the net margin. Credit unions need to be specific in their participation agreements, especially when it comes to the responsibilities of the collection procedures not just how they retain their interest from said loan, but in the event of default."