Want unlimited access to top ideas and insights?

If credit unions want to compete with personalized lending platforms like LendingClub and LendUp, some observers believe they’re going to need better aggregation tools.

“Digital channels leave a lot of opportunities uncaptured due to cumbersome forms or application processes,” stated Bradley Leimer, former head of fintech strategy and innovation at Santander U.S. “More and more, consumers are looking for that personalized experience, which alternative lenders are capitalizing on. Traditional institutions are leaving money on the table.”

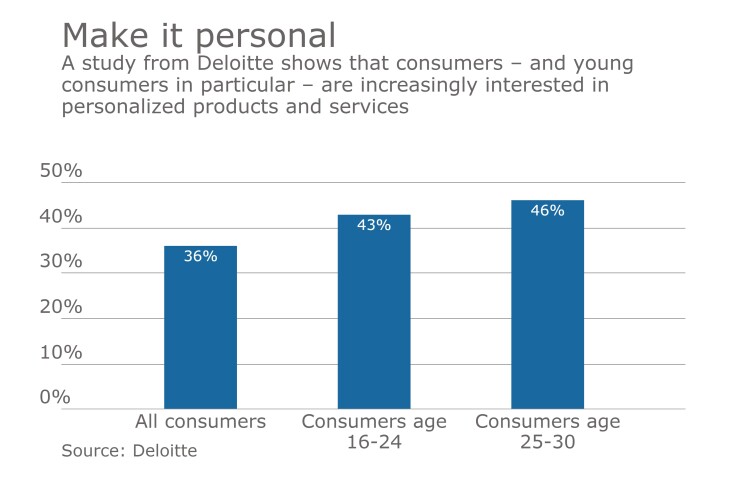

According to a July 2015 Deloitte research report, consumer personalization is more than a trend with 36 percent of consumers responding that they are interested in personalized products or services. Those polled less than 40 years of age are more interested, with 43 percent of consumers age 16 to 24 and 46 percent of consumers age 25 to 30 attracted to personalized goods and services.

“Those businesses who do not offer an element of personalization risk losing revenue and customer loyalty over the longer term as customers increasingly demand personalization,” said Ben Perkins, head of consumer business research at Deloitte.

Personalizing the credit union member experience

Last year, the $171 million Alexandria, Va.-based InFirst Federal Credit Union was working on a multi-pronged marketing campaign to increase a personal loan program as well as its auto loan program, among other initiatives.

While traditional media channels such as flyers, digital ads, printed ads and TV spots were deployed, digital outreach was lacking, explained InFirst Federal CU’s Marketing Manager Christine Sparks.

“InFirst lacked an online application form and was looking for a quick and easy way to generate lead referrals online,” she said.

The credit union partnered with the Berkeley, Calif.-based Shastic and its LeadMe solution, which delivers lead generation add-on tools for mobile banking, online and social media channels.

From discovery to launch, it only took about two months to launch LeadMe, explained Sparks.

“No beta testing was required, the product worked as dictated,” she said. “Minimal training for managing the flow of leads and informing retail officers how to follow-up with leads.”

Shastic CEO Joseariel Gomez-Ortigoza likened the inefficiency of a low conversion rate from initial inquiry to funded loan to heating a house with the windows open.

“By replacing an unwieldy processing tool specifically designed for maximizing conversion at the entry point, financial institutions can reduce waste and substantially increase loan volume in a cost-efficient way,” said Gomez-Ortigoza, whose firm often works with credit unions, including offering the

One-in-three conversion rate

During the first four months of 2016, InFirst Federal CU funded 442 without Shastic. In the four months after it launched LeadMe, the CU realized 520 loans.

“We developed set procedures within our retail and loan departments to take full advantage of the real-time delivery of leads,” said InFirst Federal CU’s CMO Jeff Parish. He added that the CU converted one in every three opportunities delivered by Shastic into funded loans or new accounts.

“It allowed us to immediately identify and act on warm prospects and optimize our operations to maximize revenue,” said Parish.

Sparks further explained that the CU’s marketing and lending departments have developed a method to process leads with the lending department receiving more of the inbound leads.

“The marketing department is better able to track the success of its marketing campaigns, by measuring the conversion ratio of these leads,” she said.