Want unlimited access to top ideas and insights?

As trade war tensions heighten and President Trump continues to impose tariffs, credit unions are persevering in the midst of uncertainty.

The industries expected to be hit hardest by Trump’s tariffs include whiskey exports, dairy exports, agricultural exports, U.S. coal producers, crude oil and U.S. car manufacturers. Trump has also proposed a tariff on foreign cars and their parts, and while that could have a negative impact in the long run, one analyst suggested the threat of tariffs could actually spur car sales in the short term.

“There’s this notion that there’s pent-up demand for cars, and in fact, the numbers that the credit unions have been showing [point to] significant increases in auto loans,” said Samira Salem, senior policy analyst at the Credit Union National Association. “So, if people are hearing this buzz about potential tariffs hitting imported vehicles, they might say ‘Hey, I might want to get ahead of that and go out and purchase my vehicle.'"

According to CUNA Mutual Group’s July Credit Union Trends Report, overall credit union loan balances grew by 1.3 percent in May (the most recent data available), nudging by the 1.2 percent pace set in May 2017. Balances grew by 3.9 percent year-to-date and pushed 9.9 percent year-over-year, which is roughly 1 percent slower compared to the reported 10.9 percent pace in May of last year.

When it comes to cars, CUNA Mutual reported continued auto loan growth thanks to an improving labor market, faster wage growth, lowered interest rates and an expanding driving-age population. As reported by DATATRAC, the average interest rate on a CU four year new-auto loan comes in at 2.7 percent, yielding a 1.3 percentage point rate advantage for CU’s compared to the 4 percent bank average for the equivalent loan.

On July 19, the National Automobile Dealers Association President and CEO, Peter Welch, testified before the U.S. Department of Commerce against imposing auto tariffs.

“NADA recognizes the importance to the United States of leveling the trade playing field; eliminating unfair trade practices; and keeping America’s automotive industry strong,” Welch said during the hearing. “But a 25 percent tariff applied to all imports would hurt auto manufacturers, dealers, consumers and the economy as a whole.”

During his testimony, Welch predicted the tariffs could raise consumer prices by as much as $6,875 per vehicle.

Salem believes that credit unions could continue to see an increase in membership within the short term due to looming threats of the trade war. If the number of tariffs continue to escalate, the trade war is expected to weaken both the American and the Chinese economy. Already, China is hedging itself against the impact the trade war is expected to deliver, and its economy is beginning to feel the dent of these tariffs.

And credit unions’ blasé attitude to the topic echoes that of many consumers. According to behavioral economist Dr. Dan Geller, who compiles the Money Anxiety Index, “Talk of looming trade wars is not elevating the level of money anxiety of consumers. The Money Anxiety Index decreased by 0.01 index points to 45.4 in August.” And that index is actually down by 5.5 points in the last 12 months, added Geller, “showing constant increase in financial confidence. More recently, since the beginning of 2018, the Money Anxiety Index decreased 2.6 index points showing that people are resilient to talk of trade wars.”

CUs and soybeans

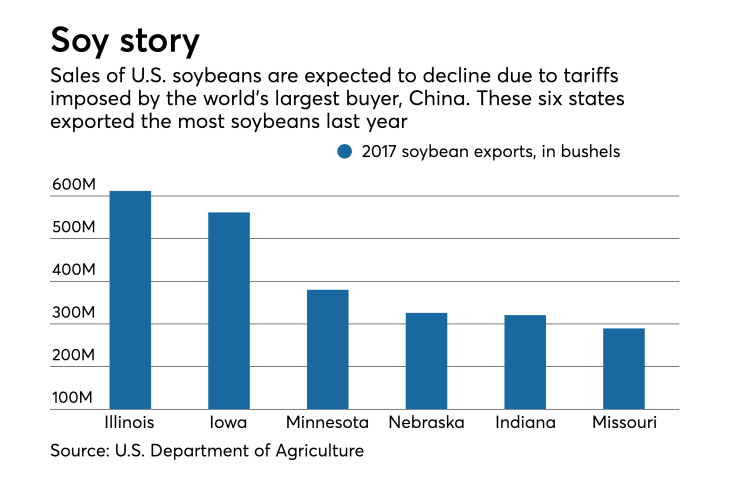

On the U.S. agricultural front, soybean farmers worry that they may not sustain themselves throughout the trade war. In response, the Trump administration announced a plan to offer $12 billion in relief aid to affected farmers, though this move has drawn skepticism across both sides of the political aisle.

"Previous congresses have objected to expanding farm subsidies in this way," said Simon Lester, associate director of the Center for Trade Policy Studies at the Cato Institute. "There will be some question to see if the administration can actually do this."

There is little question that China’s tariffs on U.S. soybeans will slow exports and crimp the profits of many farms, but how they affect the banks and credit unions that lend to soybean farmers will depend largely on how long the trade war persists and how well bankers prepare customers for the inevitable slowdown.

But banks and credit unions fall short in their efforts to help those farmers and they are unable to recoup what could be billions of dollars in lost export revenue, then lenders could be looking at a costly rise in farm loan delinquencies.

China imposed the 25 percent tariff on soybeans and other U.S. products earlier this year in response to President Trump’s decision to assess a 25 percent tariff on $34 billion worth of Chinese goods entering the U.S. China is the world’s largest buyer of U.S. soybeans, so if it wanted to impose a tariff that could most hurt the American farm economy, it chose the right product, according to a

China’s retaliation against Trump has had an immediate impact on farm exports. Total lost soybean sales for 2018 exceeded 5 million metric tons through June 28, according to U.S. Department of Agriculture

But soybeans aren't the only crop experiencing the whiplash from increasing tariffs.

"It's not just one specific crop or entity; it's across the board that [will see an] impact because we're so heavily dependent on exports," said Tom Beaton, an ag loan officer at Farmway Credit Union in Beloit, Kan.

Beaton expects the tariffs will hold a short-term impact on other consumables such as beans, corn, hogs and cattle. But so far, he said, credit union members have not raised concerns regarding the trade war, attributing tougher times to an ongoing drought rather than any political factors.

Dairy damage?

Despite growing concern from the implemented tariffs, some economists speculate that the tariffs remain inconsequential in the grand scheme of a trillion dollar economy.

“What we know is that the U.S. has put tariffs on $85 billion worth of imports, which is less than 4 percent of imports,” said Salem. “And, there’s an additional $200 billion [placed on] Chinese imports. So when you’re looking at an economy that’s $17 trillion, in context, it’s still fairly small.”

She does acknowledge that there may be existing credit unions that have been hit by the tariffs, such as those serving members in the whiskey and dairy industries.

First Alliance Credit Union in Rochester, Minn., which has roots serving the dairy industry, declined to comment when asked if the tariffs have affected their operations. Omaha-based Roberts Dairy Employees FCU, another dairy-oriented CU, was not available for immediate comment.

Wait and see?

There is also the possibility that it is simply too early in the trade war process for financial institutions to be suffering. Still, the Trump administration’s tariffs on steel and other imports almost certainly will inflict pain on the middle-market and small businesses that make up most commercial borrowers.

Trump’s 25 percent tariffs on steel that took effect this spring, and his recent threats to impose additional tariffs on other goods from China, have led dozens of U.S. companies to issue warnings about how their operations will be affected. The heavy equipment manufacturer Caterpillar, for example, said on July 30 that its