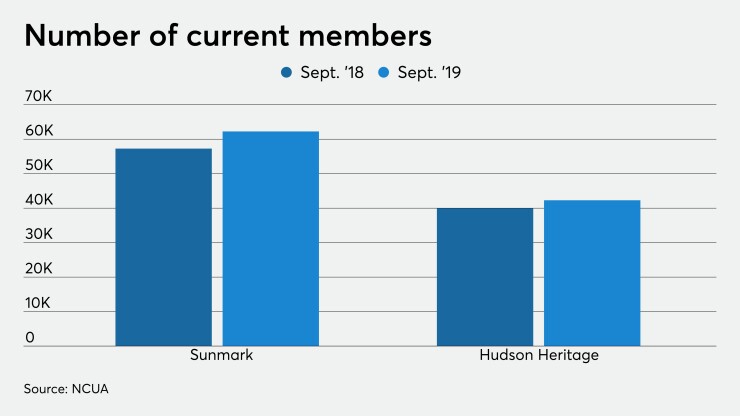

Sunmark Federal Credit Union of Latham, N.Y., and Hudson Heritage Federal Credit Union based in Middletown, N.Y., have converted from federal to state charters, effective Jan. 1.

The National Credit Union Administration, the New York Department of Financial Services and members of the two credit unions approved the charter conversion. Previously regulated exclusively by the NCUA, the two credit unions will now also fall under the purview of the New York Department of Financial Services.

“I want to take this opportunity to thank our membership for participating in the vote on the proposal to convert from a federally-chartered credit union to a state-chartered credit union,”

Sunmark President and CEO Frank DeGraw wrote in a letter to members. “As I was watching the balloting unfold, I couldn’t help but to be marveled as I watch a true democracy in action.”

Converting from a federal to a state charter increases flexibility for field of membership expansion. Sunmark is considering additional branches in new counties that the CU is eligible to serve, according to a frequently asked questions page on the credit union’s website.

Hudson Heritage has also reduced its minimum required deposit for membership from $5 to just one penny.

Both CUs have dropped the word “federal” from their branding, moving ahead as Sunmark Credit Union and Hudson Heritage Credit Union, respectively, and both will still carry federal deposit insurance from NCUA.

On Friday, Michigan-based