The possibility of a recession in the near future is having an impact on which card credit union members keep top of wallet – a matter that's top of mind for financial institutions as Black Friday approaches and the 2019 holiday shoppoing season kicks off in earnest.

The inaugural “Eye on Payments” study

Credit card balances industry wide stood at $64.3 billion at the end of August, according to CUNA Mutual Group’s Credit Union Trends Report. That’s a 16% increase from just two years prior, but that growth could slow if buyers switch payment methods as economic trends change.

According to Tom Pierce, SVP and chief marketing officer at PSCU, consumers are getting worried.

“There is a great deal of discussion in the media about a possible recession, so people are trying to avoid piling up debt,” he said.

David Robertson, publisher of payments industry newsletter the Nilson Report, said credit card use “seemingly has peaked” as a result of demographic shifts. An increasingly large segment of the adult population, he said, simply does not use credit cards.

“We are seeing the beginning of the youngest generation not having credit cards,” Robertson said. “This cohort is shifting to debit cards. This is true in the U.S., U.K. and Australia.”

Members at St. Louis-based

“For the most part our debit card users are sticking with debit and our credit card users with credit,” Kunze said. “What we are seeing is our credit card members are paying down or paying off their balances more frequently, which is a win-win. We have more engagement from them, and they have less debt to manage.”

Recession now or later?

So is a recession coming? It depends who you ask.

The U.S. economy has essentially been in growth mode since the Great Recession officially ended in 2009, and many analysts have spent the last 18 months predicting some form of economic downturn by the end of next year. But while those voices have quieted somewhat, economic patterns are cyclical and a downturn of some sort will eventually occur.

Dr. Elliot Eisenberg, chief economist for economic consulting firm GraphsandLaughs, LLC and a frequent speaker on the

According to Eisenberg, in the current U.S. economy household consumption is “good,” wage growth is “acceptable,” the labor market is “tight” and there is “decent” government spending.

“It is hard to get a recession with these conditions,” he assessed. “Unemployment will rise, eventually, but there is only a 30% probability of a recession in the next 12 months.”

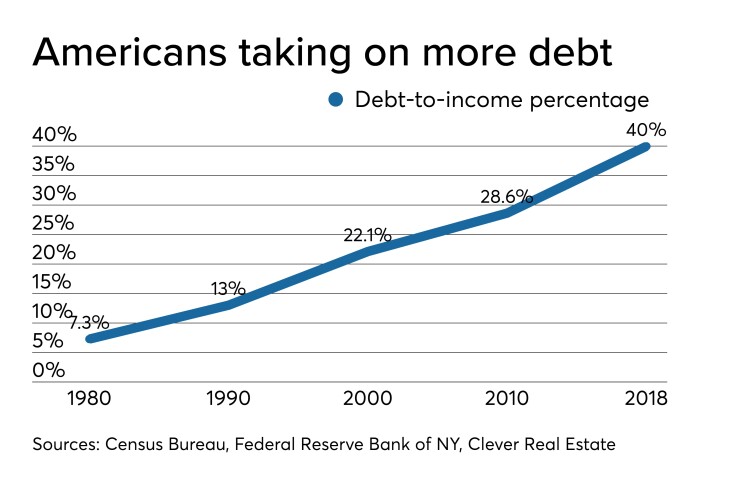

While consumer debt is 10% higher than in 2007, he said, overall American households are in good shape.

“Credit card debt continues to slowly rise, along with other forms of debt, but credit card debt is rising the least. Household debt is being driven by auto loans and student loans. Households are not going to cause the next recession; it will be caused by something else.”

Norm Patrick, VP for PSCU’s Advisors Plus Consulting, said the nation’s current has a “healthy” level of credit card debt, and many consumers learned their lessons from the Great Recession.

“We have gotten back to more responsible credit policies across the country, generally speaking, and credit unions tend to be more prudent as far as extending credit,” Patrick said. He claimed CUs had only a 4% credit card charge off rate during the last recession while

Several of the nation’s major credit card issuers

Kunze said Together CU tries to manage the risk of a potential economic downturn by making decisions “through the member lens.”

“We do this by assigning responsible limits and reviewing them periodically through the year, granting credit to members with an appropriate credit score, and having a card product for those that have struggled in the past that makes it easy for them to pay off if they face unexpected hardships,” he explained.

Together takes steps to proactively identify members who might be struggling, starting with a courtesy call as soon as accounts reach four days past due.

Robertson of the Nilson Report said a downturn would mean issuers will cut back on lines of credit to those they feel are the most vulnerable – and noted this has already begun.

“Credit card issuers are going to be much better prepared for the next recession, which will be more of a correction than a deep recession such as the one 11 years ago,” he said. “Issuers will be monitoring for risk and will weather the recession rather well, but there will be a cut in spending. Even credit-worthy consumers will migrate credit card spending to debit card spending.”

Whatever card members reach for at the point of sale, it’s likely to look different in the coming year. A recent report from PSCU noted the CUSO distributed more than half a million contactless credit and debit cards to member credit unions in 2019 and plans to issue more than 3 million next year.