MIAMI-Leading up to its decision to offer check cashing services, including a check-cashing only relationship, Cleveland-based KeyBank was surprised to find that individuals who use those services are not doing so simply because they don't know any better.

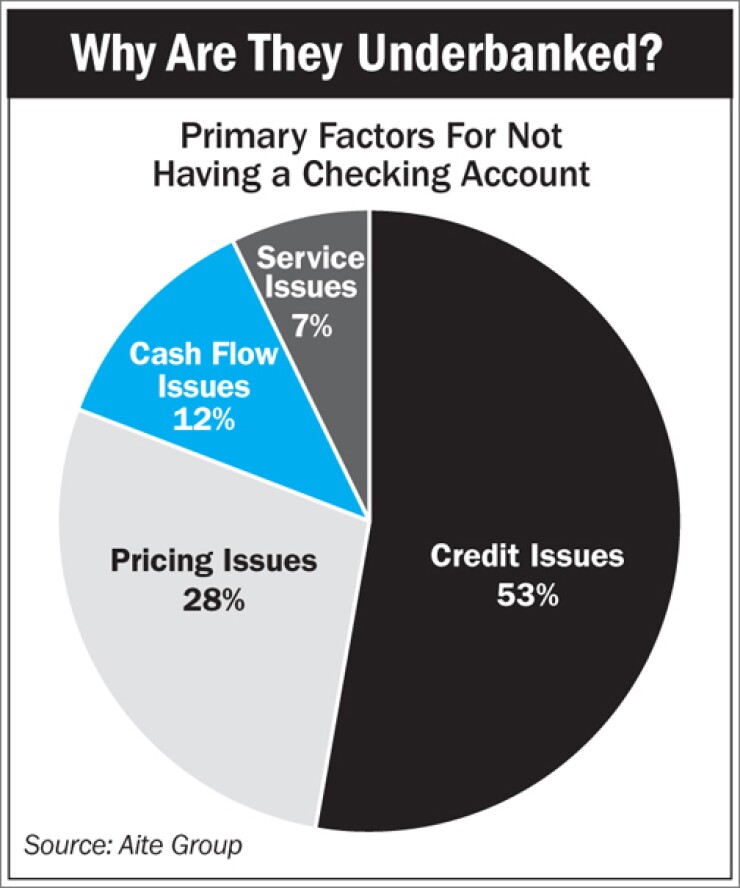

"People are making rational, clear choices about the products they use and how they use them," said SVP of Community Development Banking Michael Griffin, citing more complicated requirements and hidden fees as primary reasons some consumers who would otherwise qualify intentionally avoid regular banking relationships. "We decided to offer check cashing priced in a way they understood and priced below the competitors in the market, and at least get them to come in the door and meet the staff and learn that the staff is from the community, and over time get comfortable."

More than 240 branches now offer the KeyBank Plus cashing service, cashing more than $100 million in checks from October 2005 through December. 2009. Though the service is restricted to government, payroll and tax refund checks right now, Griffin said discussions at the 5th Annual Underbanked Conference, where he was a speaker, have prompted him to consider expanding eligibility to get more walletshare.

Fair lending programs, especially for the underbanked, must provide a route out of debt, be easy to understand and have clear fixed payment structures, according to Andrew Morrison, EVP at San Antonio-based Brundage Management Company.

"One of the big problems that we saw is that too much of the focus on innovation has been rate driven, not even cost-driven, and the idea has been if you hit some magical number on rate then the product is going to be a good product," said Morrison. "We think that is a disastrous approach." He added that lengthening the terms of loans solely to bring down payment is actually anti-consumer, as it costs more over time and keeps individuals indebted.

Morrison also praised the value of brick-and-mortar lending with face to face underwriting when dealing with the underbanked. Working with these individuals in person gives financial institutions the opportunity to stress the consumer's repayment obligations and provides a face for troubleshooting should problems arise down the line, he added.

For its part, KeyBank plans to roll out a short-term loan product next year. The program will carry an 18% interest rate and a 6% fee and will only be available to individuals with direct deposit relationships. Unlike many other payday type lending programs, KeyBank's will feature a 60-day repayment window, limits on how many consecutive months the product can be used, and a policy not to draw down funds if the customer's balance drops to under $100.

"If someone is desperate enough to need to borrow $500 today...to expect [him] to have [the money] in two weeks to repay, along with funds they need to live on, I believe is just disingenuous. The payment should be spread out over some time that's digestible," Griffin said, adding that KeyBank has priced the product "as low as they could" based on charge-off expectations. The bank is projecting the product will be less profitable than most of its other credit products.

This type of lending could become even more critical in the near future, according to Heidi Tinsley, director of One Washington Financial, Q-Cash, a subsidiary of Olympia-based Washingon State Employees Credit Union. She cited a recent state consumer protection law that caps the number of payday loans an individual can get every year as a big reason CUs need to step up into this segment. Moneytree is closing about 100 locations this year, she pointed out, as Washington state residents can not take out more than eight payday loans per year.

Q-cash does about 2,000 short-term loans that cost $12 per $100 borrowed and have a 60-day repayment period. The payments are structured around the state governments' paydays to help members get their loans repaid promptly, according to Tinsley.