Credit unions are salivating at the possibilities that the new Amazon headquarters could bring.

The online retailer announced last month that it had decided to open up new headquarters in Long Island City, N.Y., and Crystal City, Va. It plans to spend $5 billion in developing the sites and should employ 50,000 at the locations.

Some cheered the news, noting the economic boom that is likely to follow the opening of the offices to the local communities. Community chartered credit unions that serve those areas are likely to be among those that benefit as executives see opportunities to boost membership and provide consumer banking products.

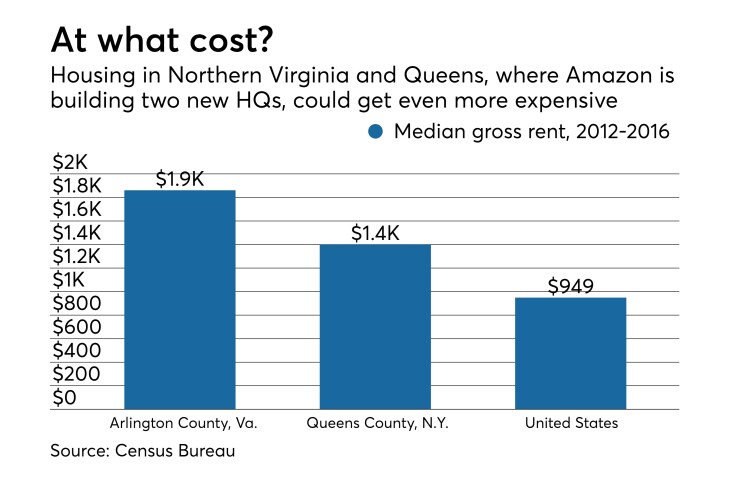

But others pointed out that the headquarters could affect quality of life in those areas, such as overwhelming already strained public transportation and driving housing costs even higher.

“The general economic lift an employment base of that size brings, whether from upward wage pressures, multiplier impacts [such as] nearby restaurants and service providers, or new residents into the market, will create demand for financial institution products, from checking accounts to mortgages," said Steven Reider, founder and president of the consulting firm Bancography. "That noted, the demand can also create significant upward pressure on already high-priced home values, which could bring risks if the economy subsequently turns toward recession."

In September 2017, Amazon announced its pursuit of a new home for its second headquarters, leading cities nationwide to court the tech giant in hopes of securing the project. Thirteen months later, Amazon put the rumors to rest and said in mid-November that it had settled on Long Island City, which is in Queens, and Crystal City, which is a few miles south of Washington, D.C.

"The Amazon related job growth will only be a plus for those credit unions, particularly on the lending side as most of the jobs are reported to draw more millennials and Gen Xers," said Dennis Dollar, a former chairman of the National Credit Union Administration who now works as a consultant. "The Northern Virginia area is already very tech heavy, and this will move those numbers even further toward a younger demographic."

To capitalize on this, Reider recommends that credit unions employ select employee group-type marketing to reach Amazon’s new hires. That should include providing packaged account offerings for Amazon employees, Reider said.

That approach makes more sense than fighting to officially become a SEG for Amazon. Larger credit unions have already expanded their fields of membership to the broader community so workers will be eligible based on where they work, Reider said.

Northwest Federal Credit Union serves members along multiple common bonds throughout Northern Virginia. Crystal City is about 25 miles from Northwest’s base in Herndon, Va.

The $3.5 billion-asset institution is planning to open a branch near Crystal City next year that should be convenient for “our members who live and work in the area, including those who transition to join with Amazon," said Jeff Bentley, CEO of Northwest.

Amazon is one of the SEGs for First Tech Federal Credit Union in San Jose, Calif. The $12.3 billion-asset institution has served the tech giant’s employees for eight years, and management believes that Amazon’s expansion should provide promising opportunities to add to its membership.

First Tech offers mortgages, stock loans, foreign and domestic relocation programs, on-campus banking and financial literacy services for its SEG members.

The credit union's potential field of membership is over 1.7 million employees, according to its call report. The institution projects it'll add 10,000 new members within the next three to five years from Amazon's expansion.

“In addition to our digital experiences, we’re also looking at brick-and-mortar locations as we can continue to grow," said Brad Calhoun, First Tech's chief retail and marketing officer. "We’re on the front end of it, and [...] if you think of our footprint today, we’re set up across the county serving the different tech-related partners. We’re in, or on, or near those campuses as they are spread across the U.S.”

Despite all of the potential positives of Amazon’s news, the announcement was met with some skepticism. For one, there is the issue of cost living and housing. New York and Washington, D.C., are already notoriously expensive. That could get worse as Amazon draws more workers to these cities.

New York City rent has increased by 31 percent within the past eight years, according to real estate listing website StreetEasy. Following the Amazon announcement, residential property sales in Long Island City

And with Amazon’s recent move, gentrification is expected to expedite in Long Island City, an area that borders the largest low-income housing area in the U.S., the Queensbridge Houses.

Additionally, public transit in New York City and Washington, D.C., have been criticized in recent years. There are questions whether the infrastructure can handle the additional riders the Amazon projects will bring.

The Washington Metropolitan Area Transit Authority, which runs the subway in D.C., has struggled to provide reliable service and has cut back service amid falling ridership in recent years.

Ridership at Crystal City and Pentagon City metro stations peaked in 2011, said Dennis Leach, director of transportation for the Arlington County Department of Environmental Services. Approximately 30,000 passengers were shuttled per day at each station when traffic reached its peak, but Pentagon City's service has dropped to 25,000 commuters a day whereas Crystal City sees 22,000 passengers during a weekday.

That decline means the stations could handle more capacity.

"Crystal City supports a larger job space than it does today because it’s an area that used to hold a lot of defense contractors that were relocated by the Defense Relocation Act," Leach said. “The employment base is lower today than it was back in 2011 and yet, the infrastructure that supports that employment is still there."

As for Long Island City, eight subway lines currently serve the Queens borough in addition to bus lines and a ferry, but many New Yorkers complain about congested service plagued with delays.

Not all of the Amazon employees may commute by subway, an MTA spokesperson said.

"With the Amazon facility in Queens, many Amazon workers are expected to be coming from Manhattan or the Bronx where they’d be going in the ‘reverse peak’ direction, i.e. towards Queens in the morning," the spokesperson said. "There is ample capacity in the reverse peak direction on train lines between Queens and Manhattan."

Despite these concerns, credit unions remain optimistic about the Amazon headquarters.

“Amazon is going to bring an additional vibrancy to Long Island City in the form of jobs and technology,” said John Lewis, senior vice president of corporate affairs at Long Island City-based United Nations Federal Credit Union. “I think it’s created an overall halo effect for the city.”