After surviving the longest recession since the Great Depression and other unprecedented challenges in 2009, credit unions continue to face obstacles to achieving earnings goals in 2010. From regulatory and compliance issues, to continued instability in the marketplace, to a rising interest-rate environment, credit unions are maneuvering in a very tough environment.

In particular, CUs will face another anticipated National Credit Union Share Insurance Fund assessment, reductions in fee income due to new legislation, potential credit losses and historically low interest rates, just to name a few.

NCUA recently reported that the reserve level for the NCUSIF fell below the required 1.3% level, to 1.24% at the end of 2009. This increased the likelihood that credit unions will face another special assessment this year, in addition to the $1.1-billion assessment that took place in November 2009. That same month, the Federal Reserve released new rules to limit overdraft charges on debit cards, creating a challenge if your credit union is one of the many that generates substantial fee income from overdraft protection.

The CARD Act of 2009 further limits financial institutions' flexibility in pricing credit cards. Under the Act, a member will have to be more than 60 days behind on a payment before seeing an interest-rate increase on an existing balance. Even then, the lender will be required to restore the previous, lower rate if the cardholder pays the minimum balance on time for six months.

Meanwhile, mortgage rates are at their lowest levels in nearly three decades, as the benchmark 30-year, fixed-rate loan average hovers near 5%. This makes it unwise for credit unions to seek additional income by keeping newly originated fixed-rate mortgages, as these loans will be unattractive and increase interest-rate risk once interest rates rise.

At the same time, investment yields are at all-time lows, so most credit unions are keeping investments fairly short in order to have cash flow available when rates become more attractive.

Focus on the Funding Side

So, how can you find earnings under these difficult circumstances? The answer lies in the funding side of the balance sheet. Credit unions tend to focus on the asset side for earnings-and overlook interest expense. But as illustrated above, now is not the time to put long-term loans and investments on the books because of the anticipated rising-rate environment and increasing interest-rate risk.

One of the basic tenets of the credit union movement is to reward members with higher dividends than those paid by other financial institutions. It's also typical for credit unions to pay almost twice the national average bank rate on money market funds according to data provided to NCUA by DATATRAC (61 BPs vs. 33 BPs). For example, many credit unions are still paying 50 BPs or more on regular shares, even though these funds are very static in nature and insensitive to interest rates. However, in these times of low yields and margin compression, it is important to be strategic when rewarding members with dividends. Your credit union can still provide value to members without jeopardizing your long-term viability by overpaying for deposits.

Manage the Margin

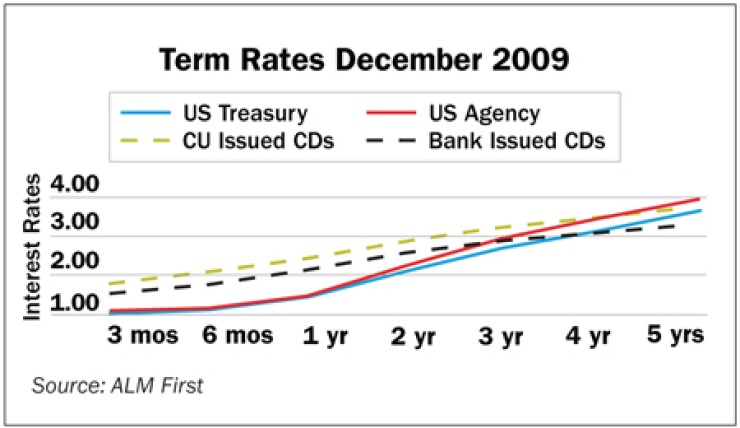

Not only does your credit union need to be careful about pricing non-maturing deposits, but also with the term structure of the certificates it offers. When looking at a Treasury or agency yield curve, you will notice that the slope is quite steep-meaning that rates move up significantly the longer the investment term. But most credit unions and banks display a much flatter curve-paying up for the shortest term deposits, and more in line for medium-to-long-term deposits.

Since most credit unions are flush with deposits right now due to the volatility in the stock market, there is no need to overpay to attract funds, especially when faced with decreasing loan demand. In particular, the average yield paid by credit unions on a one-year certificate, which is where many funds are going, is almost a full percentage point higher than the yield on a similarly structured agency or Treasury investment.

Credit unions can still reward members with better yields; however, they need to decrease the margin of that yield so they can stay in the black. This can be achieved by structuring your term investments so they are more closely aligned with the yield curves that provide the basis for the pricing of assets-both loans and investments.

Crunching the Numbers

Here's an example: A $200-million credit union that has 10% of its assets in money market accounts paying the national average of 0.61% could cut that rate by 15 bps to 0.46%-still 13 BPs better than the average bank rate. The savings would amount to $30,000 per year in interest expense. If that same credit union has 10% of its assets in certificates repricing over the next year, it could cut those rates by 50 BPs and save another $100,000 in interest expense. These actions alone would add 6.5 BPs to the bottom line. That may not sound like much, but for a credit union earning an ROA of 0.20%, which was the average ROA according to December 2009 NCUA call report data, it amounts to a 33% increase to the bottom line.

Regulatory and financial challenges are likely to be with us for some time to come. Many of these challenges are out of credit unions' control, such as the regulatory environment, the financial marketplace and economic growth. Even the asset yields on your own balance sheet are, to a large degree, controlled by prevailing rates.

Yet there are actions you can take to stabilize and improve earnings by controlling expenses. It is still possible to provide value to your members-you just have to be more strategic in how you do it.

Lisa K. McDaniel, CFA, is a Financial Advisor with ALM First Financial Advisors. She can be reached at 214.987.0860 or