Credit unions hard at work in paradise

Becoming 'part of the trust process'

The shopping journey is a multi-month process, Brenner explained, noting most shoppers do not know the make and model they want when they begin. The typical shopper only knows what type of vehicle he or she wants – a truck, an SUV, a compact car. Online shopping and dealer visits occur across all stages of the shopping journey – they do not happen in a linear fashion. Most shopping journeys are complex, unique and non-linear. “The real question is, how do we help people on this journey? Another question is, how do you contact the consumer at the right time?” he asked

The car-buying journey has much room for improvement, Brenner asserted. Early in the process people are “consumed” by the volume of online content, but hungry for more. They get confused by inconsistent facts and figures, and overwhelmed by never-ending calls, texts and e-mails because they visited a dealer. They get anxious when considering different vehicles and frustrated by high-pressure, impersonal sales.

Credit unions can position themselves as trusted experts during the research portion of the car-buying journey, Brenner said, adding it is important to realize the process is grueling and most consumers are not satisfied. Even with all the third-party and dealer websites, they feel they cannot get the information they need.

Digital retailing – moving the car-shopping process online – is creating a lot of buzz, Brenner acknowledged, but he said it still is a few years from full fruition. “Conceptually, it sounds great, but the reality is that is not exactly what the consumer wants. They want information, but they do not trust the information they see from the dealer. Even younger car buyers, known as digital natives, visit a dealer twice before buying a car.”

Metsger says farewell

Metsger spoke one day after fellow NCUA board member and acting Chairman J. Mark McWatters addressed the gathering. McWatters had said he and Metsger represent opposite political parties, but they work together for the good of credit unions.

“Mark and I have been working on the board together for three years,” Metsger said on Thursday. “Much to the disdain of some people in the trade publications, we work together pretty well. We realize we have to work together in the best interests of the credit union system, unlike the rest of Washington. Like you, we believe strongly in the credit union system.”

Metsger said he believes the “framework” comes from NCUA, but he insisted the regulator does not micromanage boards at individual credit unions. “We are just here to make sure you don’t go out of the corral. It is also important that NCUA remain an independent regulator, not thrown in with banking people who do not understand credit unions.”

The regulator continues to search for efficient, cost-effective ways to do business, he insisted.

“We are developing rules that are less intrusive on your credit union, Metsger told the crowd. “We hope to have a new field of membership proposal soon, that will add on to what we put out earlier. Mark and I have empowered our staff to give us their ideas. This has led to many good ideas.”

Metsger said it has been “a real honor” for him to serve on the NCUA board. “My term is ending soon. I still believe the job of the boards of directors is so important. As a regulator, my goal has been to provide you with tools, within the framework of the law, to help you serve your members. Come talk to us about how we can make the process better while protecting the safety and soundness of the system. It was important during the Great Depression, when the Federal Credit Union Act was passed, and it is even more important today.”

The difference between management and leadership

Leadership should be easy, because there is a lot of information available, Boles said, noting htat most people don’t quit a job because of the company – they quit because of their boss.

“People want to be well-led. But it is not easy. To be an effective leader you have to do what works for others, not what works for you,” he said.

Boles listed four expectations teams have of their leaders:

1) They want the leader to establish structure.

2) They want the leader’s help managing relationships.

3) They want the leader to balance risk.

4) They want the leader to make decisions.

By balancing risk, Boles explained, leaders have to be good at identifying, balancing and mitigating risk, not avoiding risk. “The team wants your professional judgment. A good question to ask your team members is: did you think about this? “

“If you are not doing those three things, they are going to go to someone who is,” Boles said.

Everybody knows leaders make decisions, but Boles said it is not as simple as it seems. He said leaders should ask people at the next staff meeting to tell about the decisions they made this week.

“Ask what they are working on and how it is going,” he said. “If they can do it, you are a pretty good leader. Ask what decisions your people are waiting for from you. The first time you ask they won’t tell you, so ask three or four times.”

According to Boles, leaders should not strive for perfection, they should strive for progress. “People turn to you when they need to make critical decisions. Keep taking care of your members. Members, not customers. That is important.”

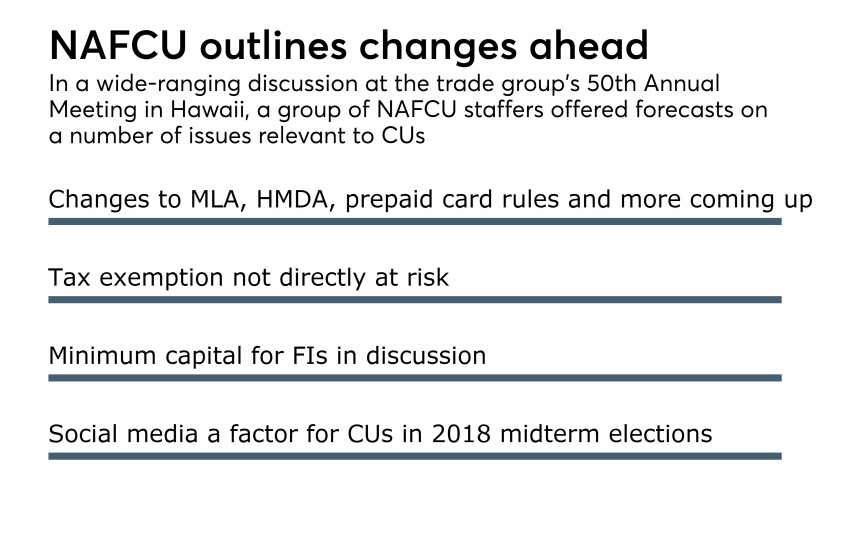

NAFCU panel

Hunt was part of a panel offering a legislative and regulatory update for credit unions. The panelists, pictured above, included: From left: Brandy Bruyere, VP of regulatory compliance at NAFCU; Dan O’Brien, director of political affairs; Alexander Monterrubio, director of regulatory affairs; Brad Thaler, VP of legislative affairs; Carrie Hunt, EVP of government affairs and general counsel.

Joining her on the panel was NAFCU’s VP of Legislative Affairs, Brad thaler, who told the crowd there is support on Capitol Hill for regulatory relief, led by the Choice Act, which recently passed the House of Representatives. The Senate is just starting the process on its own version of the bill, he said. “Expect the Senate to craft a bill later this year that can be supported. All three areas of the government are involved in bringing regulatory relief. It is a long process. What comes out of the Senate probably will be on a smaller scale than the Choice Act.”

Director of Political Affairs Dan O’Brien urged CUs to use some of the same channels for advocacy that they use for member communications: social media.

O’Brien said every member of Congress has a Facebook page and a Twitter feed. “If they get more than 10 comments on any issue, they will engage. President Trump has a massive Twitter following, and he is using it like no other president in history.”

Forecasting what's ahead

The next calendar year contains more than half a dozen compliance deadlines CUs need ot be aware of, including changes to the Military Lending Act in October, new HMDA rules in January 2018, new mortgage-servicing and prepaid card rules in April 2018, and more.

Thaler said the CU tax exemption is not directly at risk despite the Trump administration’s talk of tax reform, “Because we have friends in high places who are supportive of it. Tax reform is a long, tedious process that will have to be a bi-partisan effort.”

Hunt said capital is going to be the most important issue for credit unions in the near future. “Credit unions need to have capital standards that are flexible,” she said. “Congress is looking at capital not just in the Choice Act but in other areas as well.”

Added Thaler: the concept of holding minimum levels of capital to get regulatory relief is being discussed, for both banks and credit unions. “We are trying to make the point that increasing capital requirement is not the answer. Credit unions did not cause the financial crisis, and the credit union industry as a whole is well-capitalized.”

O’Brien noted the mid-term elections are coming up in 2018, and there could be changes in the control of the House. “On the grass roots level, get members of Congress to come to your credit union. Send a letter, send a tweet, make a Facebook post,” he urged.