It's that time of year again...

Kat Cole

When she was asked by a leader of the National Organization for Women--in the midst of a radio interview with NPR, no less--how she could call herself a women's advocate an yet work Hooters, Cole took a second to think before she responded. When she did, she talked about her pride in everything the restaurant chain has built, including one of the strongest reimbursement programs in the hospitality industry, and her gratitude for the opportunities she received, far outweighed any concerns she might have had about working for a restaurant more well known for its beautiful, buxom waitresses than the food.

While credit unions don't generally have to contend with such negative perceptions, Cole noted a number of lessons she learned first at Hooters and then throughout her career since can just as easily be applied to the movement. "We have to remember, if we don't, the competition will," Cole said. "But the other side of that is, just because we can doesn't mean we should. These have been my guardrails."

Another gem she said CUs should keep in mind as they head to hike the Hill to lobby their lawmakers this Wednesday, "if you don't have a seat at the table, you're on the menu," she said, quoting her mother. "But don't confuse having a seat with having a voice."

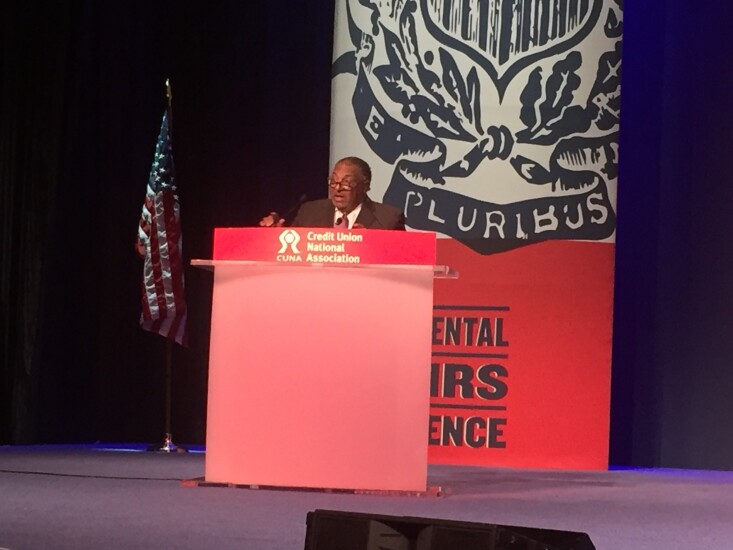

Jim Nussle

CUNA Board

Berry's back

Gigi Hyland

Fazio and Thor address examination expectations

NCUA Risk Management Officer Mary Thor detailed how the regulator's approach to modernizing the call report process and data collection. Thor told the audience NCUA is about midway through the four-phase process of call report modernization, but there is still time for stakeholders to share their insights.

Metsger looks back on his time as chairman

Those efforts included finalizing the recently released FOM rule changes, new MBL rules (and successfully defending those rules against a legal challenge from bankers) and restoring public budget briefings, among other things.

But there is more work to be done, he said, calling on Congress to repeal the MBL cap and praising the credit union business model for its potential to create change.

"What truly makes America great is its people embracing, in both word and deed, the essence of the cooperative spirit," he said.

McWatters' first GAC as NCUA chairman

“We must focus on today’s challenges and risks while preparing for the future,” he said in prepared remarks. “Absent safety and soundness concerns, NCUA must not stand in the way of your efforts to develop and execute your business plan, meet the expectations of your members, and build a robust and dynamic credit union community.”

McWatters also said that he would support bringing the Temporary Corporate Credit Union Stabilization Fund into the National Credit Union Share Insurance Fund this year “if our research determines the agency can properly and prudently satisfy” the requirements of sufficient reserves to absorb downward trends in the equity ratio and potential declines in the value of legacy assets.