On a national basis, federally-insured credit unions delivered 4.0% median loan growth for the year (up from 3.8% in 2014), while median asset growth amounted to 3.3% (up from 2.0% in 2014), and median growth in shares and deposits clocked in at 3.6% (double the 1.8% figure from the prior year).

The median loan-to-share ratio was 62% at the end of the fourth quarter of 2015, up slightly from 61% a year earlier. The median total delinquency rate slipped to 0.8% from 0.9% in the year-ago period.

Washington and Alaska

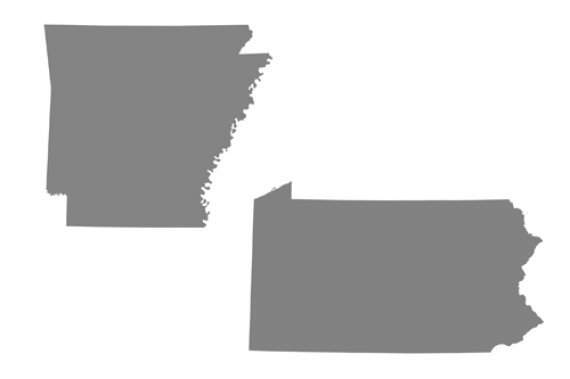

Arkansas and Pennsylvania

New Hampshire and Idaho

New Jersey and Delaware

Idaho and New Hampshire

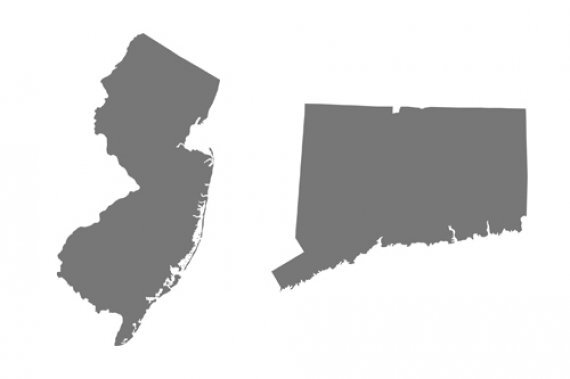

Delaware and New Jersey

Idaho and Alaska

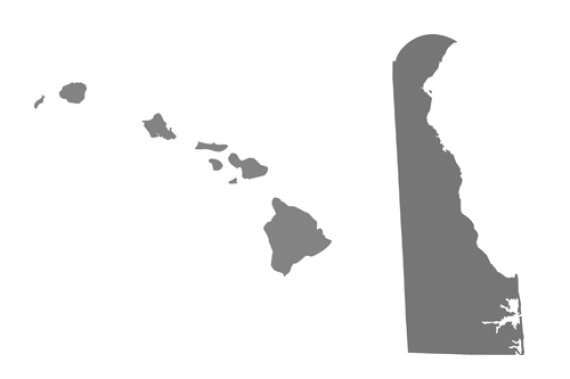

Hawaii and Delaware

New Jersey, Delaware and Washington, D.C.

North Dakota and South Dakota

Membership Growth

Moreover, more than half (52%) of all federally insured credit unions in the country had fewer members than in the prior year reflecting the fact that membership continues to decline at smaller credit unions. About three-fourths (75%) of credit unions which lost membership last year had less than $50 million in assets.

Alaska, Idaho and Maine

Pennsylvania

Utah and North Dakota