-

The credit union regulator's November board meeting covered a variety of issues, including the voluntary self-assessment, disagreements on the budget proposal and the possibility of new insurance premiums in 2021.

November 19 -

A group at George Washington University has been working to open a de novo institution to serve students, but the would-be institution faces a variety of hurdles before it can open its doors.

November 18 -

The pandemic has altered a variety of consumer behaviors, and that could make a difference in what sort of interchange and interest revenue financial institutions see in their credit and debit portfolios as they close out 2020.

November 16 -

Savings to the credit union regulator's operating budget are largely the result of surplus funds from 2020 and expected reductions in travel into next year.

November 13 -

A contentious presidential contest and social justice protests have forced employers to consider whether these types of topics should be discussed in the workplace.

November 12 -

With many Americans and members of Congress questioning the results of the presidential election, financial services trade associations quickly vowed to work with the incoming administration.

November 11 -

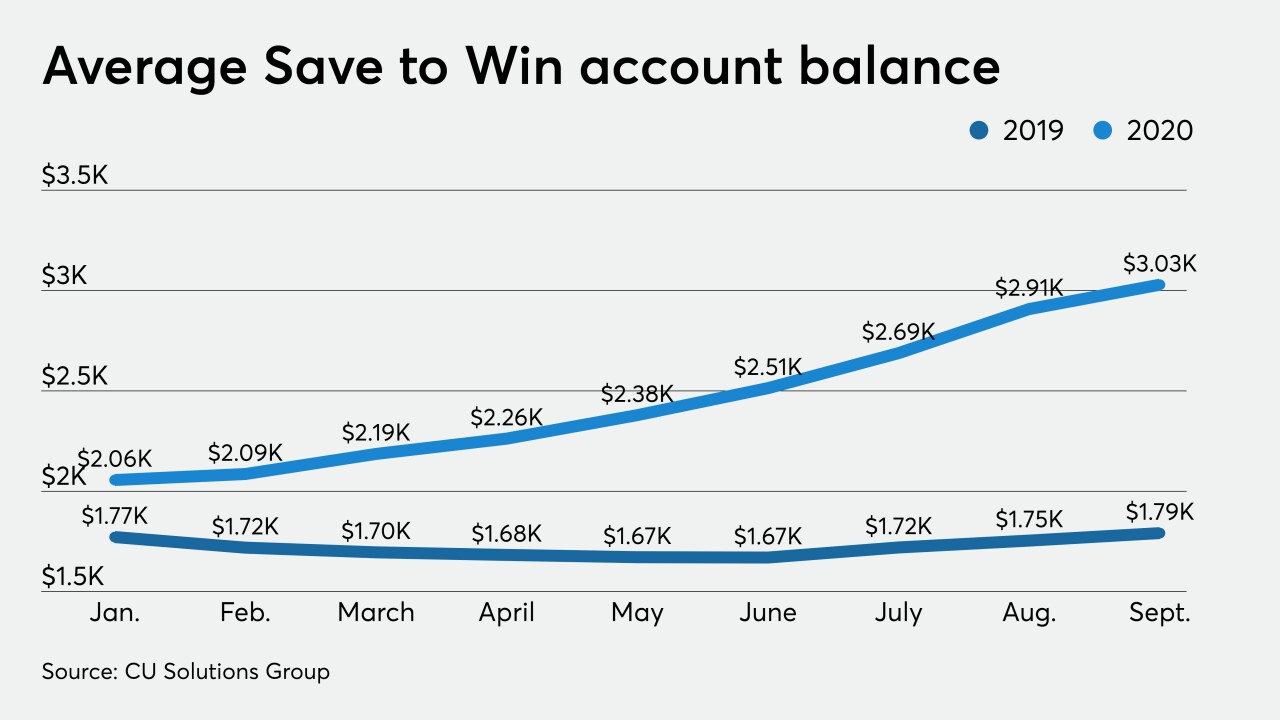

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

The industry is calling for lawmakers to extend changes to NCUA's Central Liquidity Facility and more before Congress adjourns.

November 9 -

Infinity FCU sought out a merger partner after realizing that even at $338 million in assets it was too small to provide the technologies members wanted. It could be a harbinger of more deals among larger players.

November 6 -

As lawmakers look for ways to plug budget gaps, credit union groups are preparing for a possible assault on the industry's tax exemption at the state and federal level.

November 5