-

Attackers stole over $340,000 in stablecoin from the Venezuela-focused app. The incident adds to recent troubles including frozen accounts at JPMorganChase.

January 6 -

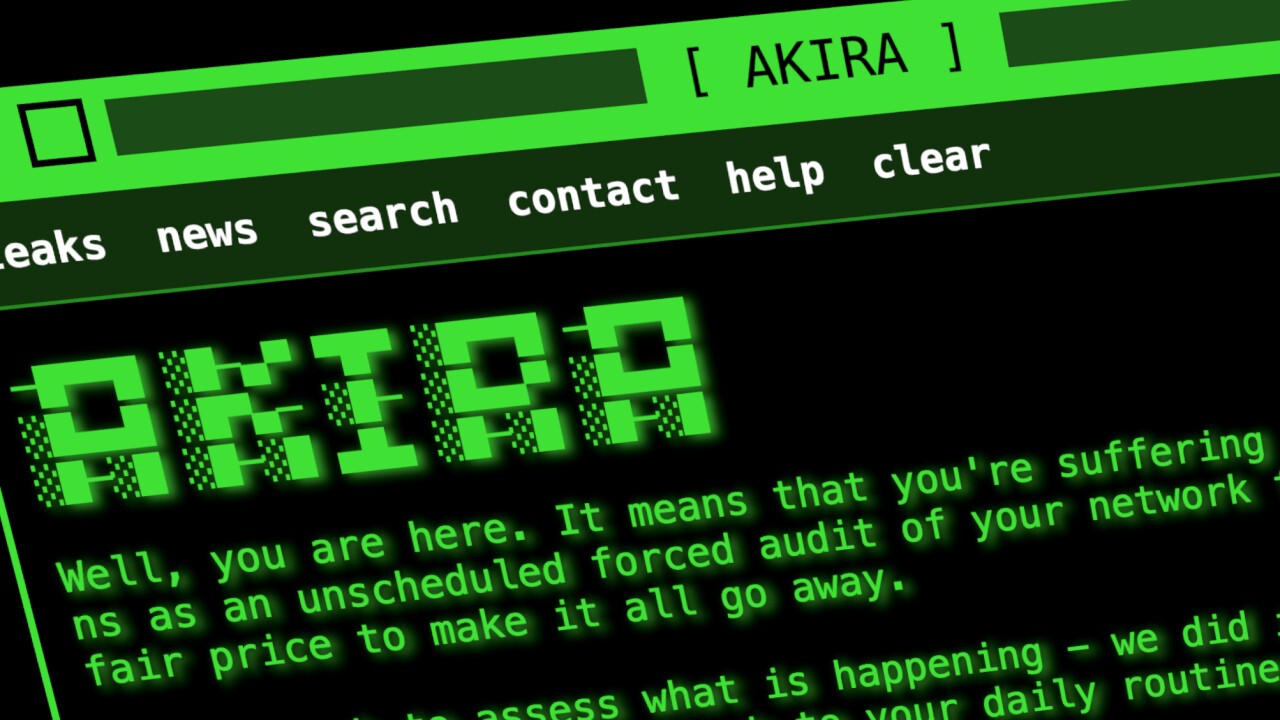

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

An American Banker survey found that bankers think the industry isn't prepared for growth in artificial intelligence and digital assets.

December 23 -

The National Institute of Standards and Technology's preliminary draft helps banks integrate artificial intelligence into their existing security strategies.

December 17 -

New research from American Banker explores how bankers predict stablecoins, subprime credit, cyber security and other factors will shape the industry at large.

December 17 -

A breach at an auto lending compliance provider highlights third-party vendor risks and has triggered class action lawsuits against the firm.

December 16 -

New data shows a 21% jump in fraud attempts during Thanksgiving week, with automated bots and credential stuffing leading the charge.

December 15 -

Part of the growing "phishing-as-a-service" economy, the Spiderman kit offers novice hackers sophisticated tools to target customers of major EU institutions.

December 12 -

The DOJ says the Ukrainian national helped coordinate Russian state-sponsored DDoS attacks against banks internationally.

December 10 -

The lawsuit alleges the fintech giant secured its own corporate data with strong MFA while leaving client systems vulnerable to compromise.

December 9 -

While overall payments declined, the financial sector remained the top payer to cybercriminals, surpassing both health care and manufacturing.

December 5 -

More than 400,000 consumers may be affected after Marquis Software Solutions suffered a breach traced to a bug in SonicWall software disclosed last year.

December 4 -

While banks welcome the "whole-of-government" approach that led the effort, private sector takedowns remain difficult without federal warrants.

December 3 -

The Troy, Michigan-based lender and servicer faces at least seven lawsuits over a hack in June allegedly perpetrated by a known ransomware gang.

December 2 -

Regulators officially ended the high-profile enforcement action over the 2020 breach, a move applauded by security leaders fearing personal liability.

November 21