-

A breach at an auto lending compliance provider highlights third-party vendor risks and has triggered class action lawsuits against the firm.

December 16 -

New data shows a 21% jump in fraud attempts during Thanksgiving week, with automated bots and credential stuffing leading the charge.

December 15 -

Investigators found text messages, photos of cash and a conspirator wearing a diamond Truist logo ring while unraveling the $1 million fraud attempt.

November 20 -

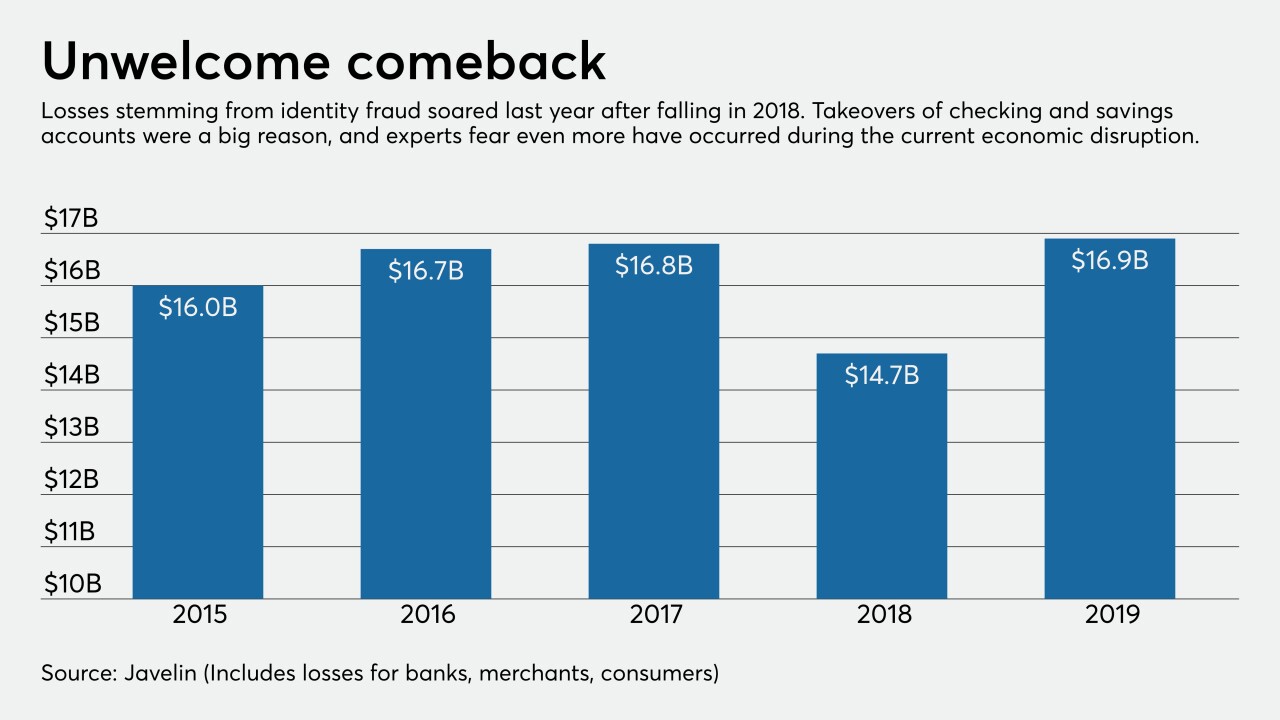

A new survey finds that fraud losses have jumped significantly in the last year, with digital channels and check fraud posing the biggest threats.

October 9 -

New Federal Reserve research reveals that identity theft victims who use extended fraud alerts often see significant and lasting credit improvements.

October 8 -

The operation washed checks stolen from USPS boxes and used "money mules" recruited on Instagram, causing financial and personal distress for victims.

September 23 -

Theft of paper checks and their use in identity theft constitute a major blind spot in the private sector's fraud detection networks. Banks and regulators need to come together to find solutions.

August 12

-

Listen to Gasan Awad, SVP, Fraud Director, Enterprise Fraud Product Management at PNC Bank, Chris Briggs, Chief Product Officer at Mitek and Jay Leal, CIO at Vantage Bank.

-

-

The alleged ringleader and 23 others face charges in a bank fraud scheme spanning three south-central counties.

February 28 -

After a California woman spent more than a decade obtaining reparations for Nazi plundering of her family's belongings, the money disappeared from her bank account. Her saga highlights a gap in fraud cases between what consumers expect from their banks and what those banks are in a position to deliver.

May 8 -

Fraud has evolved to defeat existing federal Customer Identification Program requirements. It’s time for regulators to modernize them.

April 22 SentiLink

SentiLink -

Criminals' efforts to steal identities and take over accounts have become increasingly sophisticated. Banks must upgrade their mitigation processes, which can be held back by antiquated systems and organizational silos.

August 2 Refinitiv

Refinitiv -

Fraudsters use different tactics based on their intended victims, and banks like Republic Bancorp and Wells Fargo are targeting the kinds of notices they send — and which channels they direct them to — in response.

July 2 -

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

PaymentSource's Daniel Wolfe sits down with Carey O'Connor Kolaja, AU10TIX's new CEO to discuss the rise in synthetic fraud, the fastest-growing financial crime, and how payments security has been changed by the pandemic.

-

Since July, Visa has noticed an uptick in unemployment insurance fraud with prepaid cards being used as a key disbursement vehicle. And the best solution may be rooted in technology, not law enforcement.

September 28 -

As many businesses and consumers have been forced to deal with the difficult conditions thrust upon them by the COVID-19 pandemic, so too have fraudsters needed to make adjustments just to continue their life of crime.

September 24 -

Axcess Financial is using stronger authentication, studying up on bad actors and planning to use a federal service that automates verification of Social Security numbers.

July 2