-

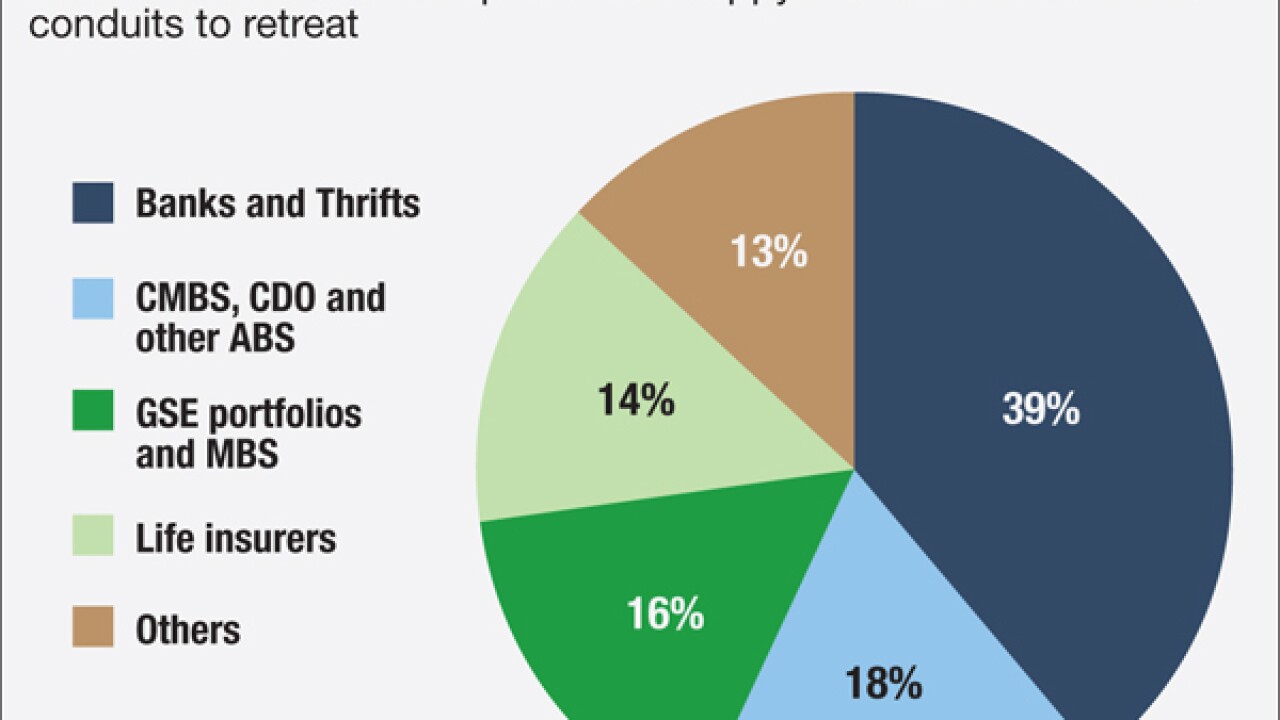

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

The Consumer Financial Protection Bureau on Thursday urged student loan servicers to provide more help to consumers who apply for income-driven repayment plans.

August 18 -

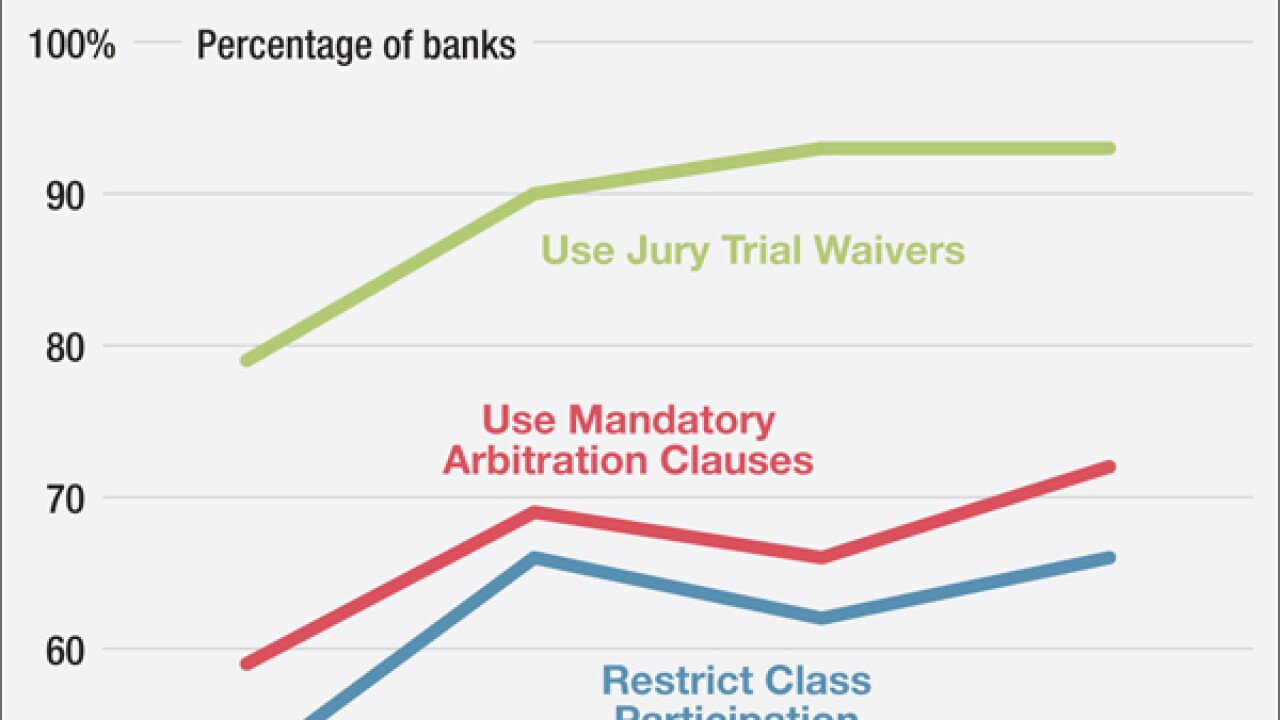

Industry representatives pushed back against a report that continues to paint a negative picture of arbitration clauses just as the Consumer Financial Protection Bureau plans to restrict such agreements.

August 18 -

Roughly 73% of donations from commercial banks' political action committees are going to Republicans in this election cycle, the most tilted toward one party by the banking industry in recent memory. Here's why.

August 15 -

Banks and industry representatives are asking whether the proposed long-term liquidity rule properly takes into account the risk profiles of certain assets, the interaction with other liquidity rules, and even whether the regulation is needed at all.

August 12 -

Those wanting to break up banks act as though policymakers had no regulatory response to the crisis, but heres an illustration of how actual reforms would have prevented a large failure.

August 11 Global Risk Institute

Global Risk Institute -

The Consumer Financial Protection Bureau has met the requirements for convening small-business review panels, though most panelists said they disagreed with the agency's final rules, the Government Accountability Office said Wednesday.

August 10 -

WASHINGTON The Dodd-Frank Act of 2010 has not had a negative impact on community banks, contrary to assertions by Republicans and many bankers, according to a group of White House economists.

August 10 -

A single paragraph in a lawsuit filed by the Consumer Financial Protection Bureau is sparking fears by third-party payment processors that the agency is quietly and significantly expanding its authority over the industry.

August 10 -

Financial reform advocacy groups are criticizing regulators' executive compensation proposal as too lax, saying the firms themselves are essentially given the freedom to ignore many of the harshest penalties

August 9 -

At best, the proposal to restore Glass-Steagall is outreach to Bernie Sanders supporters. But at worst, it suggests the GOP candidate isn't as anti-regulation as he claims to be.

August 9 American Enterprise Institute

American Enterprise Institute -

In a speech Tuesday, GOP presidential nominee Donald Trump pledged to temporarily suspend all new federal regulations if elected president, but even if he wins the White House, the plan may prove beyond his reach.

August 8 -

With supervisory pressures continuing to mount, a piecemeal approach to handling banks regulatory demands is costly and ineffective.

August 8 Ludwig Advisors

Ludwig Advisors -

The Indiana Senate race could prove to be the most important congressional race for bank policymaking if handshake deals propel former Sen. Evan Bayh to the top of the banking committee. But picking Bayh could start a civil war within the Democratic Party.

August 5 -

The Consumer Financial Protection Bureau on Thursday finalized new requirements for mortgage servicers that provide more help to struggling borrowers and add consumer protections when loans are transferred.

August 4 -

WASHINGTON Federal bank regulators issued guidelines Tuesday for submissions outlining workplace diversity initiatives.

August 2 -

WASHINGTON State bank associations threw their support behind a regulatory relief bill on Tuesday in hopes the legislation can gain traction in the Senate.

August 2 -

WASHINGTON Regulators announced Tuesday that they are giving large banks with less than $100 billion in assets an additional year to file their living wills.

August 2 -

The Consumer Financial Protection Bureau added its voice Tuesday to a chorus of other regulators in calling for sustainable foreclosure relief when the Home Affordable Modification Program expires at yearend.

August 2 -

In a political season teeming with tension around income inequality, racial economic disparities and animus toward the banking industry, reforming the Community Reinvestment Act seems like it should be a cornerstone of the debate. Yet the law has been almost entirely absent from the discussion. Here's why.

August 2