-

Firms like Oracle and Billtrust are betting companies with smaller, more remote teams will adopt digital transaction systems to ease the burden of paying their vendors.

January 25 -

The Canadian fintech is collaborating with PayPal to power the firm's technology that merchants can place anywhere — from blogs to product packaging — to enable purchases.

January 25 -

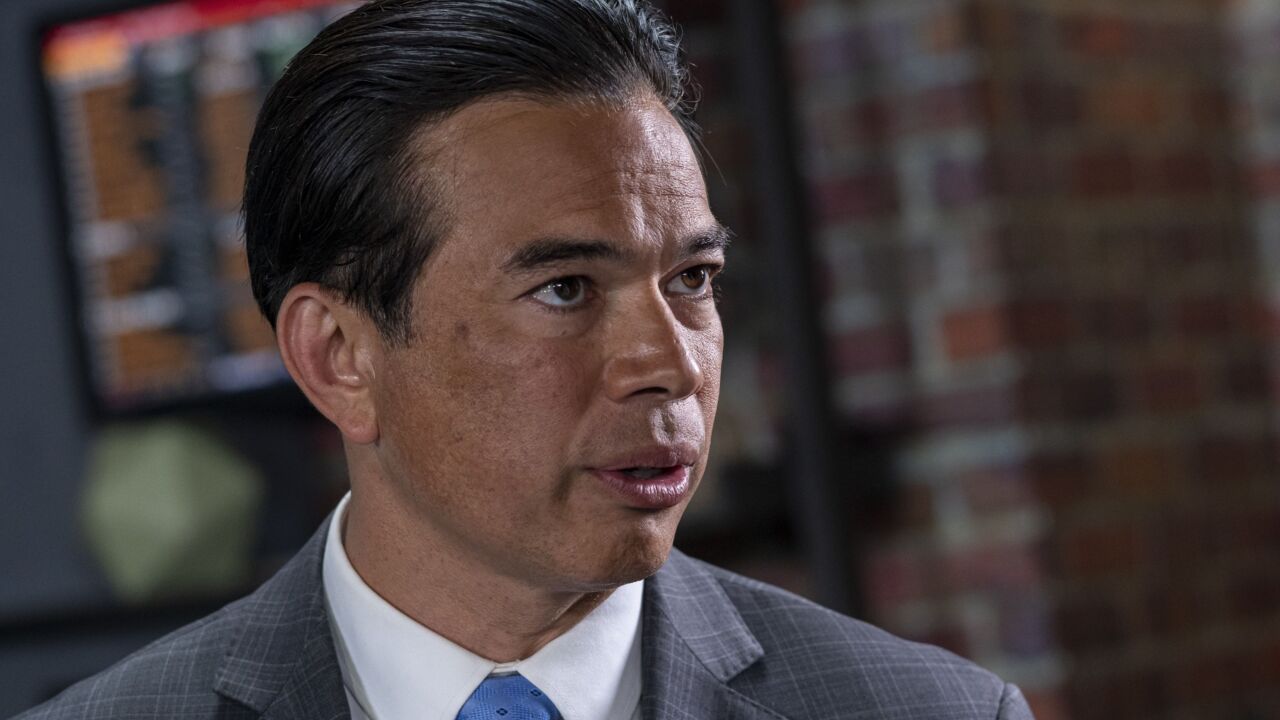

California Attorney General Rob Bonta is standing by the state's commercial financing disclosure law, urging more protections for small-business financings and arguing that federal consumer law does not not apply to commercial lending.

January 24 -

The loan-growth projections are for Columbia Banking System itself, before the Tacoma, Washington, bank officially merges with Umpqua Holdings. The $5 billion deal is scheduled to close Feb. 28.

January 24 -

Bank of America is rewarding the majority of its employees with a pool of restricted stock, boosting compensation to retain workers in an otherwise gloomy economic environment.

January 24 -

The company settled with the Federal Reserve after self-reporting that it had disbursed $1.1 million in wrongfully obtained Paycheck Protection Program loans.

January 24 -

The lending software and shared services provider was created by bankers for bankers.

January 24 -

The company told many customers they were "pre-approved" for credit card products they did not actually qualify to get. Proceeds from the fine will compensate those consumers, the Federal Trade Commission says.

January 24 -

The $1.4 billion-asset credit union said John Roemer officially became its new leader Jan. 23.

January 24 -

After months of forecasting and bracing for a recession in 2023, the economy seems increasingly durable. But it depends on what you're looking for.

January 24 American Banker

American Banker