-

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

2018 was mixed bag for credit unions in the Wolverine State, with membership and lending still seeing positive numbers but down from previous years.

April 12 -

A bipartisan proposal would allow for the removal of the FHFA director if the agency approves CEO salary increases at Fannie and Freddie beyond $600,000.

April 12 -

The company could use its share of proceeds from the IPO to repay debt and pursue bank acquisitions.

April 12 -

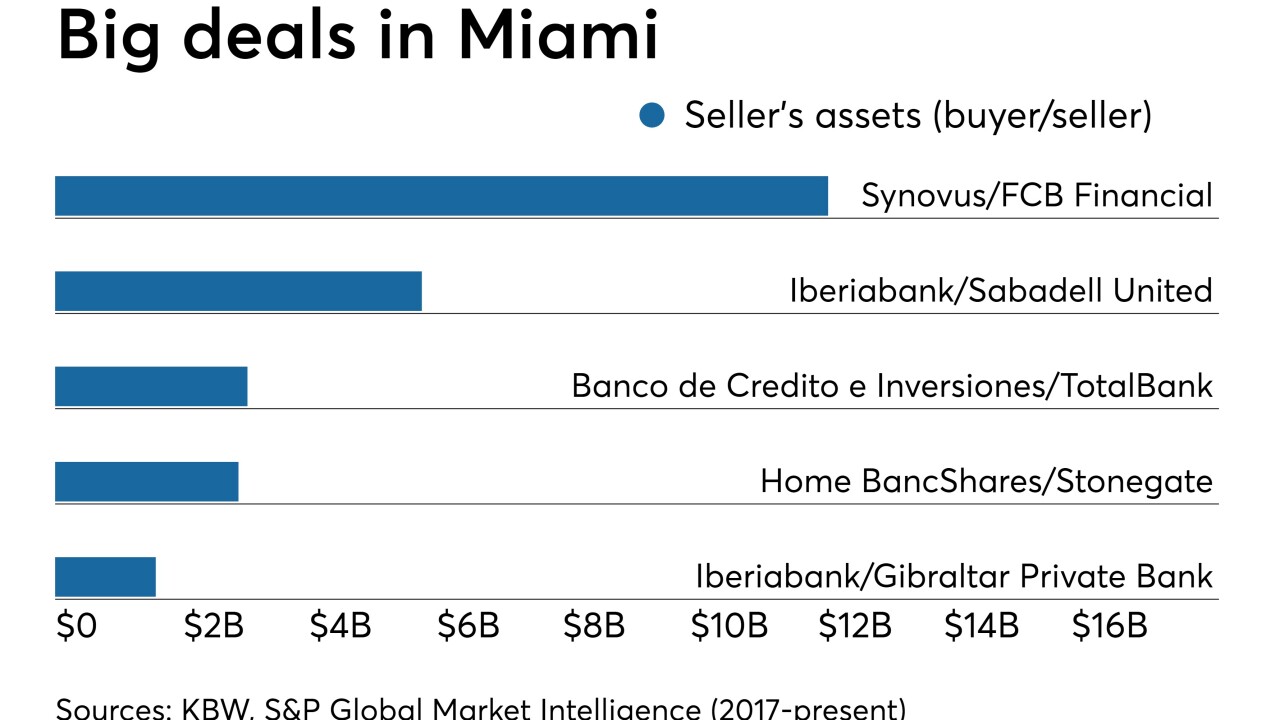

Lenders in South Florida are making tech upgrades and building scale to contend with bigger banks squeezing the market.

April 12 -

PayU is expanding its umbrella of payment companies in developing markets in a $70 million deal to buy Wibmo, a Cupertino, Calif.-based digital payments company that integrates with banks in 20 countries for payment authentication and security.

April 12 -

In a twist, bank lobbyists in the Sunflower State did not push back against nearly 70 proposed changes.

April 12 -

Urfer co-founded a business with the banking automation pioneer John Diebold, worked for Chase Manhattan and other major banks, and played an important role in the Nixon administration, phasing out exchange controls.

April 12 -

Asked during Friday's earnings call if he'd be interested in running the embattled bank, William Demchak said he will end his career at PNC. He also ruled out M&A.

April 12 -

The San Francisco bank has roughly doubled its assets in the last five years without the benefit of an acquisition.

April 12