-

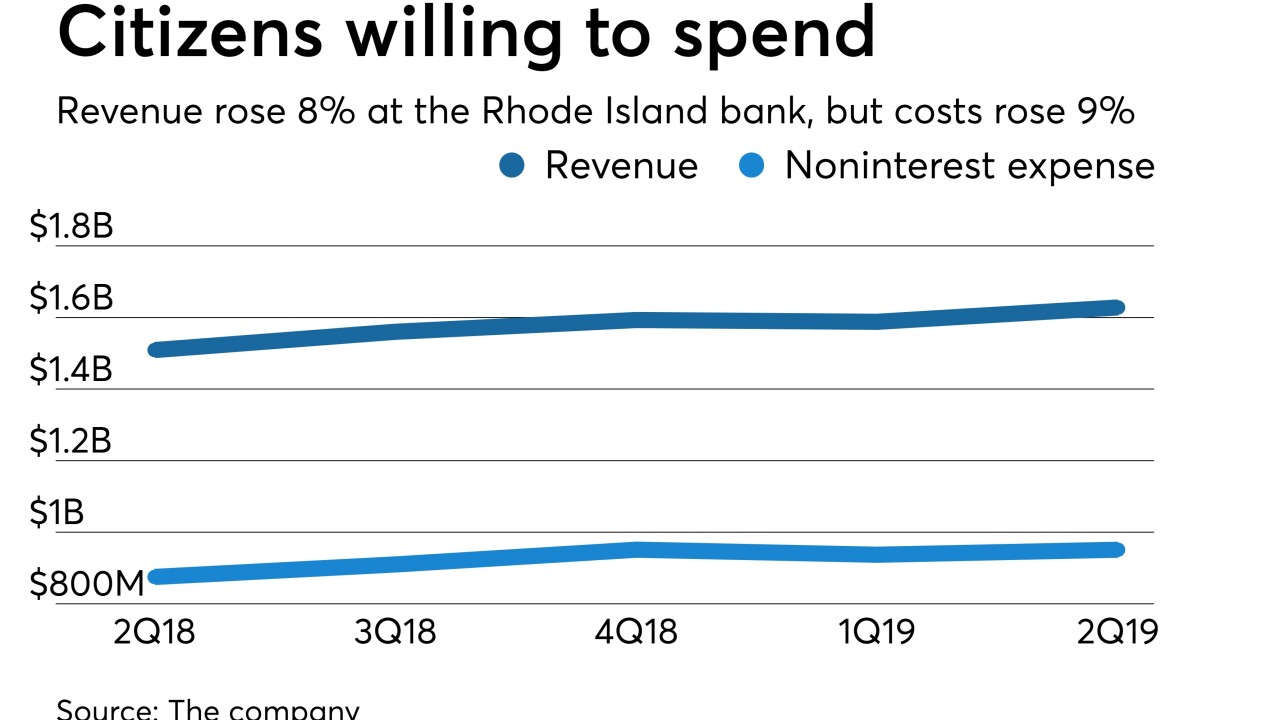

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The argument that only the federal government is up to the task is misguided.

July 19

-

The agreement with authorities including the Federal Trade Commission and state attorneys general — and possibly the Consumer Financial Protection Bureau — may be announced as soon as Monday.

July 19 -

County Bancorp is a small dairy lender in Wisconsin with an exposure to milk prices, and Bank OZK is a larger bank in Arkansas coping with out-of-market real estate trends. Their stories show how market sensitivities can vex specialists.

July 19 -

Prospects are further aggravated by the disappearance of pension plans and the financial woes facing Social Security.

July 19 -

During his time with the company, Hogg directed its transformation from Interbank to Mastercard and helped expand the card brand's global presence.

July 19 -

The Birmingham, Ala., company warned in its earnings call that moves by the central bank could make it harder to lower costs.

July 19 -

Bruce Adams, who previously served as general counsel to Connecticut Lt. Gov. Nancy Wyman, will join the Credit Union League of Connecticut next month.

July 19 -

A court ruling deals a blow to efforts by HUD to restrict nonprofit housing funds from operating on a national scale; most banks get another year to implement CECL; PNC chief William Demchak plans to enter more markets and more from this week’s most-read stories.

July 19 -

After rising between 2016 and 2018, the card issuer's charge-off rates are now steady. The trend reflects both the impact of tighter underwriting standards and the continued resilience of U.S. consumers.

July 19