-

The San Francisco bank is under pressure from investors to get out from under a Fed-imposed asset cap and to hire a new permanent CEO. But executives said Friday that thoroughness is more important than speed.

April 12 -

Wells Fargo and the denial stage of recovery; community bankers alarmed after big banks backtrack on faster-payments pricing; credit card, auto loan delinquencies hit seven-year high; and more from this week's most-read stories.

April 12 -

The Illinois-based credit union, which recently announced an expanded field of membership, saw loans rise by nearly 7% in 2018.

April 12 -

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

2018 was mixed bag for credit unions in the Wolverine State, with membership and lending still seeing positive numbers but down from previous years.

April 12 -

A bipartisan proposal would allow for the removal of the FHFA director if the agency approves CEO salary increases at Fannie and Freddie beyond $600,000.

April 12 -

The company could use its share of proceeds from the IPO to repay debt and pursue bank acquisitions.

April 12 -

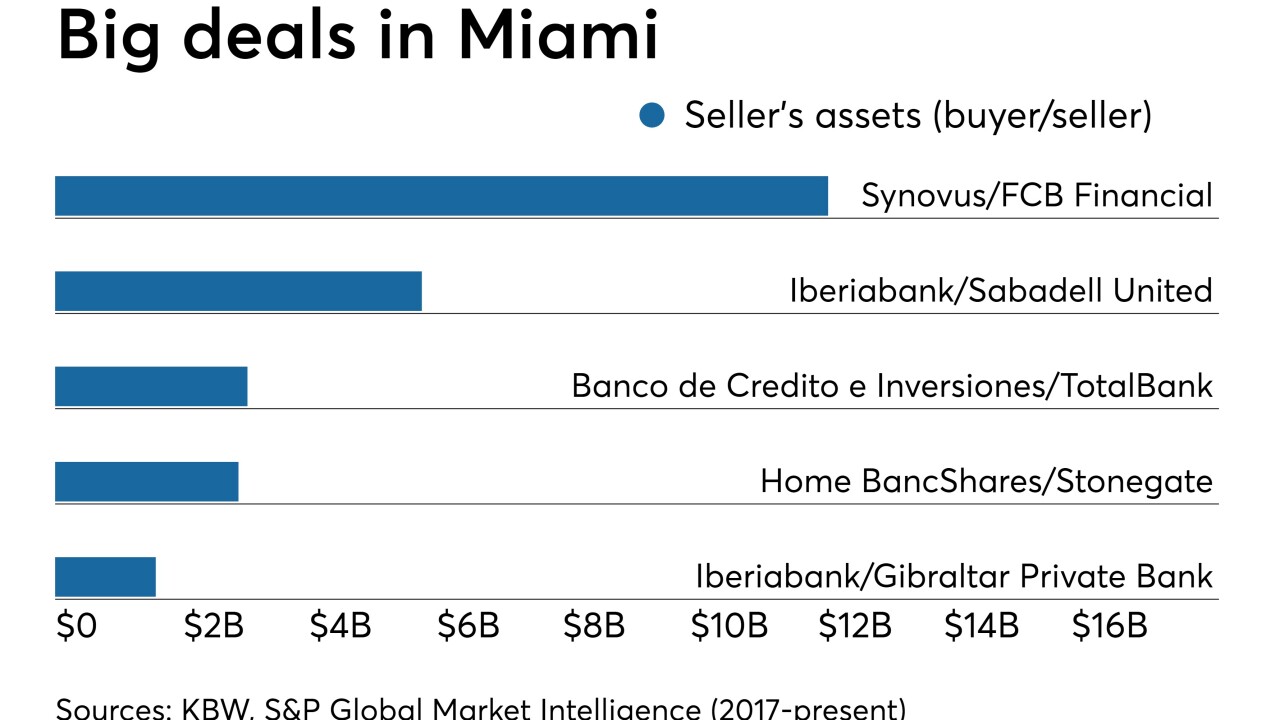

Lenders in South Florida are making tech upgrades and building scale to contend with bigger banks squeezing the market.

April 12 -

PayU is expanding its umbrella of payment companies in developing markets in a $70 million deal to buy Wibmo, a Cupertino, Calif.-based digital payments company that integrates with banks in 20 countries for payment authentication and security.

April 12 -

In a twist, bank lobbyists in the Sunflower State did not push back against nearly 70 proposed changes.

April 12