-

The company created through the combination of BB&T and SunTrust Banks expects to hit two final milestones in the first quarter of 2022. The bank is now turning its focus to performance, CEO Bill Rogers said.

October 15 -

The lender will take a $21.6 million charge related to damage a customer sustained from Hurricane Ida, leading analysts to predict a major drag on earnings. So far, there is little indication that other banks have been similarly affected.

October 15 -

Bill Demchak, whose company plans to allow crypto trading through a mobile app, nonetheless expressed concern that digital currencies pegged to the dollar could affect central banks’ ability to control the money supply.

October 15 -

Goldman Sachs Group posted a surprise jump in its trading business, rounding out a stellar quarter for Wall Street’s biggest banks.

October 15 -

Charlie Scharf faced tough questions Thursday in the wake of a recent $250 million fine. Analysts did not get the clarity they sought on how much longer the bank will be constrained by a three-year-old consent order with the Fed.

October 14 -

In a bid to boost fee income, the Minneapolis company is upgrading its payments technology to allow businesses to manage inventory, payroll and other functions — as well as make payments — all in one place. The tech is modeled after an offering from Square.

October 14 -

Jane Fraser told analysts the company will spend what’s necessary to satisfy regulators’ concerns about risk management and internal controls. That includes incentives to encourage senior executives to resolve the problems promptly.

October 14 -

The company posted a 58% increase in net income, fueled by increased loan demand from both consumers and businesses, as pandemic fears ease. It expects strong GDP growth through next year.

October 14 -

Citigroup’s equities traders surpassed analyst estimates for a fifth straight quarter, adding to signs that investments in expanding the business are starting to take hold.

October 14 -

Wells Fargo beat analysts’ expectations for third-quarter profit, another positive sign for Chief Executive Charlie Scharf’s turnaround efforts, but expenses were higher than anticipated and loans fell.

October 14 -

Bank of America beat analysts’ earnings estimates as fees climbed at the company’s dealmaking unit, boosted by a record-breaking period for mergers and acquisitions.

October 14 -

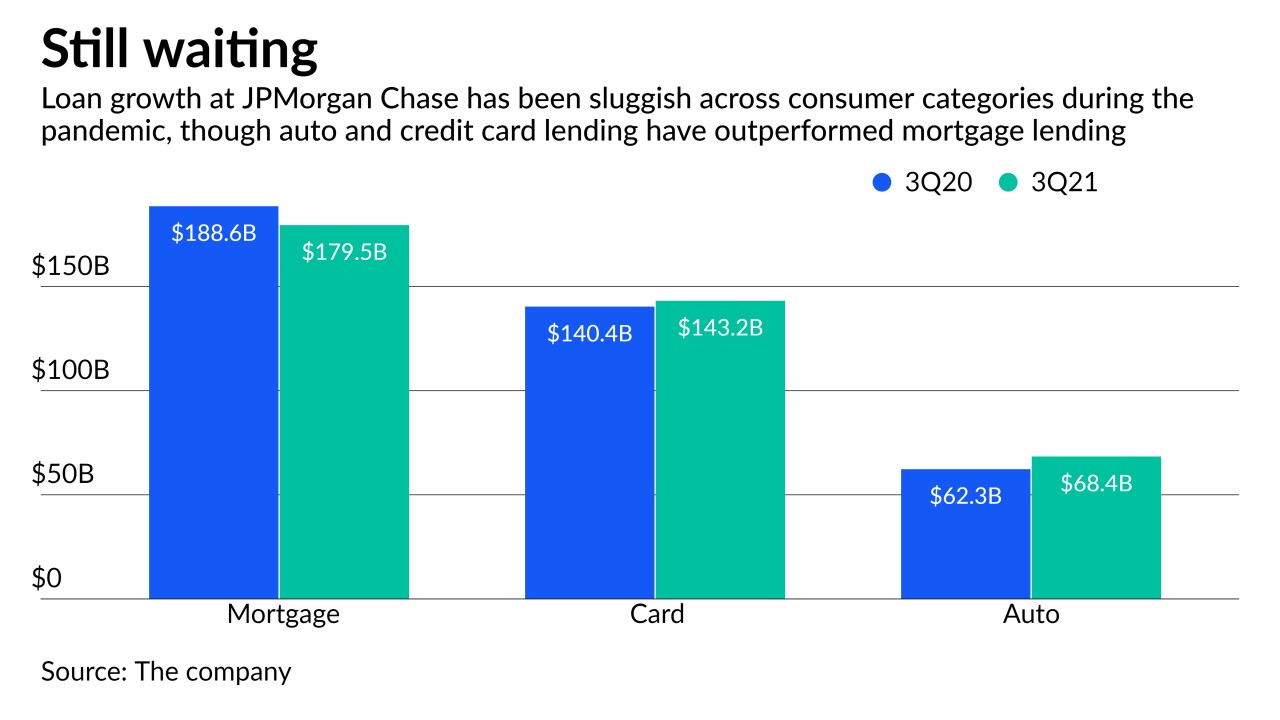

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

October 13 -

Total loans increased 6% from a year earlier, driven by gains in the company's asset- and wealth-management arm and corporate and investment bank, though consumer and commercial lending fell. Fees from advising on merger and acquisition deals almost tripled.

October 13 -

The country's biggest financial companies are well represented in the ranking. Citigroup leads the way, followed by JPMorgan Chase and Bank of America.

October 6 -

In 2020, a year marked by deep economic crisis, Pedroso led her team to execute $16.9 billion of lending overall, up 9% from the previous year.

October 6 -

Erdoes has seen huge gains in diversity throughout her 25-year tenure. Now, she says it's time for the industry to help shape the same sort of change in the broader world.

October 6 -

Portney’s recent track record has allowed her to be more confident in her role chief executor of BNY Mellon’s global financial strategy.

October 6 -

While crypto and decentralized finance will likely not replace the traditional systems of banking and finance, the industry needs to get ahead of the curve, Chakar said.

October 6 -

McLaughlin pledged to improve diversity within the capital markets division she runs and across PNC Financial Services Group more widely.

October 6