-

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 17

-

New York is the latest state to change its statutes regarding public deposits and credit unions as more institutions seek out strategies to boost liquidity.

December 17 -

The Department of Business Oversight said TitleMax charged consumers fees to push loan amounts above the threshold at which the state's rate cap applies.

December 16 -

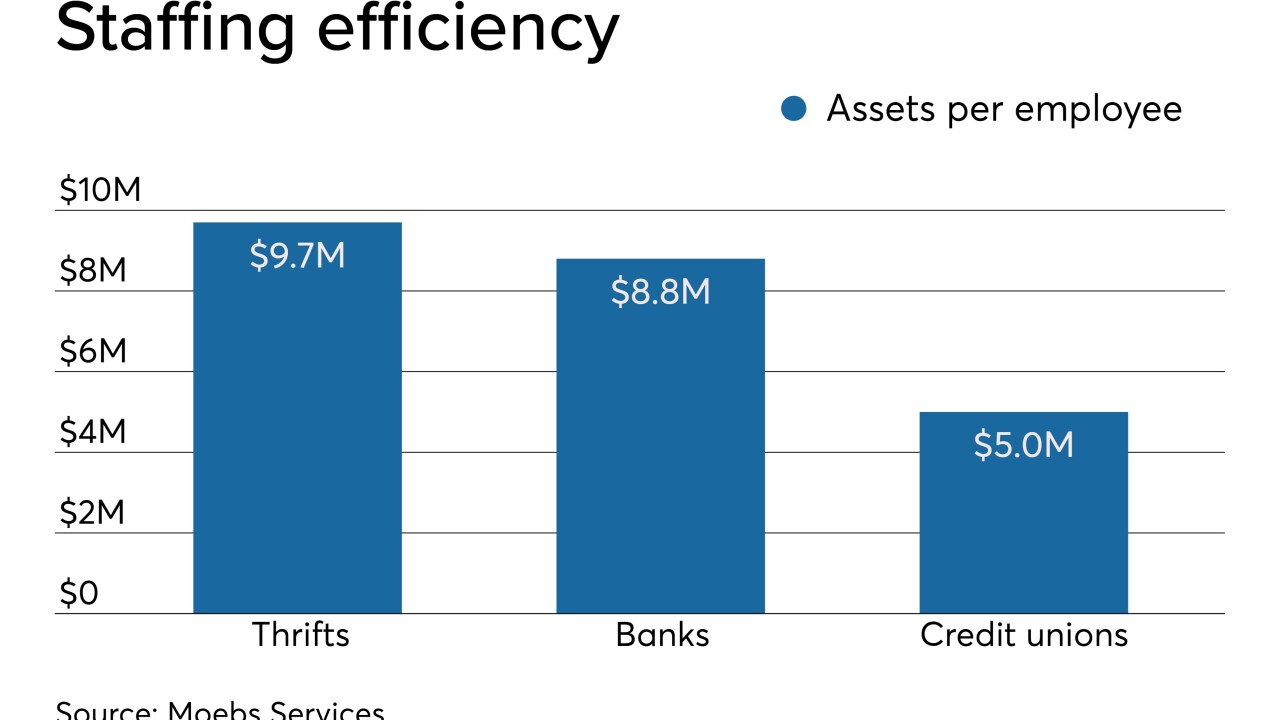

Savings institutions are aggressively cutting staff and shortening hours to be more competitive. As a result they have become more efficient than commercial banks.

December 16 -

It's long past time for the National Credit Union Administration to implement a risk-based capital standard, and the recently approved delay could hurt more than it helps.

December 16

-

John Williams said Friday that the Federal Reserve's three interest rate cuts this year have bolstered the housing market and consumer spending.

December 13 -

Organizers have applied to form Craft Bank. If successful, the bank would become the third to open in the Atlanta area in recent years.

December 13 -

The National Credit Union Administration board signed off on a controversial budget, and it delayed its risk-based capital rule to buy itself time amid complaints by bankers.

December 12 -

Corporate debt swelled to $15.987 trillion in the third quarter after borrowing increased by nearly 6%, according to the Federal Reserve.

December 12 -

The rapid pace of technological change will force financial services companies to invest in more efficient digital offerings for clients, eliminate jobs and retrain staff to focus on higher-value work, according to an Accenture report.

December 12 -

The bank joins rivals in predicting a better than expected Q4; JPM exec says AI could help create products for savings.

December 12 -

The supervisory letter had required the company to get Fed approval before issuing debt, paying dividends or making quarterly payments on its trust-preferred securities.

December 11 -

JPM’s CFO says trading, investment banking revenue better than expected; the bank will pay $192 million to settle charges it helped customers hide assets.

December 11 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The company will gain branches in Northampton County as part of the $79 million deal.

December 10 -

The Independent Bank-Texas Capital merger could prompt other banks in the state to consider selling or buying.

December 9 -

The agency’s semiannual report warned institutions to be mindful of operational risks from the innovation in core banking systems, and detailed supervisory steps to monitor the adoption of a new reference rate.

December 9 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

The market was upended because the largest banks hold more liquid assets in Treasuries than at the Fed, limiting their ability to supply repo funding on short notice, according to a new analysis from the Bank for International Settlements.

December 9