-

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

Frustrated after being overlooked by mainstream financial institutions, organizers of the proposed Pagan Federal Credit Union are hoping to be chartered by the end of the year.

October 4 -

The company will use the funds to increase research and development efforts as well as expand its global presence.

October 3 -

When she was growing up, Thasunda Duckett's family used crates as furniture and struggled to buy groceries. Now she's become one of JPMorgan Chase's most visible executives, using the lessons of her past to help guide the company's massive branch expansion.

-

States are just beginning to regulate cryptocurrency as a credit collateral for lenders. More can be done.

October 3

-

More community bankers now say that cost of funds, not regulatory expense, poses the biggest threat to profits, according to a new survey.

October 1 -

The company could raise as much as $158 million by selling shares to the public.

October 1 -

Oak HC/FT is the lead investor in a $100 million round in Rapyd, a company that’s designed to serve a complex international supply chain.

October 1 -

The GSEs will hold onto a combined $45 billion as they start the process of going private; PayPal becomes the first foreign firm to win approval to enter the country’s payments market.

October 1 -

With financial institutions relying more and more on cloud computing services, Washington is increasingly focused on the concentration of industry data in the big three technology giants.

September 30 -

CUs in the Great Lakes State continue to see positive growth, but several key metrics are increasing at a slower pace.

September 30 -

Gulf Capital Bank has received conditional approval from state and federal officials and could be up and running late this year or early next year, its organizers say.

September 30 -

Bankers are expected to field numerous questions on third-quarter earnings calls about the threat of shrinking loan yields, stubbornly high deposit prices and what they're going to do about them.

September 30 -

The institution also remained well capitalized and its membership rose in the first half of the year.

September 30 -

States are just beginning to regulate cryptocurrency as a credit collateral for lenders. More can be done.

September 30 Milbank LLP

Milbank LLP -

A research paper says the president’s constant criticisms are driving Fed policy, directly or indirectly; the huge demand by banks for cash may be the result of tougher regulations.

September 27 -

An initial review determined that lax oversight at Enloe State Bank allowed for the origination of more than 100 allegedly fraudulent or fictitious loans.

September 26 -

Wells Fargo still having trouble finding permanent CEO; Some lenders are using the deals to keep their best customers.

September 26 -

The once-acquisitive company is not interested in a "roll-up strategy" in Texas's biggest city, said CEO Phil Green. In a Q&A, he also explained why loan competition is intensifying and what's really keeping business customers up at night.

September 25 -

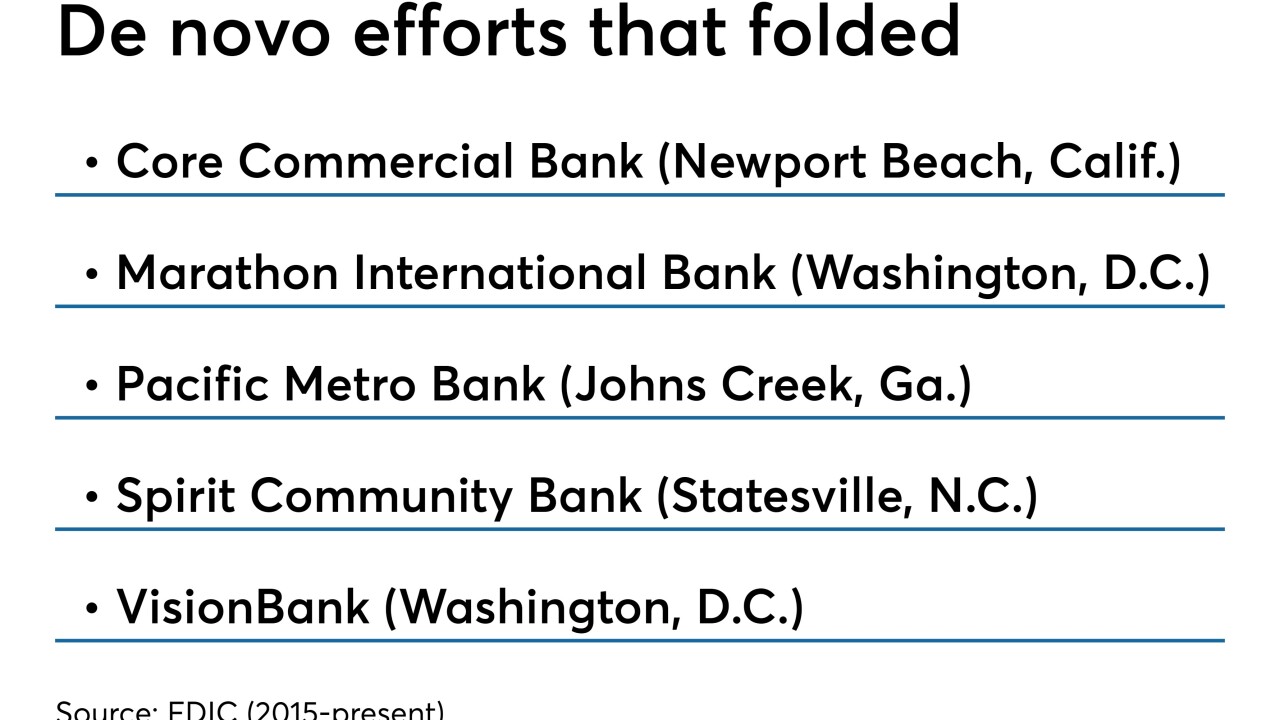

Regulators may be willing to grant new charters, but economic uncertainties, capital hurdles and inexperience have led the organizers of numerous bank startups to give up in the last few years.

September 25