-

Some contracts are not "adequately" defining which party — the bank or the vendor — is responsible for managing risks, the agency said.

April 2 -

Growth in the KeyStone State was close to or surpassed national averages across a number of fields.

April 2 -

PayPal has joined a funding round for startup Cambridge Blockchain, reportedly the first investment the online payments giant has made in distributed ledger technology.

April 2 -

As N26 schedules its launch for midyear, it will face off against other startups and mobile-only spinoffs from incumbent financial institutions.

April 1 -

Jumia Technologies AG said Mastercard Inc. has agreed to invest 50 million euros ($56 million) in a private placement ahead of the Africa-focused online retailer’s planned initial public offering in New York.

April 1 -

Restaurant point of sale and back-office management provider Toast raised $250 million in a Series E funding round, valuing the company at $2.7 billion, and is adding David Yuan from TCV to its board of directors.

April 1 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

The flagship division is on course to miss next year’s financial projections; Investors may be using SOFR swaps as a hedge against expected volatility.

April 1 -

Credit unions in Arkansas and Florida argue that allowing the industry to take deposits from cities and other public entities would help with funding and control for risk.

April 1 -

Community Bank of the Carolinas must raise about $4 million before becoming the state’s first new bank since the financial crisis.

March 29 -

The addition of the conservative pundit could signal the Trump administration's intent to have a more direct hand in central bank policies, yet Moore could experience his own transformation as a Fed governor.

March 28 -

The Scarborough, Maine-based credit union also posted a more than 4 percent uptick in membership.

March 28 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

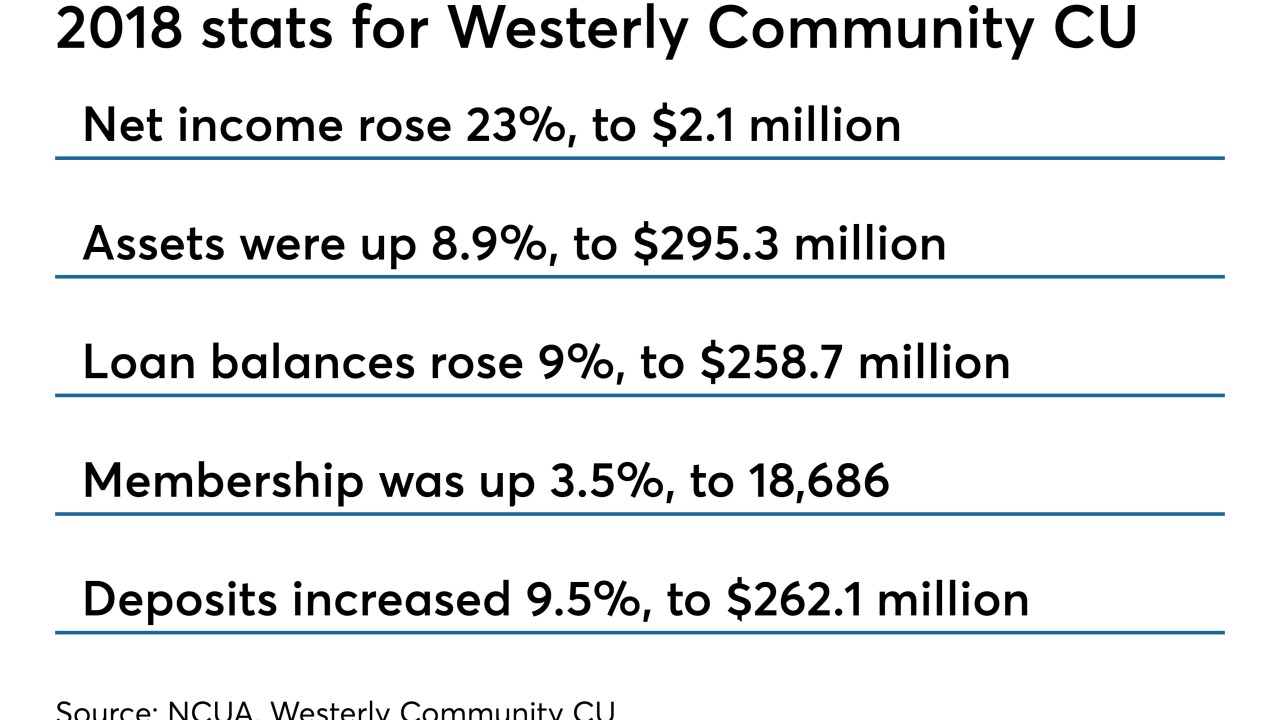

The Rhode Island-based institution also finished building a 27,000-square-foot operations center and branch.

March 28 -

Power Financial Credit Union's deal for TransCapital Bank marks the fourth time this year a bank has agreed to be sold to a credit union in the Sunshine State.

March 27 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

The Association for Black Economic Power will receive an interest-free forgivable loan and a grant from the city to help pay for a retail space and equipment for the effort.

March 27 -

Andy Reed, who currently leads Texas People Federal Credit Union, will become president and CEO of the Dallas-based institution in May.

March 27 -

Some lenders, especially in markets like California, are preparing in case of a technology-industry stumble that hurts business, real estate and other loan segments. Whether those fears are well founded is a matter of debate.

March 26 -

These programs are becoming a more common employee benefit but many lack some of the tools users need to be successful.

March 26 FinFit

FinFit