-

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

July 2 -

Two days after the Fed released the results of its annual stress tests, the nation's eight largest banks all announced plans to supplement their payouts to shareholders. At the same time, most of the banks also said that their capital requirements are expected to rise.

June 28 -

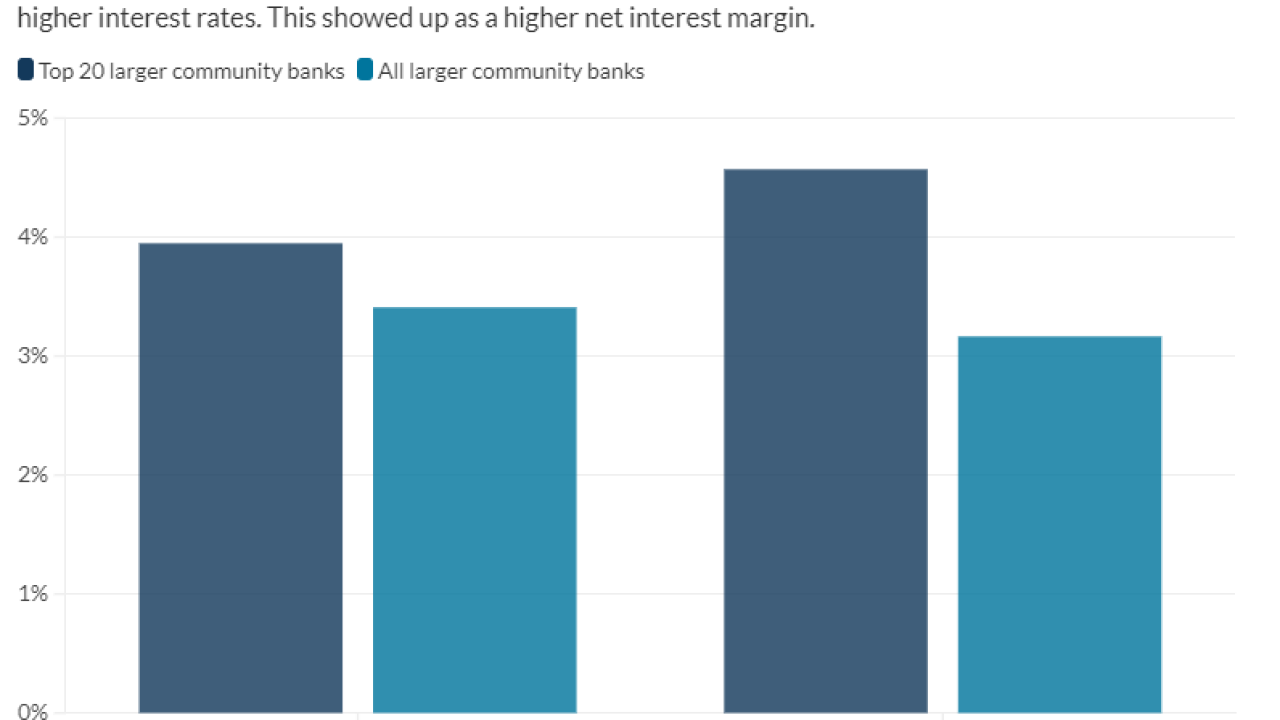

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

Publicly traded companies are showing signs of improvement, but it may take some time until venture capital funding for fintechs recovers.

June 20 -

Due to retirement, burnout, heightened regulatory standards and profitability challenges, lots of lenders are looking for new chief financial officers. The wave of departures is giving banks a chance to bring in more highly skilled finance chiefs.

June 16 -

Investors homed in on the benefits of positive economic data for lenders, rather than the possibility of a strong job market delaying interest rate cuts that would help to lower deposit costs and boost credit demand.

June 10 -

Though hard times put a dent in profitability, asset quality and net interest margin continued to shine among the list of the best performing publicly traded community banks.

June 9 -

-

The beleaguered Los Angeles-based bank reported its strongest quarterly results in more than a year, but executives at its Canadian parent company cautioned that improvements may not be linear.

May 30 -

The Toronto-based company's U.S. banking segment continues to face headwinds from muted loan growth and higher deposit pricing. Net income for the division tumbled by more than 25% last quarter.

May 29