-

The Minneapolis-based company reported an 18% increase in quarterly net income thanks largely to slimmed-down operating expenses. It also notched modest increases in loans and deposits, while asset quality issues remained manageable.

July 17 -

Two Northeast banks will get new CFOs next month. Webster Financial hired Neal Holland, the former CFO of the failed First Republic Bank, and Eastern Bankshares hired David Rosato, who left Berkshire Hills Bancorp last month.

July 16 -

CEO Ron O'Hanley touted an "encouraging financial performance" at the $326 billion-asset custody giant due to asset inflows and a jump in income from securities and loans.

July 16 -

The Wall Street investment bank saw its profits rebound in the second quarter as last year's decline in mergers continued to thaw. "The game will have to go on because there's just been so much activity that has been suppressed," said CEO Ted Pick.

July 16 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16 -

The Pittsburgh-based superregional bank reported a small quarter-over-quarter advance in net interest income, and it expects loan growth to pick up in the second half of the year. PNC, which announced job cuts last year, also said that it has identified an additional $25 million in cost savings.

July 16 -

The investment banking giant said that it will "moderate" its pace of share repurchases as it continues to talk to the Federal Reserve, which recently increased its stress capital buffer from 5.5% to 6.4%.

July 15 -

With Americans suffering from high housing costs and declining supply, we cannot afford to watch a massive government-sponsored enterprise sit on billions in retained earnings.

July 12

-

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12 -

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

The San Francisco bank's interest expenses continue to rise as depositors switch to higher-yielding options. At the same time, soft loan demand from business customers is putting a lid on how much interest Wells is collecting from borrowers.

July 12 -

The New York-based company saw assets under custody and management jump, driving strong increases in both fees and overall revenues for the quarter ending June 30.

July 12 -

Evergreen Money offers affluent savers both high returns and ready access to their money. The startup's founder, former PayPal CEO Bill Harris, says that increased regulatory scrutiny of bank-fintech partnerships is a positive development.

July 11 -

Higher funding costs, lower loan demand and the potential for increased credit costs continue to drag on the sector heading into second-quarter earnings season.

July 11 -

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

First Foundation will use the large investment to shrink its multifamily loan portfolio, which has weighed down its earnings since interest rates began rising.

July 2 -

The Council of Federal Home Loan Banks executive shares his thoughts on a particularly active period for advances, and system reviews with a lot riding on them.

July 2 -

With the Federal Reserve holding interest rates at elevated levels through the first half of the year, analysts are sharpening their collective focus on possible fallout from high deposit and borrowing costs.

July 2 -

Two days after the Fed released the results of its annual stress tests, the nation's eight largest banks all announced plans to supplement their payouts to shareholders. At the same time, most of the banks also said that their capital requirements are expected to rise.

June 28 -

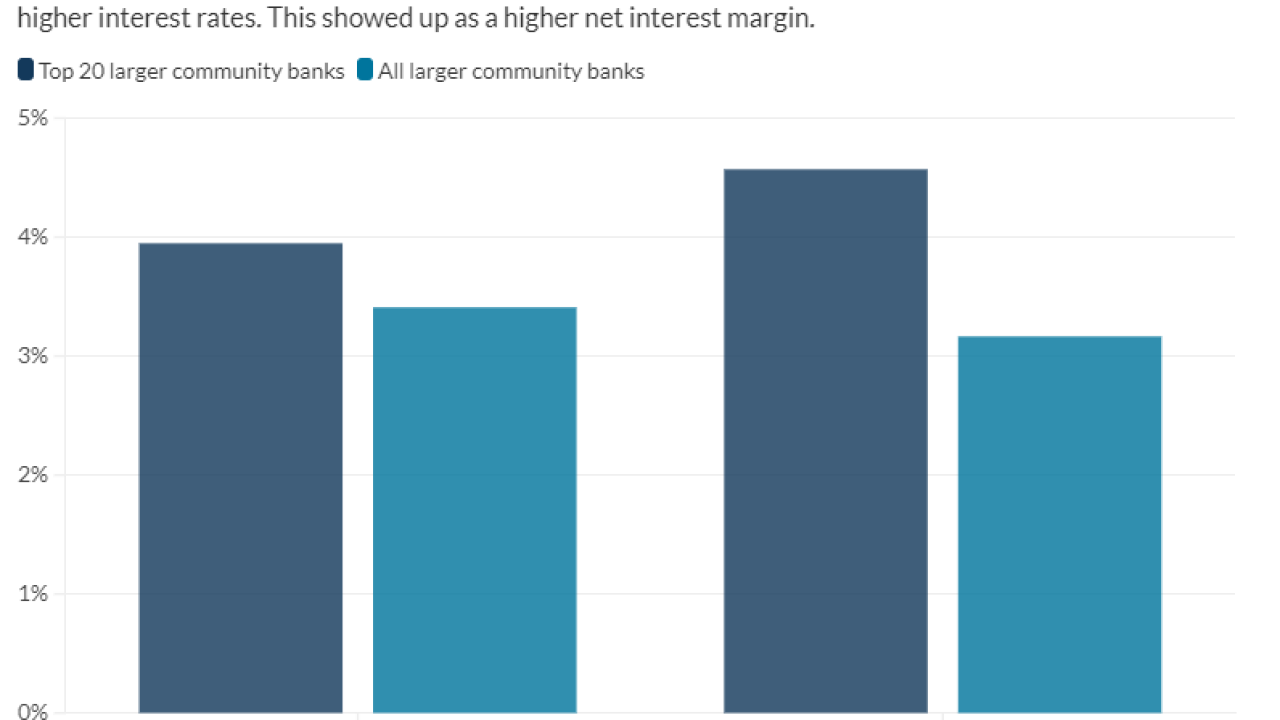

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23