-

The National Credit Union Administration plans to unveil new capital proposals on Thursday. It's a given that bankers won't like them, but credit unions could also find themselves disappointed.

January 22 -

The National Credit Union Administration plans to unveil new capital proposals on Thursday. It's a given that bankers won't like them, but credit unions could also find themselves disappointed.

January 22 -

The comptroller of the currency stood firm in defense of his agency's proposal, saying skeptics of various parts of the draft framework do not have their facts straight.

January 22 -

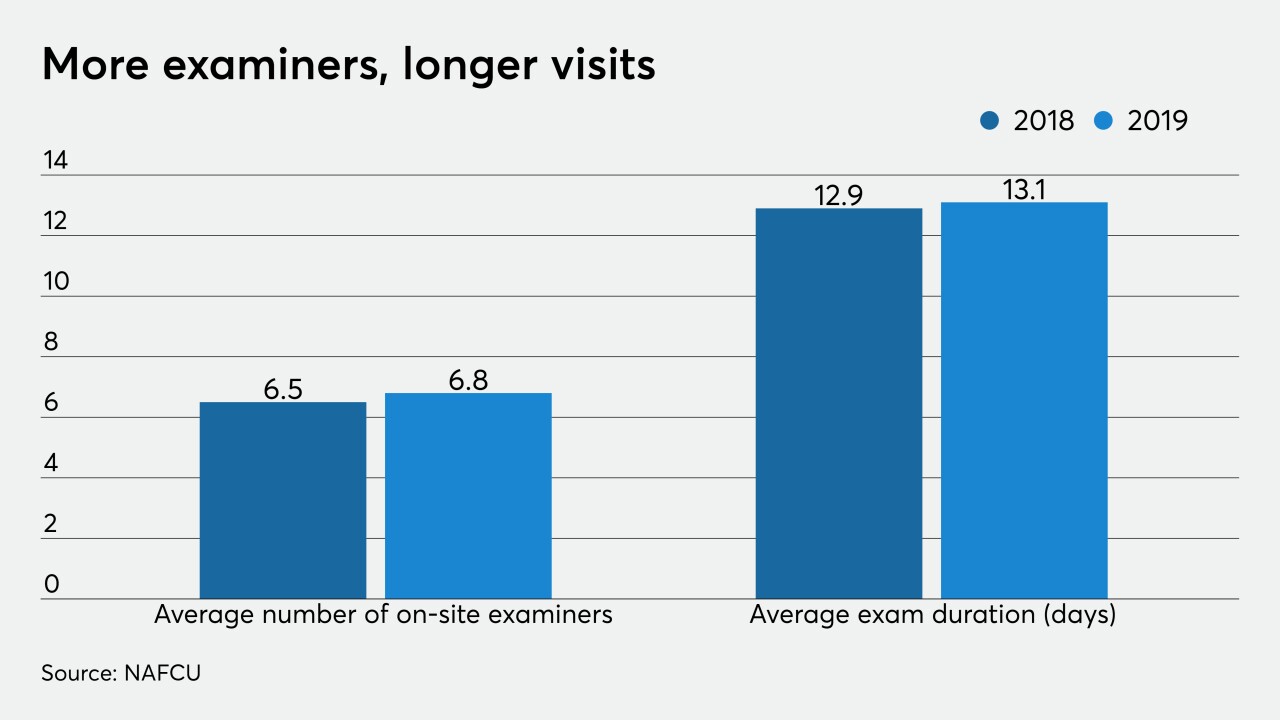

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

Alan Kline, a 22-year veteran of American Banker, has previously served as editor-in-chief of US Banker.

January 16 -

The Bay State is the latest to push its lawmakers to modernize how CUs do business in order to help state charters remain competitive with federal charters.

January 15 -

Lawmakers advanced legislation that would require financial regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

Lawmakers advanced legislation that would require banking regulators to give annual testimony to lawmakers and would mandate regular reports on cybersecurity efforts.

January 14 -

Former CFPB Director Richard Cordray and consumer advocates have designed a proposed state consumer agency that would subject more financial firms and fintechs to state oversight.

January 10 -

Former CFPB Director Richard Cordray and consumer advocates have designed a proposed state consumer agency that would subject more financial firms and fintechs to state oversight.

January 10